UPD403 Governance and Finance of Urban Regeneration 2023/24 COURSEWORK 2

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

MSc in URBAN PLANNING

UPD403 Governance and Finance of Urban Regeneration 2023/24

COURSEWORK 2

COURSEWORK TYPE: Case Report

INSTRUCTION TO STUDENTS:

1. Assessment Weight: 40% of the final mark

2. Delivery Method:

a. Individual Report (100%): Case Report

i. The case report should be approximately 2000-3000 words in length (double- spaced typing).

ii. Word count of the case report excludes figures, tables, appendices, and references.

3. Submission:

a. Individual Report: 03:00 PM 4th of January 2024

i. Submission via LMO (MS Word & PDF, no hard copy is required)

ii. The filename must be "UPD403_CW2_your student ID_your name.pdf".

iii. All Excel files for Cost-Benefit Analysis should be submitted electronically along with the report

iv. Late submission penalty applies.

Case Report – Cost-Benefit Analysis for An Urban Regeneration

Project in Suzhou

1. Project Brief

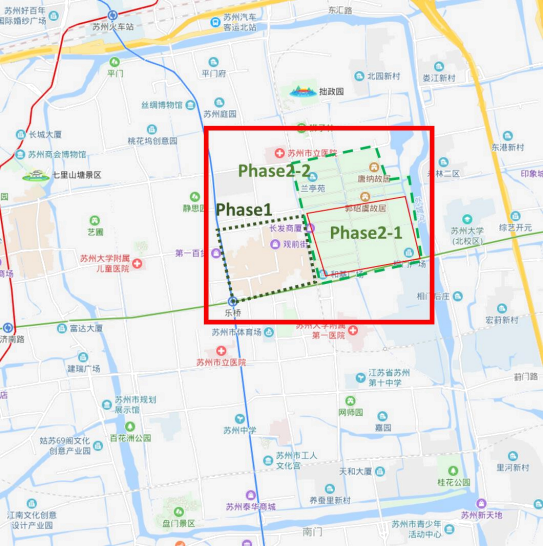

The City of Suzhou (COS) is considering a plan to regenerate part of Gusu historic district area (historic preservation area highlighted in red box) in Suzhou. The project is to be undertaken in two stages. Stage 1 will begin in 2020 and will complete the section of old market by the end of 2022. Stage 2 will complete the two phases between Pingjang road and Guanqian street, and to the northern part of the historic area to be regenerated and rehabilitated between 2022 and 2025. The location of different regeneration phases are illustrated in Figure 1.

Figure 1. The locations of different regeneration phases

It is proposed that this project will be undertaken as a Public-Private Partnership (PPP) in terms of which the private contractor (‘concessionaire’) will operate the project under a Build- Operate-Transfer (BOT) Scheme (it is not strictly BOT per se as COS take 35 percent of corporate tax). Under this scheme the concessionaire will be responsible for rehabilitating, building, operating and maintaining the historic area. It is proposed that the newly regenerated area will be operated as one of the most attractive tourist places through which the concessionaire is expected to recoup its share of the capital investment and operating and maintenance costs. Working with Suzhou government, the concessionaire will operate the historic area for 15-years after completion of Stage 2 of the project (2025 to 2040) after which it will hand over the project to the COS, at no charge. The COS will take profit share for about 30 percent. Thereafter the COS assumes full responsibility for operations and maintenance until the end of 2065, the assumed end of the project’s life.

You are required to undertake a comprehensive cost-benefit analysis of the project from the perspective of COS and the concessionaire. All calculations should be done in millions of RMB, rounded to two decimal places and expressed in constant 2020 prices. Note that all values reported in this project summary are at 2020 prices.

2. Investment Costs

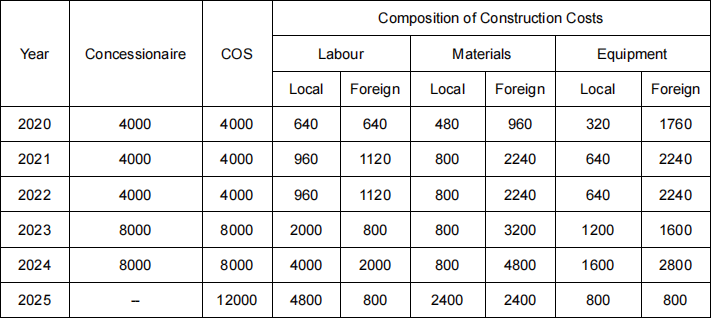

The investment costs are given in Table 1 which shows the year-by-year breakdown, the allocation between the private and public sectors, and, the composition of inputs.

