Economics 304 Potential Final Exam Questions Fall 2023

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Economics 304 Potential Final Exam Questions

Fall 2023

Length of examination 2.5 hours

Examination aids allowed Calculator.

Instructions Do 2 out of 3 questions

Note : Final exam questions will appear exactly as listed below except that some of the

parameter values might change. Question 1-3 are taken from the potential test 1 and test 2 questions that were not asked on test 1 or test 2. Students must answer 2 out of 3 questions. One question is based on test 1 and test 2 material (Question 1-3) and 2 questions are from material after test 2 (Question 4-7).

Question 1: Price Discrimination

a) (10 marks). Explain why third-degree price discrimination is profitable and why price

discrimination can either increase or decrease welfare. Explain why basing price on buyer characteristics can increase profits. Give examples.

b) (10 marks). Demonstrate the impact of price discrimination on profit and welfare by solving the third-degree price discrimination model done in class for the parameter values indicated below.

Third Degree Price Discrimination Model

pi = ai − bQi i = 1,2, MC = c

Parameter values : a1 = 32, a2 = 40, b = 1, c = 4

c) (10 marks). Explain the motives for the use of coupons in the breakfast cereal market. Explain whether the use of coupons in the breakfast cereal industry is consistent with third degree price discrimination.

d) (10 marks). Do either (i) or (ii).

(i) Explain the various factors which affect price dispersion in the airline industry.

(ii) Explain price discrimination in the car market. Explain why and how internet selling has affected a car dealer’s ability to price discriminate.

Question 2: Non-linear pricing and Tying

a) (10 marks). Explain how and under what circumstances tying can increase profits by acting as a metering device. Give a real-world example. Demonstrate your answer by solving the tying example done in class for the parameter values indicated below.

Tying Example

qB1 = a1 – pB, qB2 = a2 – pB MCA = cA, MCB = cB, N buyers of each type Parameter values : a1 = 13, a2 = 17, cB = 1, cA = 5

b) (10 marks). Solve the menu of two-part tariff example done in class for the parameter values and level of pL indicated below. Your solution should (i) derive values for pH, FL, FH and profits and (ii) show how buyers select from the menu.

Menu of Two-part Tariffs Example

p1 = a1 - q1, p2 = a2 - q2, MC = c, N buyers of each type

Parameter and pL values: a1 = 40, a2 = 50, c = 0. pL = 30

c) (10 marks). Solve the menu of block prices example done in class for the parameter values

and level of qL indicated below. Your solution should (i) derive values for qH, FL, FH and profits and (ii) show how buyers select from the menu.

Menu of Block Prices Example

p1 = a1 - q1, p2 = a2 - q2, MC = c, N buyers of each type

Parameter and qL values: a1 = 40, a2 = 50, c = 0. qL = 10

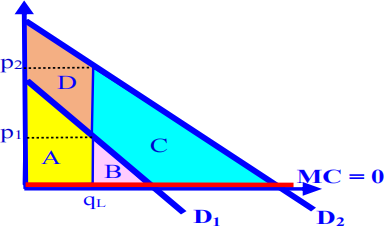

d) (10 marks). Use the diagram below to explain the profit earned from each buyer from the contracts in part c). Explain what happens to FL, qH and FH and the profits earned from each buyer if qL is slightly increased. Indicate whether overall profit will rise or fall.

Note : Diagram does not accurately reflect the distance between the demand curves or the

positioning of qL between the origin and the demand curves. Note also that there are no user fees and so the p1 and p2 indicated on the diagram are not user fees but are intended to assist in making the argument about how profits will change.

Question 3: Entry deterrence and Predation

a) (10 marks). (i) Discuss the credibility and profitability of the following strategies: Limit pricing, Buyout, Market Pre-emption and Predation. (ii) Explain how capacity and price evidence can be used to determine whether a firm has engaged in predation.

b) (10 marks). Solve the “Stackelberg-Limit Pricing” model done in class for the parameter

values indicated below to determine for what values of the market size parameter ‘a’ (i)

entry is not blockaded and (ii) both limit pricing and Stackelberg outputs are credible and (iii) entry accommodation at the Stackelberg equilibrium is more profitable than entry deterrence via limit pricing.

