N1569 Financial Risk Management Topic 1: Mathematical Background

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Financial Risk Management (N1569)

Topic 1: Mathematical Background

1. Given two samples {3, −1, 4, 2} on X and {0, 2, 4, −2} on Y :

(a) Calculate the mean and standard deviation of each sample

(b) Calculate the covariance and correlation between the two samples

2. Two random variables X and Y have the following parameters:

µx = 2, σx = 3, µy = −1, σy = 4, ρx,y = 0.5

Find:

(a) E[2X + 4Y ] (b) Cov[X, Y ]

(c) Cov[2X, 3Y ] (d) Corr[2X, −5Y ]

(e) Corr[−2X, −5Y ] (f) V[2X − 5Y ]

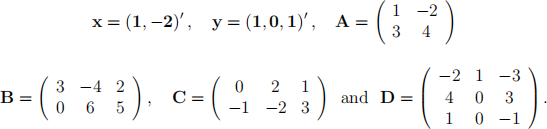

3. Set

Calculate (if it exists):

(a) C − 2B (b) AC

(c) x'Ax (d) y'Dy

(e) ACD (f) CA

4. Express the following system of linear equations in matrix form:

7x + y + 5z = 67

4y + 4z = 32

7x + y + 2z = 79

Does it have a solution? If so, find it.

5. A portfolio consists of three assets with volatilities: σ1 = 25%, σ2 = 16%, and σ3 = 38% respectively. When the correlations are: ρ12 = 0.5, ρ13 = −1, and ρ23 = 0.9, how can you express the covariance matrix between the assets using matrices?

6. The table below shows daily prices of UK power and gas contracts (both in GBP/MWh). Since natural gas is used as the main fuel of electricity, there should be a strong relationship between the commodities.

(a) Fit, and display the model Yt = α + βXt + εt to these data.

Note: In reality we will need much larger sample size to make statistical inferences.

(b) What is your estimate for the expected change in power price for a one-unit change in gas price when sp = 0.566, sg = 0.355, and ρpg = 0.898?

(c) Using the same information, what is the standard error ˆσ of the regression?

What does it tell us about the estimated model?

7. Let f(x) = log (1 + x). Find the third order Taylor approximation to the function f(x) in a neighbourhood of x0 = 0.

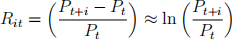

8. Let Pt denote the price of a financial asset, assumed to be always positive. Prove that, when i is small, the i−period ordinary return Rit is approximately equal to the the i−period log return.

That is, using forward-looking returns

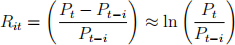

Note: The same applies to backward-looking returns, where we define:

9. Prove the square-root-of-time rule. That is, if µh denotes the mean of h-period log returns and σh denotes the standard deviation of h-period log returns, and if 1-period log returns are i.i.d., prove that:

and

2024-01-10