ECON6023 Macroeconomics Homework 1

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Macroeconomics, ECON6023

Homework 1

Due Friday, 15 December 2023 (by 11:59 PM)

Weights: Q1=10%, Q2=90%

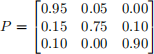

1. Consider the following matrix:

(a) Can this matrix be used as a transition matrix of a Markov chain?

Please explain.

(b) Suppose that π′0 = [0.1, 0.8, 0.1]. Compute π′1.

(c) Compute the probability of the following history of state realiza-tions, starting with t = 1:

{e2, e1, e3}

(e) Compute the stationary distribution for this Markov chain.

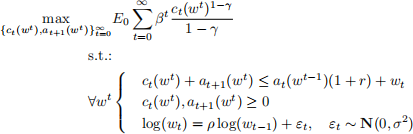

2. Consider the stochastic version of the consumption-savings problem.

The dynamic optimization problem that the consumer solves has the following sequential formulation:

where  is the per-period utility function, r is the interest rate on savings (which we assume to be constant), and wt is the wage income which we assume is random and follows an AR(1) process.

is the per-period utility function, r is the interest rate on savings (which we assume to be constant), and wt is the wage income which we assume is random and follows an AR(1) process.

(a) Provide the recursive formulation of the above dynamic optimiza-tion problem. What is/are the state variable(s)?

(b) First, assume that γ = 1 so that the per-period utility function becomes u(c) = log(c). Furthermore, assume that wt = ¯w, which means that the wage income is constant, and the problem becomes deterministic. Solve this problem using the method of undeter-mined coefficients (Hint: guess that the value function has the fol-lowing form: V (a) = A + Γ log(a + Ψ), where A, Γ and Ψ are some unknown coefficients).

(c) Next, assume that γ = 2, β = 0.95, r = 0.02, ρ = 0.8 and σ = 0.12.

Solve the dynamic optimization problem numerically, discretizing the state space and using the ‘value function iterations’ method.

Some suggestions:

– Use the Tauchen method to approximate wt with a Markov chain with n = 5.

– Discretize the state space for a using Ad = [0, ¯A]. Try ¯A = 40.

Use Na = 300 equally spaced grid points over Ad. Make sure that you get a ′ = g(ai , w) < ¯A for all ai ∈ Ad and all w during each iteration of the algorithm. Otherwise, increase ¯A.

(d) Plot your solutions for the value function and policy functions for c and a′.

(e) What is the value of E(a) predicted by the model?

Some suggestions:

– Generate a random draw of the realizations of w of length 100000.

– Use the generated path for wt and the policy function for a ′ to generate the path for at+1. You can use any a0 ∈ Ad. I would suggest choosing a0 close to E(w), but you can experiment and see how robust your results are with respect to your choice of a0.

– Discard the first 10% of the generated at+1. Use the remaining observations to compute E(a).

(f) How does the predicted E(a) change under the following scenarios:

(1) β increases from 0.95 to 0.965,

(2) β remains equal to 0.95, but the interest increases to r = 0.03,

(2) β remains equal to 0.95, r remains equal to 0.02, but the stan-dard deviation of the wage shocks increases to σ = 0.18,

Can you provide intuition for your results in each of the three cases above?

If you find questions 2(c)-2(f) too challenging, try to answer them as-suming there are no shocks to the wages (and setting wt = 1 for all t).

2023-12-14