DMS ECO2103 Macroeconomics 2024

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

DMS ECO2103 Macroeconomics

Instructions for CA1 Individual Assignment, January 2024 Semester

. The purpose of this individual assignment is to enable you to use relevant analytical tools and macroeconomic concepts (not necessarily all of them) that you have learnt in Lectures 1 to 4.

Choosing Articles as References for Analysis

. Search through newspapers, journals, magazines or internet for THREE articles that are relevant to the concepts discussed in Lecture 1 to Lecture 4 .

. Quote the source of the article in your report or if the article is obtained from the web, quote the web address. Include a screenshot of the articles in the reference list section.

. You have the flexibility to choose (a) all 3 articles from one country or (b) 3 articles from various countries. But only articles selected from 1 November 2023 onwards will be accepted.

. The articles selected should be in English and based on the following topics:

Article 1 - Lecture Topic 1: Introduction to Macroeconomics, GDP and Economic Growth Article 2 - Lecture Topic 2: Inflation and the Price Level

Article 3 - Lecture Topic 3: Wages and Unemployment

OR

Lecture Topic 4: Saving, Capital Formation, Financial Markets and Financial System

. Each article should deal with a different macroeconomic aspect of the country (for example, GDP growth, labour productivity, wages and unemployment, price level and inflation or national saving and capital formation) .

Analyzing your Country

. For each of the 3 articles, summarize the article first and followed by an analysis of the macroeconomic performance of the country based on the article. The analysis must cross- reference to concepts discussed in one particular lecture topic.

. You are required to use the lecture notes and textbook to help you better illustrate your analysis. If you extract exact phrases or sentences, please put them in quotation marks in your report.

. Explain your understanding of the article using the economic concept and knowledge discussed in the lecture. Establish the linkage between the article and the economic concept under the particular lecture session and topic. Draw diagrams to support your analysis if needed.

Writing your Report

. Write a summary report for each country based on your analysis. Combine and organize all your work in a single word document.

. Use Times New Roman Font Size 12pt.

. Number your pages.

. Use single line spacing.

. Save as Word document.

. Your report should have a word count ranging from 1000 to 1500. Each Analysis (Part 3 – 5 in the template below) should have at least 250 words.

Submission of Report

. Submit the Word version of your report via Canvas. Reports submitted through other ways (e.g. through email or hardcopy to the lecturer) will not be accepted.

Template for Report

. Use the following template or outline for your report:

1. Title: DMS Macroeconomics Individual Assignment

Date of Report:

2. Content Page

List the topics and chapters in the report.

3. Chapter 1 - Analysis on Topic 1

a. Source: Put down the title of the article and its source, or if the article is obtained from the web, quote the web address.

b. Summary: Briefly discuss the main points of the article.

c. Analysis: Using the concepts in the lecture to relate to the article and analyze the situation.

4. Chapter 2 - Analysis on Topic 2

a. Source:

b. Summary:

c. Analysis:

5. Chapter 3 - Analysis on Topic 3 or Topic 4

7. Conclusion

Summarize the main findings of your analysis

8. References

. Put down the source of articles, title and Internet link if the articles are obtained from the web.

. Insert a screenshot of each article after quoting the source and title. Do NOT type in or “copy and paste” the articles as this will affect the plagiarism index.

. Indicate other sources of reference, data, or materials used in your report.

SAMPLE

. A sample at the end of the document is included to provide guidance on article selection and report analysis.

. Please note that you should NOT use the sample articles for your report. No part of the sample may be copied and reproduced for your report.

Important Dates for CA1 Report

CA1 Deadline: 24 January 2024 (Wednesday), 11.59 am

Submit your report via Canvas. Only reports submitted via Canvas will be accepted.

The distribution of marks will be as follows:

1. CA1 30%

|

Component |

Weightage |

|

Selection of relevant articles & content page |

5% |

|

Summary and analysis supported by economic theory/graphs/diagrams |

80% |

|

Conclusion |

10% |

|

Reference list |

5% |

|

Total |

100% |

2. CA2 (online quiz) 20%

3. Final exam 50%

CA2 opens on 24 January 2024 12 noon and closes on 31 January 2024 11.59 am (Topics 1 - 6)

CA Submission

. CAs must be submitted online via Canvas. Please read through instructions in Canvas and CA outline carefully before submitting. If you have further queries, please read the FAQ. If after you have read the FAQ, you need assistance on Canvas submission, please email to itsd_simge@sim.edu.sg or call 6248 9393 Option 4. For non-Canvas issues please email he10@sim.edu.sg. Please email with your "Live@Edu email account". Email from other addresses will not be entertained. If issues raised are covered, you will be directed to read through instructions in the CA outline, Canvas and the FAQ. Please take time read through before raising issues.

SAMPLE – TOPIC 1

Article

Japan’s economy sinks deeper into worst postwar contraction, intensifies challenge for new leader

TOKYO (REUTERS) - Japan’s economy sank deeper into its worst postwar contraction in the second quarter as the coronavirus jolted businesses more than initially thought, underscoring the daunting task the new prime minister faces in averting a steeper recession.