Table 1: Composition of Capital Costs

(all values in RMB millions)

2.1. New Building Construction and Rehabilitation of Old Buildings

Land is rented at the start of each stage of construction with a lump-sum payment. Land rent costs are included in COS capital costs. Assume that in 2020 3,200 million RMB (of the 4,000 million RMB) and in 2022 6,400 million RMB (of the 8,000 million RMB) is for land. The land rented for the regeneration of historic tourist place has an opportunity cost estimated at approximately 50% of the cost paid to the previous occupants (renters, property owners, etc.).

Assume local labour consists of 50% unskilled and 50% skilled/managerial, and foreign labour is 100% skilled/managerial. The shadow price of unskilled labour is 20% of the wage and the shadow price of skilled labour (local and foreign) is 100% of their wage.

Assume that all local materials and equipment prices are inclusive of a sales tax of 10% paid to COS, and all imported materials and equipment costs include a 5% import duty. Note that no sales tax is levied on imports.

2.2 Entrance Ticketing Plaza System

The entrance ticketing plaza system will require the construction of 4 plazas to be installed as new sections of the designated project area are completed. The capital cost of each plaza is estimated at 10 million RMB (2020 prices). The first two plazas will be installed in 2022, another one in 2023 and one more in 2024.

The composition of this cost is: 40% imported materials, including 5% import duty; 40% local materials including 10% sales tax; 10% skilled labour; and, 10% unskilled labour.

3. Maintenance/Operation Costs and Salvage Value

3.1 Regenerated Area (New Buildings and Rehabilitated Buildings)

It should be assumed that expenditure on the maintenance of the regenerated site (excluding the ticketing house facilities) will amount to 300 million RMB per annum, beginning in 2022. Assume the same composition as with total capital construction costs over the period 2020- 2025 as shown in Table 1.

3.2 Ticketing System

Operation of the ticketing system will require regular maintenance and periodic rehabilitation equal to 5% of the total initial capital cost of the toll utilities, beginning in 2025. For the net- benefit analysis, assume the same composition as for the initial capital costs of the ticketing plazas.

3.3 Salvage Values

The salvage value of the Regenerated Area and Ticketing System utilities will be approximately 50% of the initial capital cost. For the net-benefit analysis assume that the benefits of all salvage values are equal to their value at market prices. If at the end of the 15- year concession COS decide to collect the tickets, allow for the 50% salvage value of the entrance ticketing plazas at the end of 2040, otherwise for ticketing houses and regenerated tourist area at the end of 2065. The salvage value of the toll plazas and highway will accrue to COS.

4. Benefits from the regeneration

The main categories of project benefits that should be considered in the project appraisal are:

(i) Ticketing revenues received by the concessionaire and COS

(ii) Increase in property values in surrounding areas

(iii) Growth of the number of local services (shops, hotels, restaurants, etc.) in the areas

(iv) Increase of tax revenues and employment of the businesses

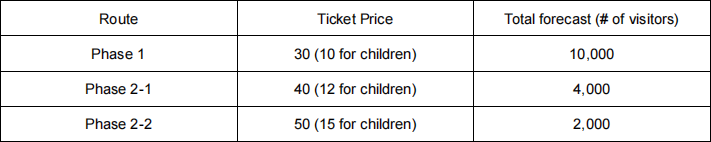

Table 2 shows the forecast visitor volume on the new regeneration project. The forecast total includes tourists (local and regional) visiting in on existing other areas in Gusu District and the newly regenerated area combined.

Table 2 Forecast of Total Site Visitors form 2024

It has been estimated that with the ticketing service, 60% of the forecast tourists will visit the urban regeneration area, with the other 40% continuing to use the existing historic area. Based on recent trends it should be assumed that this forecast visitors will increase by 4% each year, starting with year 2025, until the end of the project’s life. Assume that in 2024 and 2025 the visiting number of tourists in the regenerated area is equal to 36% of the forecast total volume of visitors for the complete regeneration project. In 2026 when Phase 2 opens, the urban regeneration project will operate at 100% of the forecast volume of visitors from the first year onwards.

The following sub-sections outline the details necessary for calculation of each component of project benefit.

4.1 Revenues from Ticketing

Ticketing charges are expected to be set at 30 RMB for tourist in Phase 1 and 40 RMB for Phase 2-1 and 50 RMB for Phase 2-2, in 2020 prices, and indexed for inflation. There is no sales tax on the ticketing, the concessionaire retains all the proceeds from the ticketing until the end of its concession (at the end of 2040).

