ACCT332-22S2 (C) Advanced Management Accounting End-of-year Examinations, 2022

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Department of Accounting and Information Systems

EXAMINATION

End-of-year Examinations, 2022

ACCT332-22S2 (C) Advanced Management Accounting

1. Culture, Ethics and Control

Mike and his friend Mark founded HRV in 2003. From the beginning the founders sought to establish a workplace that fostered an intense emotional attachment and identification comparable to a family’s, where employees would feel a deep commitment to each other and were passionate about the firm. They demonstrated their commitment to and concern for their employees by focusing on both the financial and physical well-being of the staff. The culture was seen as familial, fun, unique, and different from anything that anyone had previously experienced. While they had a vision, the culture the founders wished to nurture emphasize the firm’s core values and how they expected employees to conduct themselves.

As the company grew the two founders developed a reward system, which comprised both financial and non-financial rewards, to reinforce and support the cultural controls. Financial rewards in the form of commission-based wages were aimed at ensuring financial goal congruence between the telemarketing and sales employees and the firm. Sales employees who visited a potential customer’s home to deliver the sales pitch received a commission percentage considerably higher than the average for the industry. Telemarketing employees were also remunerated with a commission based on a formula that included the number of appointments booked and the number of resulting sales. Both commission systems were designed and used to incentivize employees to sell as many HRV systems as possible, since it was recognized that sales drove the growth of the business.

In addition to positive rewards, the founders also designed strong penalties for employees who violated firm policies or culture. These were considered extremely important for two reasons. First, recognising that there was a great deal of pressure on sales employees to close sales, the penalties acted as a counterbalance to the commission-based financial incentives. While HRV recognized the importance of sales, it did not wish to promote a “sell at all costs” approach. Second, there was a fundamental belief in the importance of organisational culture as central to the long-term success of the business. Therefore, it was felt that people who violated the culture were placing this success in jeopardy. Consequently, HRV would fire successful salespeople who did not adhere to the organisation’svalues.

In addition to the rewards and penalties detailed above, managers implemented a customer relationship management (CRM) system. This system aimed to inform employees as to what was expected of them and encourage them to do what they could to produce the desired results. While this system started as a way for HRV to collect and organise non-financial customer focused information, it developed into a comprehensive performance measurement system that provided managers with the ability to monitor and compare the performance of individual salespeople, sales teams, and franchises across several metrics. A comprehensive report was distributed every four weeks. The CRM system was alive system with all data relating to the prior day, entered into the system by 10 a.m. the following day. This allowed managers and franchise owners to track on a daily basis the performance of their salespeople, as well as others across HRV, thus allowing them to benchmark performance relative to other sales teams or franchises. Managers and franchise owners were encouraged to use the functionality of the CRM system to promote a dialogue about performance with the salespeople. Recognising that this pressure could result in some salespeople deviating from HRV’s values or culture resulted in strict adherence to the penalties described above. It was felt that only through this strict adherence could HRV ensure that their values and organisational culture would not be compromised.

Required

Using Simon’s Levers of Control Framework identify and provide evidence of the existence of each type of control and how they enable the founders to accomplish their growth strategy.

