BABM2001 Finance and Reporting for Management Decisions

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

BABM2001

Finance and Reporting for Management Decisions

Assessment Information – What you need to do

This assignment is a group assignment.

Please read the whole assessment brief before starting work on the Assessment Task.

The Assessment Task - Case study – Mars LTD

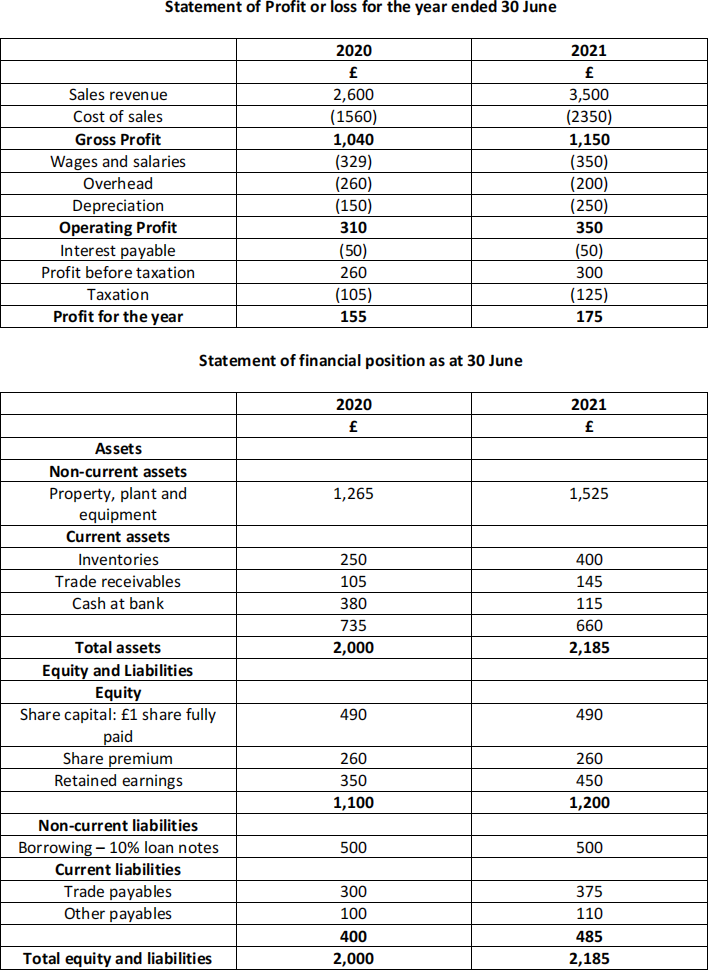

The financial statements of Mars Ltd are given below for the two years ended 30 June 2020 and 2021.

Mars Limited operates a department store in the Centre of a small town.

Dividends were paid on ordinary shares of £65,000 and £75,000 in respect of 2020 and 2021 respectively

Required:

As a junior accountant you are required to Produce a report (1500 words. The calculation is worth 500 words. The remaining 1000 words should be split between the remaining parts of the report) to advise on the financial statements of the above-mentioned company that covers the following:

1. using the financial statements provided, please calculate the following ratios:

- Gross profit margin

- Return on capital employed

- Current ratio

- Quick ratio

- Inventory holding period

- Receivables collection period

- Gearing

- Interest cover

- Earnings per share

- Dividend pay-out ratio.

Ensure that formulae used to arrive at each figure are clearly displayed. All figures should be rounded to 1 decimal place- 30 Marks

2. Using the ratios calculated above provide a detailed commentary on the company’s financial performance and financial health in comparison to the previous year. Ensure that you provide clear and consistent recommendation on the company operations at the end of your discussion. – 40 Marks

3. The principle of recording the substance or economic reality of transactions rather than their legal form lies at the heart of the Conceptual Framework for Financial Reporting (Framework). The development of this principle was partly in reaction to a minority of public interest companies entering into certain complex transactions. These transactions sometimes led to accusations that company directors were involved in ‘creative accounting’

a - Explain, with relevant examples, what is generally meant by the term ‘creative accounting’. – 20 Marks

10% of the marks are allocated for professional presentation and skills applied in developing the report

The report should contain the following:

1- Title

2- Introduction

3- Body of report (questions 1, 2 and 3)

4- Recommendations

5- Conclusions

Criteria for Assessment - How you will be marked

The criteria by which the work will be assessed is attached to the present assignment brief. A rubric is provided and can be found at pages 8 to 9 of this document.

