ECON 1100: Intermediate Microeconomics Assignment #5

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ECON 1100: Intermediate Microeconomics

Assignment #5

Due 10/19/2023 by 9:30 am

Answer the following two questions clearly and completely. Be sure to show enough of your work - I want to be able to see how you arrived at your answers so that I can understand your thought process and give partial credit if warranted. You are welcome and encouraged to work in groups as long as the work you hand in is your own! Do not hesitate to stop by my office hours if you have any questions or merely wish to talk through any aspect of the problems. Good luck!

1. George is a musician who enjoys playing two different instruments. His utility function is given by

u(G, S) = 8G1/2 + S, where G and S denote guitars and sitars, respectively. The prices of guitars and sitars are PG & PS respectively. For the following consider guitars to be the good on the horizontal axis.

a. Setup George’s cost minimization problem when he wants to achieve a utility level (u(̅) = 28),

which he considers to be consistent with a “ reasonable” lifestyle. Be sure to identify what he is minimizing and what is serving as his constraint.

b. Given your answer to part (a), find the bundle of goods George would consume to achieve a utility level 28, while minimizing the money he spends (solve this symbolically and then

substitute in the numerical values). Also find asymbolic expenditure function, that is, E(PG , PS,u(̅)) for George. What is the minimum amount he needs to spend given the prices PG = $200 and PS = $100?

c. Now suppose Apple Records gives George a guaranteed income of $1,800 and the prices of

guitars and sitars are still PG = $200 & PS = $100. Can George sustain his “ reasonable” lifestyle, that is, achieve a utility level of 28 or higher?

d. Imagine George is currently in the situation from part (b), but the price of a sitar has increased to $150. Does George need an income of $2600, i.e., enough money that he can still afford the optimal bundle he was buying before the price increase, to maintain his preferred lifestyle

(U=28)? If he doesn’t, what is the least amount of income he would need? Use the consumer’s problem diagram to illustrate the logic of your answer.

2. Over the past few years, one of the most closely monitored economic variables has been the inflation rate, which measures the change in the price level. Measuring it is complicated because different

prices change by different amounts and sometimes in different directions (for example, the price of college tuition has been steadily rising for decades, whereas the price of TV sets has been decreasing). We can use the expenditure function to aggregate the change in the price level, by asking how much more it costs to achieve the same utility level under the new prices. That is, if the prices change from

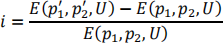

(p1, p2) to (p1(′), p2(′)), where p1(′) > p1 and p2(′) > p2, we can define the inflation rate as:

Suppose Bebelhasa Cobb-Douglas utility,  and an income level of Y = 1600. Suppose p1 =

and an income level of Y = 1600. Suppose p1 =

100 and p1(′) = 100 so the price of good 1 doesn't change, but the price of good 2 increases from p2 =

16 top2(′) = 25.

a. Calculate Bebel’s optimal consumption bundle and utility level at the initial prices p1 = 100 and p2 = 16.

b. Solve for the income level Bebel would need to achieve the same utility level under the new prices p1(′) = 100 and p2(′) = 25.

c. Given your answer to part (b) what is the inflation rate for Bebel given the price change?

d. How much more money would Bebel need to maintain her initial standard of living after the price of good two increases from $16 to $25?

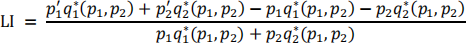

e. In practice, economists can’t observe utility functions but only the consumption levels chosen. For this reason, it is necessary to try to approximate the inflation rate using consumption levels. One approach is the Laspeyeres price index which calculateshow much more money would be needed to afford the initial consumption bundle, q1(∗)(p1, p2) and q2(∗)(p1, p2), at the new prices:

Calculate the Laspeyere’s price index for Bebel when the price of good 2 increases from 16 to 25.

f. Does the Laspeyres price index over or underestimate the inflation rate? Illustrate on a graph, using roughly drawn indifference curves and budget constraints, and briefly provide an economic intuition (no more than 3 sentences) for your answer in terms of the substitution effect.

2023-12-07