Entrepreneurship Project 2023/2024

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Entrepreneurship Project

Post Graduate Diploma in Management

Post Graduate Diploma In Business Administration

Year: 2023/2024

INTRODUCTION TO THE MODULE

Introduction

Successful businesses compete through the identification of new opportunities before their competitors and developing new products and business ventures at an early stage.

Managers today must be innovative in their thinking, their proposals and their actions. Ambitious managers must be entrepreneurial and much research now indicates that organisational success can be conceptualised as a series of transient competitive advantages, thus underlining the importance of innovative thinking.

This module provides a critical approach to the application of entrepreneurial concepts in order to help students to develop an innovative new venture in a sector of their choosing, resulting in a 'professional standard' approach to the analysis and strategic development of their chosen business plan.

Overall aims for the module

To demonstrate and develop the knowledge, skills and attitudes of successful entrepreneurs required in the evaluation of business opportunities and the planning of new ventures in the modern complex business world.

To create and develop 'professional standard' New Venture proposals, embodying innovative solutions and drawing upon key concepts covered in the module and prior skills and experiences.

Learning outcomes

On successful completion of the module students will be able to:

Knowledge and Understanding

a) Analyse the critical debates about the role of entrepreneurs and entrepreneurship in the delivery of business innovation.

b) Evaluate the management efficacy of alternative approaches and tools in identifying, selecting and managing emerging opportunities.

c) Demonstrate a critical understanding of the cultural, tactical and strategic challenges and issues involved in developing a sustainable New Venture.

Subject - Specific Skills

d) Apply a critical- enterprising mindset and elements of entrepreneurial 'best-practice' to the task of creating a New Venture proposal.

e) Provide a comprehensively researched and detailed analysis of emerging opportunities within a specific business sector and show an awareness of the contrasting influences.

f) Write a 'commercial standard' business plan, justifying a New Venture proposal.

Key Skills

g) Collate, organise, critically evaluate and synthesise evidence and information from a variety of sources including: academic articles, business reports and case studies.

h) Solve problems using complex concepts, appropriate tools and arguments leading to creative solutions and innovative business approaches.

i) Engage confidently in academic and professional communication with others and report on proposals in a clear, autonomous and competent manner.

1. Assessment

Assessment 1:

Please read the whole assessment brief before starting work on the Assessment Task.

The Assessment Task

You are required to produce an Opportunity Analysis for a new venture. Please use the template below and answer all the sections required.

Writing an Opportunity analysis (or feasibility study) can help finalise your business idea, and to check it against the initial perception of the market-place. Feasibility study is a first draft of ‘nature of the business’ proposal that can allow further investigations and calculations to be based.

Task:

Write an Opportunity Analysis (Feasibility study) for a new business, answering all the sections.

|

1. BUSINESS OVERVIEW (Approx. 200 words) Include key information points regarding your venture (write a short summary of a proposed venture including some details regarding the market, customers and competition). |

|

2. PERSONAL ANALYSIS (Approx. 200 words) Carry out an analysis of your own strengths (S) and weaknesses (W) as an entrepreneur. What skills and experience will you bring to the new venture? |

|

3. MARKET RESEARCH (Approx. 800 words) 3.1 SWOT – Carry out a SWOT analysis of your idea. 3.2. PESTEL – Carry out a detailed PESTEL analysis to assess opportunities and trends arising from changes in the environment. Remember to apply each component to your chosen country, industry and/or idea, for example Social trends and opportunities related to your idea. Include evidence of your statements (citations). 3.3 Competitors – Carry out the analysis of market and competition. What is your USP and value proposition? What is your key differentiating factor? Compare your new venture to main competitors (consider competitors’ strengths and weaknesses; identify how you will position yourself; decide what is your basis of competition, i.e. cost/differentiation). |

|

4. GROWTH POTENTIAL (Approx. 200 words) Compare the new venture to the ideal business. How do you see the company growing and becoming more profitable in the future? |

|

5. CAPITAL REQUIREMENTS (Approx. 200 words) Identify your Start-up capital and possible funding options. |

NOTES:

Growth strategies: Generating larger profits, expanding its workforce, and increasing production.

P&L statements are not needed.

Less models/theories to apply in market and industry analysis.

Key market information should be included in 3.3.

NB: Please include a list of references using Harvard referencing style, any details of primary research, and applications of models and frameworks. You can include up to 5 pages of appendices.

The maximum word limit for this assessment is 1600 words (excluding appendices)

Learning Outcomes

On successful completion of this assessment, you will be able to:

a. Select and apply academic literature, industry sources and models to examine and analyse markets and industries to identify opportunities for the development of a new business venture.

c. Demonstrate the capacity for original thinking through the identification and evaluation of an unexploited market opportunity.

Your grade will depend on how well you meet these learning outcomes in the way relevant for this assessment. Please see the final page of this document for further details of the criteria against which you will be assessed.

Assessment 2:

Please read the whole assessment brief before starting work on the Assessment Task.