Further information on University mark descriptors can be found here.

This assignment is designed to assess the following learning outcomes:

LO1 - Use fundamental financial theories and principles in order to measure and analyse key business issues.

LO2 - Calculate and interpret financial ratios

LO3 - Read and interpret financial statements

LO4 - Apply the principles of budgeting in relevant contexts

LO5 - Analyse business cycles and their associated investment rationales

Assessment Details

The word count is 1,500

There will be a penalty of a deduction of 10% of the mark for work exceeding the word limit by 10% or more.

The word limit includes tables, figures, quotations and citations, but excludes the references list and appendices.

How to Submit your Assessment

The assessment must be submitted by 23:59 GMT on 02/11/2023. No paper copies are required.

You can access the submission link through the module web.

• Your coursework will be given a zero mark if you do not submit a copy through Turnitin. Please take care to ensure that you have fully submitted your work.

• Please ensure that you have submitted your work using the correct file format, unreadable files will receive a mark of zero. The Faculty accepts Microsoft Office and PDF documents, unless otherwise advised by the module leader.

• All work submitted after the submission deadline without a valid and approved reason will be subject to the University regulations on late submissions.

o If an assessment is submitted up to 24 hours late the mark for the work will be capped at the pass mark of 40 per cent for undergraduate modules or 50 per cent for postgraduate modules

o If an assessment is submitted beyond 24 hours late the work will receive a mark of zero per cent

o The above applies to a student’s first attempt at the assessment. If work submitted as a reassessment of a previously failed assessment task is submitted later than the deadline the work will immediately be given a mark of zero per cent

o If an assessment which is marked as pass/fail rather than given a percentage mark is submitted later than the deadline, the work will immediately be marked as a fail

• The University wants you to do your best. However, we know that sometimes events happen which mean that you can’t submit your coursework by the deadline – these events should be beyond your control and not easy to predict. If this happens, you can apply for an extension to your deadline for up to five working days, or if you need longer, you can apply for a deferral, which takes you to the next assessment period (for example, to the re-sit period following the main Assessment Boards). You must apply before the deadline for your assessment. You will find information about applying for extensions and deferrals here.

• Students MUST keep a copy and/or an electronic file of their assignment.

• Checks will be made on your work using anti-plagiarism software and approved plagiarism checking websites.

Return of Marked Work

You can expect to have feedback returned to you on 16/11/2023. If for any reason there is a delay you will be kept informed. Marks and feedback will be provided online. It is important that you access the feedback you receive as this will help to make improvements to your later work, you can request a meeting with your Module Leader or Personal Tutor to discuss your feedback in more detail.

Marks will have been internally moderated only, and will therefore be provisional; your mark will be formally agreed later in the year once the external examiner has completed their review. More information on assessment and feedback can be found here.

Academic Integrity and Generative AI Use

In submitting a piece of work for assessment it is essential that you understand the University's requirements for maintaining academic integrity and ensure that the work does not contravene University regulations. Some examples of behaviour that would not be considered acceptable include plagiarism, re-use of previously assessed work, collusion with others and purchasing your assignment from a third party. For more information on academic offences, bad academic practice, and academic penalties, please read chapter four of our academic regulations.

Generative AI tools cannot be used for this assessment. You must not use generative artificial intelligence (AI) to generate any materials or content in relation to your assessment.

You can find the library guide on generative AI use here - https://library.dmu.ac.uk/genai

Academic Support and Your Well-being

Referencing is the process of acknowledging other people’s work when you have used it in your assignment or research. It allows the reader to locate your source material as quickly and easily as possible so that they can read these sources themselves and verify the validity of your arguments. Referencing provides the link between what you write and the evidence on which it is based.

You identify the sources that you have used by citing them in the text of your assignment (called citations or in-text citations) and referencing them at the end of your assignment (called the reference list or end-text citations). The reference list only includes the sources cited in your text. The main referencing guide can be found here and includes information on the basics of referencing and achieving good academic practice. It also has tabs for the specific referencing styles depending on whether you require Harvard style used in business or OSCOLA style used by the Law school.

The University has a wealth of support services available to students; further information can be obtained from Student Gateway, the Student Advice Centre, Library and Learning Services and, most importantly, your Personal Tutor. If you are struggling with your assessments and/or deadlines please do seek help as soon as possible so that appropriate support and guidance can be identified and put in place for you. More information can be found on the Healthy DMU pages.

2023-11-05