Other data put that challenge in perspective, with household spending and wages falling in July as the broadening impact of the pandemic kept consumption frail even after lock-down measures were lifted in May.

The world’s third-largest economy shrank an annualised 28.1 per cent in April-June, more than a preliminary reading of a 27.8 per cent contraction, revised gross domestic product (GDP) data showed on Tuesday (Sept 8), suffering its worst postwar contraction.

The record drop roughly matched a median market forecast of a 28.6 per cent contraction in a Reuters poll.

The main culprit behind the revision was a 4.7 per cent drop in capital expenditure, much biggest than a preliminary 1.5 per cent fall, suggesting the COVID-19 pandemic was hitting broader sectors of the economy.

“We can’t expect capital expenditure to strengthen much ahead. Companies won’t boost spending when the outlook is so uncertain,” said Hiroshi Miyazaki, senior economist at Mitsubishi UFJ Morgan Stanley Securities.

The data will put the new prime minister, to be elected in a ruling party leadership race on Sept 14, under pressure to take bolder economic support measures.

Chief Cabinet Secretary Yashihide Suga, a frontrunner to become next premier, has signalled his readiness to boost spending if he were to lead the country.

Japan recently saw a renewed rise in infections but has been spared the kind of big casualties seen in western countries. Total infections stood at 72,321 as of Monday, with 1,380 deaths versus a global tally of over 27 million cases and more than 888,000 deaths.

Japan’s economy has shown some signs of life after slipping into three straight quarters of contraction, with factory output rising in July at the fastest pace on record due to a rebound in demand for automobiles.

In a sign of any recovery will be modest, however, separate data release on Tuesday showed household spending fell a bigger-than-expected 7.6 per cent in July from a year earlier. Real wages declined for the fifth straight month in July, pointing to possible deeper strains ahead for consumer spending.

BROAD IMPACT

The health crisis has ravaged a broad array of sectors, with firms such as automaker Honda Motor forecasting a 68 per cent decrease in annual operating profit and cosmetics firm Shiseido Co expecting a net loss for the full year as the pandemic hit cosmetics sales.

The fresh batch of data will be among factors the Bank of Japan will scrutinise at its rate review next week, when it is widely expected to keep monetary settings unchanged.

Analysts polled by Reuters in August said they expect the economy to shrink 5.6 per cent in the current fiscal year to next March, and grow just 3.3 per cent in the following year, compared with the BOJ’s forecast released in July for a 4.7 per cent contraction and 3.3 per cent growth in the same periods.

The central bank eased monetary policy twice this year including by setting up a lending facility to pump money to cash-strapped small firms, complementing two big government spending packages.

Many analysts expect the BOJ hold off on ramping up stimulus for now as steps to spur demand could get people moving more freely into shops and risk spreading the virus.

“Even though restrictions to economic activity have been relaxed, some of them will remain under the new lifestyle forced upon by the pandemic,” said Yoshiki Shinke, chief economist at Dai-ichi Life Research Institute.

“It will probably take a long time for the economy to normalise and return to levels before the pandemic.”

SAMPLE - TOPIC 1

REPORT

1.1 Source:

https://www.straitstimes.com/business/economy/japans-economy-shrinks-more-than-first- estimated-in-q2-heightens-woes-for-new

1.2 Summary

Due to the Covid- 19 pandemic, movement was restricted globally, and Japan’s gross domestic product has suffered a contraction from the past two quarters, with their economy falling by 28.1% in April-June. Analysts forecast that Japan’s economy would decrease by 5.6% in the current fiscal year, on the account of falling household spending and wages, low capital expenditure and trade restrictions. As a result, the government has taken economic measures in their attempt to raise their GDP.

1.3 Analysis

Through applying the expenditure approach, it is possible to calculate GDP using the formula of GDP = Consumption(C) + Investment(I) + Government Expenditure(G) + Net Export(Exports(X) – Imports(M)).

From the source article, it can be deduced that the decrease in GDP was contributed by the decrease in consumption, investment, exports, and imports. The main reason that consumption(C) decreased was due to the fall in wages and household spending. According to (Hermesauto, 2020), the fall in household spending was caused by lower income through job losses amid the recession during the pandemic.

Additionally, capital expenditure had dropped by 4.7%, which decreased investment(I). In general, the low consumption and demand, along with big companies like Honda Motor and Shiseido facing decreased profits and net losses has made companies wary about spending.

The restriction in movement would also impact Japan’s trade industry, resulting in a decrease in the country’s exports(X) and imports(M) .

In hopes of combating the recession and increasing GDP, the government had implemented two stimulus packages that according to (Kyodo, 2020) is aimed towards helping low -income households and provide interest-free loans to struggling companies. The aim is to provide consumers and businesses with more disposable income to encourage spending, which increases consumption(C) and Investment(I). However, despite the government’s efforts, GDP failed to show signs of improvement. Furthermore, since the stimulus packages are a form of transfer payments, Government Expenditure(G) stays the same.