25 MARKS

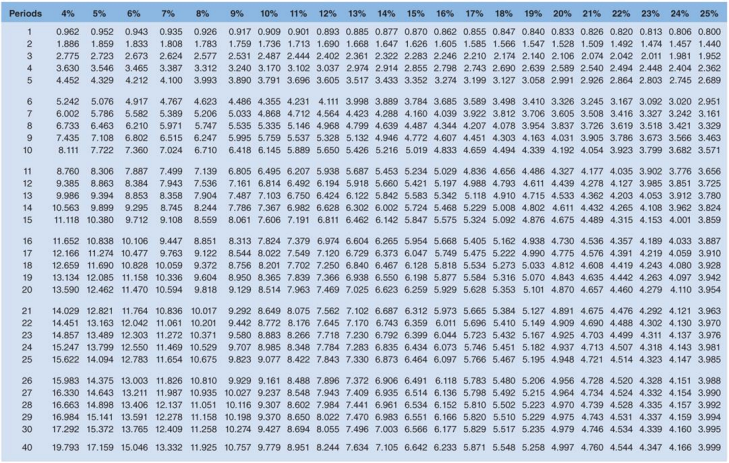

2. Capital Budgeting

Irrigation Express is negotiating with Bunnings to supply heavy-duty sprinkler heads at $18,000 each year for five years. Irrigation Express would need to retool at a cost of $20,000 to fill this order. Incremental costs associated with the order (in addition to the retooling costs) would be $12,000 per year. In addition, existing fixed overhead costs would be reallocated among Irrigation Express’s products, which would result in a $1,000 overhead charge against the special order. For income taxes, the retooling costs would be depreciated using the straight-line method with no terminal value. Irrigation Express’s marginal income tax rate is 25 percent. Assume that all cash flows (except the initial retooling costs) occur at year-end. The company’s discount rate is 16 per cent.

Required

(a) Create a time line showing the relevant cash flows for this problem. (4 marks)

(b) What is the net present value of the special order? (4 marks)

(c) What is the payback period for this project? (2 marks)

(d) For this problem, what do you learn from the NPV analysis, and what do you learn from the payback period? (5 marks)

(e) The managers of Bunnings (the customers in this problem) believe that demand will ensure their ability to purchase sprinkler heads from Irrigation Express. Explain why the Bunnings managers cannot be certain about the future demand for sprinkler heads. (5 marks)

(f) Discuss how uncertainties for the hardware store could lead to uncertainties for Irrigation Express. (5 marks)

TOTAL 25 MARKS

3. Rewards and Incentives

The NZ Adventure Company has grown from a one-woman operation into a large, soon to be listed, adventure clothing and equipment company. For much of its four-year history, the NZ Adventure Company has used one company-wide incentive plan that all employees and managers participated in. The plan is based on equal sharing of a bonus pool determined on the basis of 10 per cent of all profits earned over $2 million. As the company has grown, the benchmark profit figure has changed, but otherwise the plan has remained substantially the same. The company founder explained that the plan was structured this way to encourage an organisational and team view, an objective that has permeated the company’s activities since its beginning.

With the impending stock exchange listing, the newly constituted remuneration committee has been working on the development of new incentive plan for executives and managers. The brief from the board includes the requirement to ‘develop an incentive plan inline with company’s strategy of revenue growth through high-quality products and customer service, and align the interests of the new executive team with shareholders’ and other important stakeholders.

Required

(a) If you were a member of the remuneration committee of NZ Adventure Company how would you suggest the incentive plan be structured to meet the requirements set by the board? (15 marks)

(b) What are the dangers for the NZ Adventure Company in moving away from the current incentive plan to a new one? How could these dangers be overcome? (10 marks)

TOTAL 25 MARKS

4. Sustainability

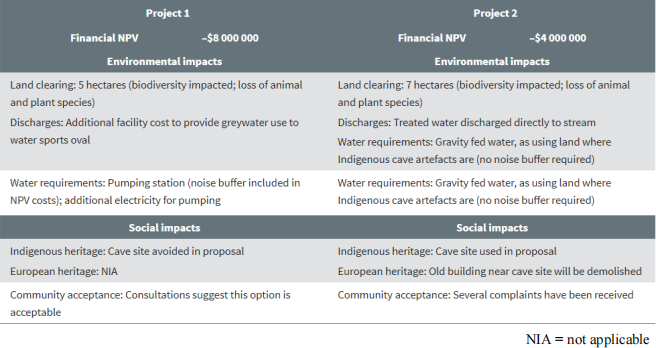

As part of community town planning, an industrial estate was proposed for development on the outskirts of a growing township which was a two-hour commute from the Melbourne CBD. The estate required water and sewerage facilities to be provided. At this stage the land featured native vegetation, including a few big old gum trees, an old cave with Indigenous artefacts, an old building near the cave and a local waterhole frequented by native wildlife.

As part of the estate development, the following factors were considered by the Council Water Board:

1. financial NPV

2. environmental impacts:

• land clearing

• discharges to the environment (liquid waste into sewerage drains; carbon dioxide emissions to air; noise pollution)

• water requirements

3. social impacts:

• Indigenous heritage

• European heritage

• community acceptance

The following two developments were submitted to the Council’s Water Board.

Required

(a) Discuss the ramifications of each option for the council and the community. (15 marks)

(b) Explain which project the council should accept? Include an analysis of the trade-offs between the financial, environmental and social impacts. (10 marks)

TOTAL 25 MARKS

2023-11-13