4.2. Increase in property values in surrounding areas

There are different types of properties: residential, commercial and mixed use. It has been estimated that annual growth rate of property value on the host regeneration area and surrounding area can be broken down as follows: 10% for residential; 30% for commercial, and, 30% for mixed-use. The increase of property values continue to happen up until 5 years after the project construction. All property values increased should be treated as external non-financial benefits (ie. should be omitted from the project and private analyses) and should be priced at the appropriate shadow prices. The initial property values in total is estimated as follow:

Table 3 Growth of value of property market

4.3. Other benefits

There are other benefits inherited from the regeneration project.

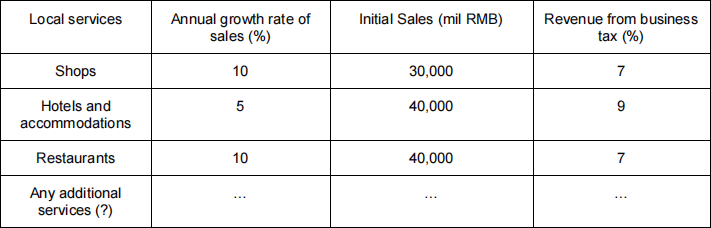

1) Growth of the number of local services (shops, hotels, restaurants, etc.) in the areas

For the purpose of study, it will be assumed that there will be 10 percent increase in the sales of shops and restaurants annually and 5 percent growth of hotels and accommodation services. Further services and functions can be added using Suzhou statistics (see http://www.sztjj.gov.cn/SztjjGzw/tjnj/2018/zk/indexeh.htm).

2) Increase in tax revenues of the businesses for the COS

General rule of thumb is to take 7-9 percent of the sales from businesses. This can be broken down to different local services provided in the new regeneration area.

Table 4 Annual growth of sales of local services

5. Tax and Financing Arrangements private CBA = project (BA- tax) - debt

The concessionaire is required to pay 35% corporate tax on its earnings. While interest payments on loans can be treated as a tax deductible cost, no provision is made for depreciation allowances as a deduction against income for tax purposes.

The concessionaire will finance its share of the initial capital cost with loans from international banks of 20,000 million RMB drawn in 2022 and repayable over the next 15 years at 3.5% (real) interest rate. The balance of its investment is financed from its own funds (equity) held by its parent company in UK. The other investor is the COS which borrows the equivalent of US$48,000 million domestically at 4.5% (real) interest rate in 2022, repayable over 40 years, and finances the balance of its expenditure from its own funds.

6. Arrangements on Termination of the Concession

On termination of the concession at the end of 2040 the regenerated area and its maintenance are handed over to and will become the full responsibility of COS. There will be no payment to the concessionaire. Assume that the regenerated project is operated for a further 25 years (ie. until the end of year 2065) and that the salvage value is 50% of the initial highway capital cost. A decision has to be made as to whether the regeneration project should be managed with or without a ticketing system from 2041 onwards. It has been predicted that removal of the ticketing office would result in a 30% increase of the total forecast tourists visiting to the regenerated area from the other part of Gusu district.

The ticketing facilities have a salvage value of 50% of initial cost, and will be scrapped either at the end of 2040, if COS decides not to continue the ticketing system, or at the end of 2065 if they do. (In either case the salvage value will accrue to COS.)

It should be assumed that if the ticketing office is removed in 2041 all benefits, with the exception of the reduced maintenance costs on existing historic preservation area (item 4.3 above), increase proportionately with the increase in visitor volume.

7. Your Task

Suppose you area planning professional in China and beginning your project with your team. As a consultant, you have been asked by the COS to provide an evaluation report for assessing Cost-Benefit Analysis (CBA). Your task is to undertake a complete CBA of the proposed project as detailed above, with and without the ticketing service after 2041. The results of the project, private Cost-Benefit analysis should be calculated and discussed.

The COS uses a 6% discount rate (real) for public sector investment decision making. It is understood that the concessionaire requires a minimum return of 12% (real) on its equity. Your report should advise the government on whether the project is worthwhile and which scenario (with ticketing or no ticketing after 2041) you consider the best, giving reasons.

In constructing your spreadsheet tables you are required to use the template Excel spreadsheets which can be downloadable from ICE. These are an essential guide to the structure of the spreadsheet model. You should not change the structure of the template spreadsheets unless requested to do so.

In your discussion of your findings you should identify (in 250 words or less) what other variables if any, should be selected for further CBA, and explain why. (Please note: it is assumed that import duties and sales tax are fixed and are not subject to change.). You should be able to conclude with some recommendations regarding how to achieve a better distribution of costs/benefits (who should pay the costs) and, in case, which compensation measures could be employed further.

