MIDTERM SAMPLE PROBLEMS 2021

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

MIDTERM SAMPLE PROBLEMS

Please note the Zt in the following is the same as wt, namely these are white noises.

• 1. What are the model assumptions of ARIMA(p,q) model?

1.

2.

3.

4.

2. Explain the following terms briefly

1. Weak stationarity.

2. White noise.

3. Sample autocorrelation function.

4. The if and only if conditions for the invertibility of the MA(q) process.

3. (1) Suppose that {Yt} is stationary with autocovariance function γk. Show that Wt = Yt − Yt−1 is stationary.

(2) Suppose Yt = β0+β1t+Xt where {Xt} is a zero-mean stationary series with autocovariance function γk and β0 and β1 are constants. Show that {Yt} is not stationary but that Wt = Yt − Yt−1 is stationary.

4. (1) Consider the process: Wt = 0.8Wt−1 + et − 0.3θet−1 where Wt = Yt − Yt−1. What kind of model is it? Find the variance of the process {Wt}. (2) Find the autocorrelation for {Wt}.

• Problem A

1. State whether the following model is stationary, and whether it is invertible. Explain why.

Xt = Zt − 1.5Zt−1 + 0.5Zt−2

2. We perform ARMA analysis on a time series Xt . The following are the outputs of the ARMA model.

ar1 ma1

0.2569 -0.9302

s.e. 0.0787 0.0361

(a) Write down the estimated model for Xt .

(b) Write down the AR and MA polynomials of the model.

3. Obtain all non-zero serial correlations ρ(h) of the model Xt = (1 − 0.2B)(1 − 0.3B2)Zt where Zt is i.i.d. normal with mean zero and variance 3. Show your computation steps.

4. Suppose the monthly simple returns of a portfolio for Oct., Nov., and Dec. of 2011 were 0.04, 0.03, and -0.02 respectively. What is the quarterly log return of the portfolio for last quarter of 2011? What is the quarterly simple return of the portfolio for last quarter of 2011?

1. First we look at the outputs of simple statistics calculated for sp500 daily log returns.

Answer the next two questions:

> basicStats(sp500.logreturn)

sp500.logreturn

nobs 1528.000000

NAs 0.000000

Minimum -0.094695

Maximum 0.109572

1. Quartile -0.005430

3. Quartile 0.006319

Mean 0.000024

Median 0.000857

Sum 0.036776

SE Mean 0.000396

LCL Mean -0.000753

UCL Mean 0.000801

Variance 0.000240

Stdev 0.015485

Skewness -0.276724

Kurtosis 7.927383

(a) Based on the output, is the mean of the log return significantly different from zero at 5% level? Write down the test-statistics and draw conclusion. Z0.025 = 1.96, Z0.05 = 1.65?

(b) Which statistics in the output is usually used for checking if the log return is heavy tailed? Write down the numerical value of that statistics.

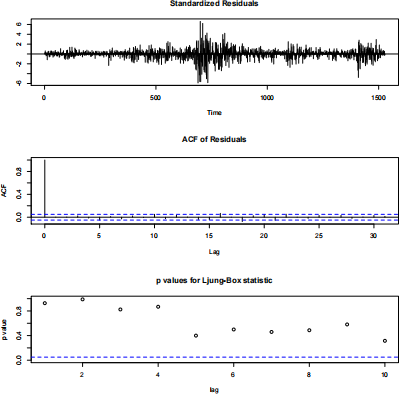

2. Next we fit an AR(2) model to the data. Judging from the tsdiag plot of the model, is the model adequate? Why? Pay special attention to the first plot.

> model1=arima(sp500.logreturn ,order=c(2,0,0))

> tsdiag(model1)

• Problem C

Consider the AR(2) model

Xt = 0.02 + 0.7Xt−1 − 0.1Xt−2 + Zt ,

where Zt is normal with mean 0 and variance 2.

1. What is E(Xt)?

2. What is the AR polynomial for this model? What are the roots of the polynomial?

2023-12-23

Time series modeling