The Assessment Task

You are required to produce a professional business plan for a new venture. This should follow on from your AS1 opportunity analysis. Please use the template below and answer all the sections required.

Task:

Write a professional business plan for a new business, answering all the sections. Please include a short executive summary and the table of content.

|

1. YOUR BUSINESS IDEA (approx. 500 words) What will your business do and what is the opportunity? Describe, in detail, the products and/or services your business will be selling, what channels you will use to sell them and who you will sell them to. What does your brand stand for? What is the business philosophy and values? Include any pictures, drawings, or links that help bring this to life. |

|

2. YOU AND WHY YOU’RE STARTING (approx. 250 words) Tell us about yourself, where the idea came from, and how your knowledge and experience will help to make the business a success. |

|

3. MARKET RESEARCH (approx. 400 words) 3.1 The Big Picture Describe the wider market you are planning to operate in and identify where your company will sit in this landscape, as well as any key statistics or trends to support why you have chosen this area of the market. Include evidence of demand and as many details as possible to support your choice of new venture. 3.2 Competitors Analysis Analyse your competitors’ strengths and weaknesses (include 3-4 competitors’ information): Competitor 1: · Name & Type of Competitor · What will you be competing on · Strengths of Competitor · Weaknesses of Competitor · Summary of How you will compete with them Competitor 2: · Name & Type of Competitor · What will you be competing on · Strengths of Competitor · Weaknesses of Competitor · Summary of How you will compete with them |

|

4. CUSTOMER RESEARCH (approx. 300 words) Include information on direct research and/or evidence of demand etc. |

|

5. MARKETING (approx. 400 words) 5.1 Customer Profile · Description of Customer · Why are they your Customer · Channels you will use to market to them · Activities within channel and related costs 5.2 Route to Market 5.3. Launch Marketing & Growth Strategies |

|

6. OPERATIONS (approx. 200 words) 6.1 Premises 6.2 Staff (Job title; hours per month/week or FT; Cost; Month Start (1 – 12)) 6.3 Suppliers and Third Parties 6.4 Risks 6.6 Legal and Regulatory |

|

7. FINANCES 7.1. Capital requirements and funding options 7.2. Financials (Sales forecast, P&L, Cash flow, Balance sheet, Breakeven analysis) |

|

8. RISKS AND MITIGATION (approx. 150 words) 8.1. Strategic, Financial, Operational, Reputational, Compliance, etc. (approx. 150 words) |

|

9. GROWTH STRATEGY (approx. 200 words) |

NB: Included in your assignment submission should include: a list of references using Harvard referencing style, spreadsheets with financial data (P&L statement etc.) and any other additional information (e.g. applications of models, stats & graphs etc). Consider that 10% of overall mark is given to Academic / professional quality (use of sources & references, content clarity, use of supporting evidence). You can include up to 5 pages of supporting evidence in Appendices.

The maximum word limit for this assessment is 2400 words (excluding appendices).

Learning Outcomes

On successful completion of this assessment, you will be able to:

a. Demonstrate the capacity for original thinking through the identification and evaluation of an unexploited market opportunity.

b. Communicate effectively with specialist and non-specialist audiences, using evidence-based approaches and selecting appropriate tools and strategies to convey meaning and purpose.

c. Build on a recognised opportunity to systematically evaluate the selected industry and produce a viable business plan.

Your grade will depend on how well you meet these learning outcomes in the way relevant for this assessment. Please see the final page of this document for further details of the criteria against which you will be assessed.

Project 1 - Business Plan

This assessment comprises a 3000 word business plan. It is a comprehensively researched proposal for the formation of a New Venture, together with a clear strategy for growing the business in the medium term. Assessment criteria will include: clarity of business objectives; proof of market; management and operational detail; promotional and marketing planning; consideration of funding requirements; justified financial costings and forecasts; explicit growth strategy; evidence of innovation and entrepreneurial focus; presentation to a good commercial standard.

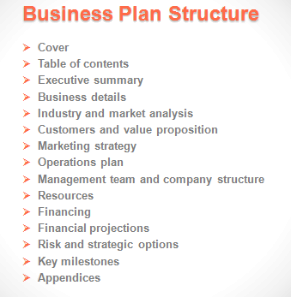

According to sources such as Burns (2014)1 and others, a business plan should consist of the following elements:

The business plan will be assessed on:

· Clarity of business objectives

· Proof of market and the breadth and currency of research sources

· Management and operational detail

· Promotional and marketing planning

· Consideration of funding requirements

· Justified financial costings and forecasts

· Strategy for growing the business in the medium term

· Evidence of innovation and entrepreneurial focus

· Professionalism of presentation

1 Burns P, (2014) New Venture Creation: A Framework for Entrepreneurial Start-Ups, Palgrave Macmillan

Details of Business Plan

Cover

The cover should include the business name and contact details. You should consider whether the plan needs to be marked 'confidential'.

Table of contents

This is a list of sections and sub-sections, with page numbers.