(2) Delivery Format

There are two different delivery formats: case report and Excel. The format of the report should be as follows:

1) The essay should be approximately 2,000-2,500 words in length.

2) Word count of the main body of the essay excluding figures, tables, appendices, and references.

3) It should be on A4 size pages (portrait orientation only), 12-point Times New Roman font, double line spacing, and 2.5 margins on all sides.

4) Use illustrations (maps, diagrams, graphs, etc.) for effective communication.

5) The report should begin with an executive summary of no more than one page in length. Results of the CBA should be reported in summary tables included in the text, and where necessary, in more detailed tables in an Appendix (not included in the 2000-2500 words). Do not attach copies of spreadsheets (eg. in PDF) to your main report, although sections showing summary results can be cut and pasted into the report.

6) Excel files for all scenarios should be submitted electronically, formatted in landscape in normal view, and left unlocked so calculations can be checked. Each Excel file (and/or sheet in a workbook) should be clearly and logically labelled with your student number and scenario for reader-friendly identification.

7) For ease of reading you need only show the cash flows for the first 21 years of the project (i.e. up to and including 2040) and the last two years (2064 and 2065), hiding all the years in between so the entire sheet can fit on one screen.

Please also note:

1) Please make sure that you include proper references in the report and the language you use is readable. Your prose should be simple, clear, and easy to read. When discussing technical information, avoid the use of jargon or at least define your terms clearly. Proofread carefully so that you do not distract your readers from the content of your essay with poor spelling or grammar.

2) I will not agree to read and comment on draft reports before the submission dates; however, general guidance on the direction and structure of the reports will be provided.

(3) Marking Criteria

There are six marking criteria for the assignment:

It is the responsibility of all students to familiarise themselves with the University’s policy on plagiarism and collusion. The University and Department treat with the utmost seriousness all suspected cases of academic malpractice. The standard penalties are listed below:

1. Plagiarism, copying, collusion or dishonest use of data (Category C): Award ‘0’ for that assessment task

2. Second Category C offence (Category D): Award ‘0’ for the whole module

3. Third Category C offence or unfair and/or dishonest academic practice:

a. Suspension for one year, or

b. Termination of studies

Please see the “Academic Integrity Policy” document available on e-Bridge in the Student Academic Services section under the heading 'Policies and Regulations ’.

Rules of submission for assessed coursework

Full details of compatible file formats can be found on Learning Mall under Modules/Miscellaneous/Support Areas/Learning Mall Support for Students. If you are uploading a PDF file please review the information available under the topic called 'Turnitin Compatible Software and File Formats' on the Learning Mall page.

The University has detailed rules and procedures governing the submission of assessed coursework. You need to be familiar with them. Details can be found in the “Code of Practice for Assessment” available on e-Bridge in the ‘Assessment and Examination ’ section under the heading ‘ Policies and Regulations’.

Late Submission of Assessed Coursework

The University attaches penalties to the late submission of assessed coursework. You need to be familiar with the University’s rules. Details can be found in the “Code of Practice for Assessment” available on e-Bridge in the ‘Assessment and Examination ’ section under the heading ‘ Policies and Regulations’ . Five percentage points will be deducted from your mark out of 100 for the assessment for each working day or part there-of after the submission date/time that you submit it, up to a maximum of five working days. Thereafter, a mark of zero will be awarded. Please note that it is university policy that there can be no exceptions to this rule without appropriate certification.

Generative AI

The use of Generative AI for content generation is permitted/not permitted on all/some assessed coursework in this module.

For more information and resources on Generative AI and your learning and assessment, please consult the “XJTLUAI for Learning” pages of the Learning Mall Core.

Rating Scales

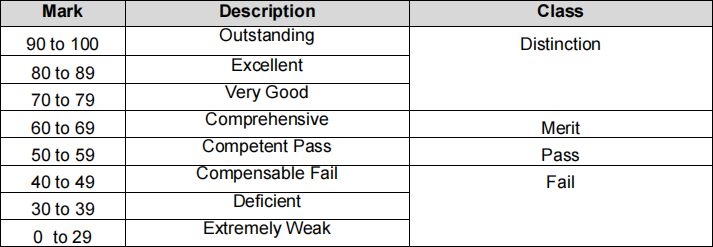

Rating scales conform to the XJTLU Marking Descriptor. The marks awarded on individual modules are categorised as follows:

2024-01-03