Stackelberg-Limit Pricing

P = a – Q, MC = c, FC = F

Parameters : c = 80, s = .75, F = 100

c) (10 marks). In the Exclusive dealing and Uncertain Entry model explain why exclusive dealing contracts are accepted by buyers and are profitable for incumbentseven if they do not deter entry. Explain why exclusive dealing contracts reduce welfare if they result in entry deterrence. Illustrate the profit and welfare consequences of exclusive dealing by solving the “Exclusive Dealing and Uncertain Entry” model done in class for the parameter values indicated below

Exclusive Dealing and Uncertain Entry

Incumbent cost: c, Entrant cost: ce = cL or cH. Prob(cL) = p, Prob (cH) = 1 – p, Buyer WTP = v Parameter Values: v = 10, c = 5, cL = 3, cH = 4, p = .3

d) (10 marks). In the Exclusive Dealing and Economics of Scale model explain under what

circumstances exclusive dealing contracts are accepted by buyers, deter entry and are

profitable. Explain why such contracts are welfare reducing. Solve the Exclusive Dealing and Economics of Scale model for the parameter values indicated below to show that exclusive dealing is only profitable if markets are sufficiently small (i.e. N is low).

Exclusive Dealing and Economies of Scale

N buyers, Buyer demand: q = a - p, AC falls for Q ≤ Q*, AC = c, Q > Q* Parameter Values: a = 12, c = 4, Q* = 200

Question 4: Collusion

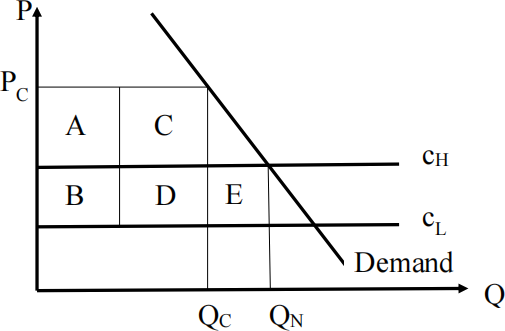

a) (10 marks). Explain what the discount factor is and the factors which determine the size of

the discount factor (p). Explain why collusion is sustainable if the discount factor is

sufficiently high or markets are sufficiently concentrated. Use the Asymmetric Bertrand Grim model done in class to illustrate your answer by using the parameter values indicated below the diagram to solve for the minimum market share needed to sustain collusion for each

firm. Determine whether collusion is sustainable in this market.

Asymmetric Bertrand Grim

Parameter values : PC = 70, QC = 60, cH = 20, QN = 110, cL = 10, p = .2

b) (10 marks). Suppose there are two markets: A and B. Firm 1 and Firm 2 operate in both

Market A and Market B and play a Multi-market Bertrand-Grim Strategy. Firm 3 and Firm 4

operate in Market B only and play a single-market Bertrand-Grim Strategy. Inverted demand is given by P = 60 – Q in each market. Marginal cost for each firm is constant and equal to MC = 20. The discount factor is ρ = 0.7.

i. Determine if collusion at the monopoly price in both markets is sustainable. If so then indicate the sustainable range of market shares for firm 1 and firm 2 in Market A

(S1(a) , S2(a)) and for firm 1, firm 2, firm 3 and firm 4 in Market B (S1(b) , S2(b) , S3(b) , S4(b)).

ii. Now suppose there are no multi-market firms. Determine if collusion at the monopoly price in both markets is sustainable. If so then indicate the sustainable range of market

shares for firm 1 and firm 2 in Market A (S1(a) , S2(a)) and for firm 3, firm 4, firm 5 and firm

6 in Market B (S3(b) , S4(b) , S5(b) , S6(b)).

c) (10 marks). (i) Explain the workings of real estate cartels. (ii) Discuss the various ways in

which price fixing can be detected. (iii) Explain how antitrust enforcement reduces cartel

formation. (iv) Explain the leniency program and discuss the impact of this program on cartel formation.

d) (10 marks). Discuss the evidence regarding the factors which determine cartel success.

