Assignment Two of MTH312

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Assignment Two of MTH312

Q 1.

(a) List the assumptions underlying mean variance portfolio theory. [5]

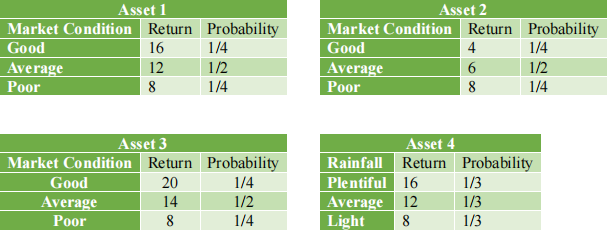

Assume that you are considering selecting assets from among the following four candidates:

The unit of Return is %. Assume that there is no relationship between the conditions of the stock market.

(b) Calculate the expected return and the standard deviation of return for each asset. [4]

(c) Calculate the correlation coefficient and the covariance between each pair of assets. [4]

(d) For Assets 1 and 2, find the composition, standard deviation, and expected return of the portfolio P that has minimum risk, assuming short selling is not allowed. [8]

(e) Comment on the above result. [3]

(f) Assuming that the riskless lending and borrowing rate is 5%, and short sales are allowed, describe the influence on portfolio P. Repeat for a rate of 8%. [3]

(g) Assume that the average variance of return for an individual security is 50 and that the average covariance is 10. What is the expected variance of an equally weighted portfolio of 5, 10, 20, 50, and 100 securities, and what is your conclusion from it? [3]

[Total 30]

Q 2.

CAPM suggests that the higher beta is for any security, the higher must be its equilibrium return. A group of students is first exposed to the CAPM, one or more students will find a high-beta stock that last year produced a smaller return than low-beta stocks. How are you explaining this within CAPM framework.

[Total 25]

Q 3.

Suppose X1 , X2 , … are independent identically distributed random variables. Let m(t) = E(etxi), s0 = 0, and sn = X1 + X2 + ⋯ + Xn. For a fixed value of t, and m(t)<∞,please prove

{Mn = [m(t)]−netsn}

is a martingale related to X1 , X2 , …, Xn.

[Total 25]

Q 4.

Find the solution of dst = μstdt + σstdBt.

[Total 20]

2023-11-25