ECON 412 Labor Economics and Labor Markets Homework 4 Fall 2023

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ECON 412

Labor Economics and Labor Markets

Homework 4

Fall 2023

Problem 1

Suppose a drop in the compensating wage differential between risky jobs and safe jobs has been observed. Two explanations have been put forward:

a) Engineering advances have made it less costly to create a safe working environment.

b) The phenomenal success of a new action serial “Die On The Job!” has imbued millions of viewers with a romantic perception of work-related risks.

Using supply and demand diagrams, show how each of the two developments can explain the drop in the compensating wage differential. Can information on the number of workers employed in the risky occupation (or the changes therein) help determine which of the two explanations is more plausible? How?

Problem 2

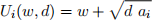

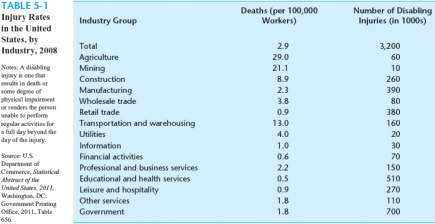

Assume that there are 200 workers (i = 1, ..., 200) in the labor market, each with preferences given by

where w denotes their disposable income, d denotes the number of vacation days they get each year, and ai is a preference parameter. Assume preferences are heterogeneous, such that a1 = 1, a2 = 2, and so on until a200 = 200. Assume there are only two types of jobs in the labor market: job A and job B. Job A pays a gross salary of $100 and offers 16 vacation days, whereas job B pays a gross salary of $80 and offers 36 vacation days. Assume that everyone within the same job gets the same wage and the same number of vacation days.

a) How many workers choose job A, and how many choose job B? Who is the marginal (i.e. indifferent) worker, and what is her utility level at each job? Show your work.

b) Now assume there is an income tax rate of τ = 20%. How do your answers to part a) change? In particular, which workers strictly prefer to switch jobs?

c) Assume there is no income tax, but instead, suppose there is a new start-up firm (“job C”) in the market which offers jobs with only 4 vacation days. Suppose they are looking to hire 25 people. How high should they set their salary, and which workers will they end up hiring?

d) Assume there is no income tax, but instead, suppose there is a non-profit firm (“job D”) that can only pay their workers a salary of $24. What’s the minimum number of vacation days they should offer their workers, if they are looking to hire at least 5 people? Which 5 workers will they end up hiring?

Problem 3

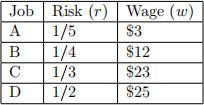

Consider a competitive economy that has four different types of jobs that vary by their wage and risk level. The table below describes each of the four jobs. All workers are equally productive, but workers

vary in their preferences. Consider a worker who values her wage and her risk level according to the following utility function:

a) Where does the worker choose to work? What is her utility level?

b) Now suppose the government regulated the workplace and required all jobs to have a risk factor of 1/5 (that is, all jobs become type A jobs). What wage would the worker now need to earn in her job to be equally happy following the regulation?

c) Now suppose there is no government regulation, but assume instead that the worker systematically underestimates the risk in all four jobs, and believes the risk is r = 1/10 everywhere. Which job would she choose now? What happens to her actual and her perceived utility compared to her old job?

d) Do you think the government should regulate this market or not? Why or why not? How does your answer depend on the worker’s perceived versus her actual risks on the job? Explain your reasoning in detail.

Problem 4

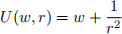

Consider Table 5-1 below (see also Borjas Chapter 5.2) and compare the fatality (or death) rate of workers in the Construction, Manufacturing, and Financial industries, respectively.

a) Based on the theory of hedonic wages, what would you expect the distribution of wages to look like across these three industries, given the compensating differential they might have to pay to compensate workers for risk?

b) After doing some Googling, suppose you find out that the actual hourly earnings for each industry in 2006 were: $20.02 in construction, $16.80 in manufacturing, and $45.60 in finance. Does the actual distribution of wages confirm your answer to part a)? Why or why not?

c) Besides compensating differentials, what else might affect the determination of (and differences between) median weekly earnings in these three industries? Discuss at least 2 possible factors.

Problem 5

Consider a society with millions of individuals, who all value only two things about their job: Money (i.e. the annual salary it pays) and Status (e.g. how famous you are). Everyone likes both of these aspects of their job, but preferences are heterogeneous, such that some people care (much) more about money than about status, whereas others care (much) more about status than about money. Assume that apart from their individual preferences, everyone is equal in every other respect (e.g. age, experience, education, looks, skills, etc.). Assume there are many different competitive labor markets (i.e. professions) in this world, each one offering a distinct “total compensation package” consisting of a combination of money and status.

a) Plot the indifference curves of two different individuals: (i) someone with relatively high tastes for money, and (ii) someone with relatively high tastes for status. How do you interpret their reservation prices, and how to they differ?

b) Make a graph of the hedonic wage function in this world. How would you interpret its slope and its intercept? Plot the optimal tangency points (and corresponding indifference curves) for the two individuals whose indifference curves you plotted in part a).

2023-12-27