Question 5: Mergers

a) (10 marks). (i) Explain why mergers are always profitable in Differentiated Bertrand but are only profitable in Cournot provided cost efficiency gains are sufficiently large or markets are sufficiently concentrated. (ii) Explain why non-merging firms (i.e. outsiders) benefit from a merger in both Differentiated Bertrand and Cournot. (iii) Explain why merger waves occur in Cournot. (iv) Explain howelasticities determine the impact of merger on mark-ups in

Differentiated Bertrand.

b) (10 marks). Demonstrate the profit and welfare consequences of merger by solving the

‘Cournot Mergers with Variable Cost Savings’ model done in class for the parameter values indicated below.

Cournot Mergers with Variable Cost Savings

P = a – Q, Pre-merger : n firms, MC = c, FC = F

Post-merger: n – 1 firms, Outsider MC = c, FC = F, Insider MC = c – x, FC = 2F

Parameter values : a = 90, c = 30, x = 12, n = 4

c) (10 marks). Explain why vertical mergers in successive oligopoly are profitable and under what circumstances they give rise to foreclosure effects. Solve the “ Vertical Mergers in Successive Oligopoly” model done in class for the parameter values indicated below and verify that vertical merger is profitable and indicate whether or not foreclosure has occurred..

Vertical Mergers in Successive Oligopoly

P = a - Q

Integrated firm MC = 0, Non-integrated dealer MC = w, Non-integrated manufacturer MC = 0

Pre-merger: nI integrated firms,n nonintegrated dealers,m non-integrated manufacturers

Parameter values : a = 120, nI = 3, n = 2, m = 2

d) (10 marks). Discuss the results from the empirical horizontal and vertical merger literature.

Question 6: Vertical Integration

a) (10 marks). Explain and give real-world examples of the problems which arise when

contracts are incomplete, and assets are specific. Explain and give real-world examples of how these problems can be overcome or mitigated.

b) (10 marks). Explain the economizing theory and its main predictions. Explain at least one piece of empirical evidence that supports the theory.

c) (10 marks). Explain the assumptions and predictions of the Property Rights Theory (PRT). Use PRT to explain why the type of insurance (life, term/substandard) determines whether

insurance companies use an in-house sales force or a broker.

d) (10 marks). Describe and explain vertical integration and contracting in either the Pepsi/Coke or GM/Ford examples.

Question 7: Vertical Restraints

a) (10 marks). Explain the causes and effects of Resale Price Maintenance (RPM). If RPM is not legal than explain what other vertical restraints can be used to achieve the same outcome. Explain the empirical evidence regarding the effects of RPM and which theories are consistent with this evidence.

b) (10 marks). Explain how RPM can be used to increase retailer demand for inventories and

thereby increase manufacturer profit. Explain whether profitable RPM can either increase or decrease welfare and how this depends on the variation in demand. Use diagrams and verbal explanation to explain your answer. Demonstrate the profit and welfare consequences of

RPM by solving the ‘RPM and Inventories Model’ model done in class for the parameter value indicated below.

RPM and Inventories Model

Manufacturer MC = 0, Dealer MC = 0,

Low and high demand are equally likely

Low demand: qL = 1 – pL, High demand: qH = S(1 – pH)

Parameter value: S = 4

c) (10 marks). Explain why manufacturers grant exclusive territories (ET) to their dealers.

Explain whether ET gives rise to double marginalization and if so how this problem can be overcome. Use the car dealership evidence to explain the alternative vertical restraints that can be used if ET is illegal.

d) (10 marks). Explain the causes and effects of manufacturers imposing exclusive dealing on

their dealers. Explain which of the exclusive dealing theories are supported by evidence from the beer industry.

2023-11-30