By applying the information above to the expenditure approach assuming no additional information is added, it would result in ![]() GDP =

GDP = ![]() C +

C + ![]() I + G + NX ( X - M). Hence, the implications caused by the pandemic led to the continuous decrease in Japan’s GDP.

I + G + NX ( X - M). Hence, the implications caused by the pandemic led to the continuous decrease in Japan’s GDP.

SAMPLE - TOPIC 2

ARTICLE

India's October CPI likely above 7% again, industrial output falls: Reuters poll

BENGALURU (Reuters) - India’s retail inflation likely stayed above 7% for a second straight month in October as supply distortions led to a surge in vegetable prices, especially of onions, a Reuters poll showed, lowering the chances of further interest rate cuts.

Disruption from by the coronavirus pandemic and excessive rainfall in states such as Maharashtra, Karnataka and Andhra Pradesh have damaged and delayed the harvesting of onions - a key ingredient in Indian kitchens - alongside other vegetables.

A Reuters poll of 50 economists conducted from Nov. 4-9 predicted consumer prices rose 7.30% last month from a year earlier, a touch lower than September’s 7.34% rate.

If realised, it would be above the top end of the Reserve Bank of India’s medium-term target range of 2%-6% for the seventh consecutive month, a streak not seen since August 2014.

“India’s recent inflation trajectory is driven by a confluence of seasonal supply-side drivers lifting the food segment, magnified by COVID-19-led disruptions, hindering inter-state transfer as well as provision of general services,” said Radhika Rao, economist at DBS Bank.

“Price and tax rigidity in commodities has also added to the boost.”

Demand remains weak in Asia’s third-largest economy, which contracted at the sharpest pace on record of 23.9% in the April-June quarter, as the ongoing pandemic left millions unemployed and resulted in massive pay cuts. India has the second-highest total infections in the world at more than 8.5 million cases.

The poll also predicted industrial output in September dropped 2.0% from a year earlier, the seventh consecutive month of falls and its longest streak of decline since June 2009, as infrastructure output, which accounts for about 40% of total industrial production, contracted 0.8%.

Still, the RBI, which has eased its key repo rate by 115 basis points since March, was widely expected to wait until February before cutting the rate again amid worries over higher inflation.

“We see a space for a rate cut in the February policy meeting as the RBI leans towards stimulating growth and acts at the first window it gets when inflation drops within its target range,” said Sakshi Gupta, senior economist at HDFC Bank.

“That said, we think the RBI is towards the end of its rate cutting cycle and there could be a prolonged pause as inflation concerns linger on.”

SAMPLE - TOPIC 2

REPORT

2.1 Source:

https://www.reuters.com/article/india-economy-poll/indias-october-cpi-likely-above-7-again- industrial-output-falls-reuters-poll-idUSKBN27Q0ML

2.2 Summary

Disrupted supply chains due to the COVID- 19 pandemic as well as severe weather in many states in India reduced the amount of production in agriculture and industry. This has caused India’s retail inflation to rose above 7% in October 2020 compared to the same period last year.

2.3 Analysis

Obviously from the article, the heavy rain has damaged and delayed the harvesting of onions, a key ingredient of the Indian dish. The shortage of raw materials, as well as the high transportation costs due to nationwide lockdown, caused the costs of raw materials to rise, which leads to the reduction of production output by manufacturers. This will create a shortage of output at existing price level, price level will climb, and inflation occurs.

The same trend is repeated in the industrial sector. Furthermore, many Indian factories depend heavily on imported raw materials from China. China is one of the countries most affected by COVID- 19, hence the supply of industrial production in India is interrupted or scarce, causing the cost of raw materials to rise. This leads to an increase in the producer price index (PPI), which will be passed on to consumers in the higher retail prices.

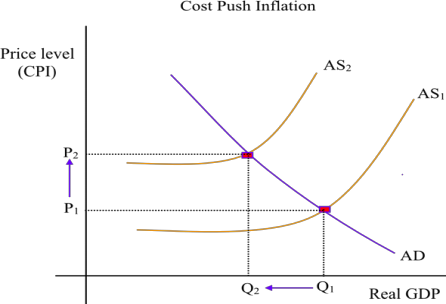

In both above cases, there is a combination of higher price and lower output, which causes cost- push inflation to occur. The economy has a simultaneous appearance of inflation and recession, this phenomenon is called as stagflation.

The above graph indicates that there are lesser resources available in the economy to produce output, then the Supply Curve decreases (shifts leftward, from AS1 to AS2), whereas consumer demand remains (AD). Cost-push inflation occurs when manufacturers respond to increasing cost of raw materials by increasing their prices (from P1 to P2) to protect profit margins. As a result, real GDP also drops (from Q1 to Q2) .

2024-01-06