Executive summary

If you are seeking external finance, this is probably the most important section of the plan. Many equity

investors will only read the full plan if they find the summary attractive it should only be written after

the full plan is complete, and then it should be written with the reader and purpose of the plan in mind

If it is to be used to attract funding, it should state what is requested from the lender or Investor and

how they will benefit by providing the funds it must be a summary of the plan - not an introduction it

should highlight the nature of your product/service, target customers, value proposition and

competitive advantage. It should appeal to the reader by highlighting the distinctive capabilities and

potential of the business, including the financial return if the plan is written to attract an equity investor.

It should state what deal you are offering, for example, '20% of the business in exchange for £100,000'.

Above all, the executive summary must be focused and succinct -no more than one or two pages long.

Business details

This section covers basic information such as business name, address, legal form and ownership.

It should include:

· A description of your product/service;

· Your mission and vision statement;

· Your aims and objectives.

If this is an existing business, you should include a brief business history.

Industry and market analysis

This section provides background information on your industry sector and the market segments within it. It should take the form of a narrative informed by academic models such as a SLEPT analysis and Porter's Five Forces. You should review your competitors and their strengths and weaknesses. The more you know about an industry and market, and the competitors you face, the more confidence your readers will have in your ability to compete within it. This section should include:

· Industry size, growth, structure (macro and micro/local level).

· Industry and market trends (macro and micro/local level).

· Market segments and reasons for target market(s) selection.

· Buyer behaviour across segments.

· Competitor analysis (strengths and weaknesses).

· For an existing business - market share.

In most industries there are some key success factors that industry players have to have mastered in order to compete. These need to be highlighted but judgement is required about what is important for your particular venture.

Customers and value proposition

This is the section where you outline your target market segment(s) and the value proposition(s) for your product/service. It is essential that your 'unique selling proposition(s)' are clearly and simply articulated. In doing this you should highlight your differential advantage over competitors. The more points of difference and the stronger and more sustainable these differences, the better.

This is where you also set out your sales targets. If you have firm orders for the product or service; be sure to mention this.

Marketing strategy

This section provides the details about how you propose to achieve those sales targets -not only the details of your marketing mix but also the details of your sales tactics (how the product or service will actually be sold). As well as the launch strategy, this should also highlight the growth potential through market and product development, your competitive reaction and strategy for establishing your brand. It should include:

· Price, promotions, distribution etc.

· Launch strategy.

· Sales tactics.

· Brand development.

· Competitive reaction.

· Product and market development

· Growth potential

Investors are always particularly interested in pricing strategy because this is a prime determinant of the profitability of the business.

Operations plan

This section outlines how your business will be run and how your product/service will be produced. What goes into the operations plan varies depending on the nature of the venture. However, what is important is that the key activities for your venture are highlighted. The operations plan must convince the reader that you understand the operation of the business -how to do whatever needs to be done to deliver your product/service. So, issues of business control, if critical to the business, need to be covered. Also, the prospect of scalability - should the business prove to be even more successful than planned - can be addressed in this section. What are your strategic options?

The content of this section is difficult to predict might include:

· Key operating activities (e.g. manufacturing processes, business model etc.);

· Partnerships;

· Business controls;

· IP issues;

· Scalability.

Management team and company structure

This section outlines all the people involved in the venture - details of their background and experience –as well as the organizational structure you are adopting. A new venture team with an established track record in the industry or with relevant experience will certainly add credibility to any start-up. Remember that investors ultimately invest in people, not products. An experienced board of directors can achieve the same result.

Brief CVs can go in the appendices. For larger start-ups, an organization chart can go in this section. This section should include:

· Key people, their functions and background;

· Business organization or structure;

· Directors, advisors and other key partners;

· Skills saps and plans for filling them.

Resources

This section describes the firm's facilities, equipment and staff requirements. It should include:

· Premises and facilities;

· Machinery and equipment;

· Staff.

Financing

This section highlights the finance you need to launch your business. External funders will expect you to contribute some capital. Lenders will be interested in the risks they face and the security they can obtain. Equity investors will be interested in the overall return they might make and how this might be realized. This section should include:

· Founders' contribution;

· Loan and/or equity finance requirements;

· Gearing/leverage

· Time scale and exit routes for equity investors.

Financial projections

Typically financial projections for three years are expected by funders, with a monthly cash flow forecast for the first year. A very small-scale start-up insight only provide financial projections for the first year Five-year forecasts might be expected for larger projects where significant commercialization risks have not been resolved. You should provide a one-page financial summary and place the detailed projections in the appendices.

Financial details going into your appendices should be as long as it takes to provide all the information required. These should include:

· Income projections;

· Cash flow projections;

· Balance sheet projections;

· Key ratios;

· The assumptions on which your financial projections are based, particularly the basis for your

· sales projections.

Risks and strategic options

This section should identify the key risks you face and explain how they will be monitored and mitigated. You need to identify your critical success factors and the strategic options you face should these key risks materialize. Strategic options are valuable because circumstances can, and do, change. They give you flexibility in a changing environment. This section should include:

· Identified risks;

· Risk monitoring and mitigation;

· Critical success factors;

· Strategic options.

2024-01-04