MATH5816 Continuous Time Financial Modelling

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

MATH5816 Continuous Time Financial Modelling

Assignment 1, 2021

Instructions: This is a group assignment (up to 3 person per group) which is worth 10% of the total assessment. The assignment must be submitted online to turnitin on moodle before 7pm on Wednesday Week 4. There will be two turnitin submission boxes, one for the group and one for each individual. Everyone in the group should submit a copy of the assignment to the individual submission box and only one member of the group should upload their assignment to the group submission box. Only the copy submitted to the group submission box will be marked.

Exercise 1. Suppose for t ∈ [0, T] that X satisfies the SDE

and Y satisfies

where V is a Wiener process which is independent of W.

1. Define Z by Z = XY and derive the stochastic differential equation satisfied by Z. Note that if X describes the price process of an APPLE in USD and Y is the currency rate AUD/USD then Z describes the dynamics of the APPLE stock expressed in AUD.

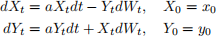

Exercise 2. Let X and Y be the solution to the following system of SDEs

where W is a Brownian motion and x0, y0 are constants.

1. Show that

is a deterministic process.

2. Compute

Exercise 3. Let  be a one-dimensional standard Brownian motion defined on a filtered probability space

be a one-dimensional standard Brownian motion defined on a filtered probability space  endowed with the filtration

endowed with the filtration

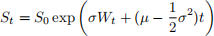

1. Show that the process (St, t ∈ [0, T]) given by the formula, for every

where

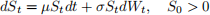

is the unique solution of the stochastic differential equation (SDE)

Hint: To establish S is a solution, it is sufficient to apply the

formula and the uniqueness of a solution to SDE (1), assume that

is another solution to equation (1) with

and use the

formula in order to show that

2. Using the

formula, derive the stochastic differential equations satisfied under

by the processes

and

Recall that

and

is a probability equivalent to P under which the discounted stock

is a martingale.

3. Apply the Girsanov theorem in order to find the unique probability measure

on

under which the process

is a martingale. Write down the dynamics of

under

with respect to a suitably defined Brownian motion

2021-10-12