OPSMGT 370 Operations and Supply Chain Strategy SEMESTER ONE, 2023

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

OPSMGT 370 Operations and Supply Chain Strategy

SEMESTER ONE, 2023

1 Based on Fisher’s framework , for which of the products below would you recommend efficient supply chains and for which of them would you recommend responsive supply chains? Briefly explain how you decided.

2 In the figure below, briefly explain when the gray triangle is set closer to the right and when it is set closer to the left.

3 For each company indicate whether you think they pursue operational excellence or innovation excellence as their competitive advantage.

Toyota, KMART, Samsung, Tesla, Walmart, Zara.

4 Upload one file for your answers to Questions 2 to 7. In all questions , show your calculations to receive full mark.

Question 2 [8 marks]

In 2022, a company had the following for the average value of inventory across its production facilities:

The cost of goods sold by this company in 2022 was $9,550,000. Assume 360 sales days in 2022.

a) What was the inventory turnover for this company in 2022? [4 marks]

b) How many days of supply on average the company was holding? [4 marks]

Question 3 [10 marks]

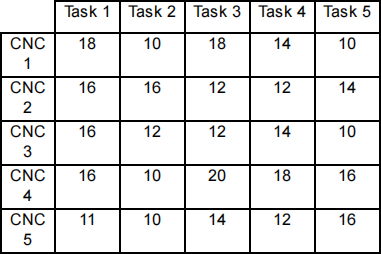

NiceCutt Machinery has five multitask CNC machines . All machines must be run by professional technicians . Such technicians work for $50 per hour. The company has recently received a work order for five tasks . Some of the machines are more advanced and well-maintained than the others . The table below shows how many hours will take for a professional technician to finish each task using different machines .

a) What is the optimal allocation of the tasks to the machines? [8 marks]

b) What is the total operating cost the company has to pay to professional technicians? [2 marks]

Question 4 [10 marks]

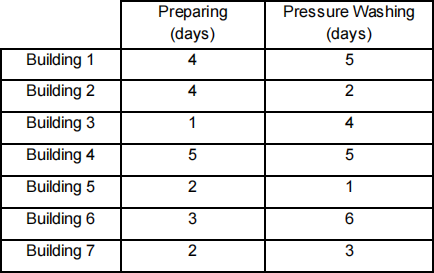

Shine Washing Inc . washes high-rise buildings . The company has seven buildings to wash over the next month. Every washing job consists of two steps: preparing (which includes clearing the wash way, setting up the water connection, pre-cleaning of the building, etc .) and then performing the pressure wash. The company has one professional team for each step.

The buildings are different in their location, height, cleanness , etc . The table below shows how many days each building will need for each step. Note that preparing should always proceed pressure washing.

a) Using the Johnson’s rule, optimally schedule the jobs . [5 marks]

b) Compute the makespan time? (Show your solution in a table like below.) [5 marks]

Question 5 [8 marks]

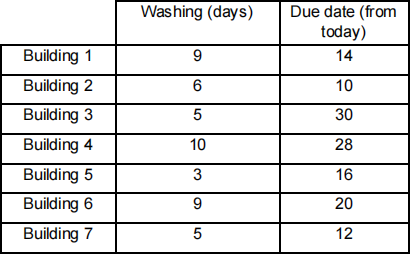

Assume that Shine Washing Inc . in the previous question has only one team to perform both steps of jobs . Hence, the two steps are combined into a whole washing task. Also, assume each

building has a due date for its washing to be completed by. The table below shows how many days each building’s washing will take and their due dates .

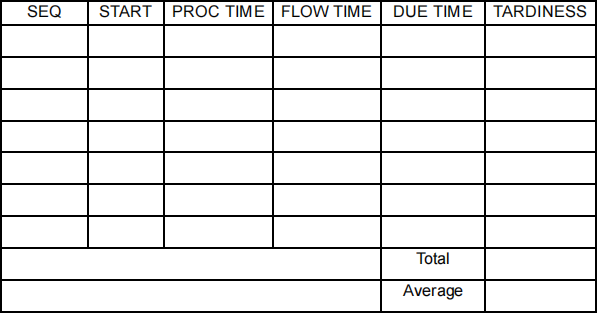

Using the SLACK rule, optimally schedule the jobs and calculate total and average tardiness . (Show your solution in a table like below.)

Question 6 [16 marks]

A hiking-shoe manufacturer in European Union is confident that it can sell a certain number of hiking shoes every year in Australia and New Zealand, hence it is considering expanding its production for that. To do so, it can either spend 1,500,000 EURO to add capacity to its current production plants across European Union countries or buy a new production plant in New Zealand for 2,700,000 NZD. With the former, the annual production and distribution cost is expected to be stable at 250,000 EURO. With the latter, this cost is currently estimated to be 200,000 NZD , but may vary next year; in particular, depending on labour availability, there is 50-50 chance that it may rise or fall by 25%. In addition, the exchange rate which is currently 1 NZD = 0.58 EURO , may change to 1 NZD = 0.65 EURO next year with probability of 0.4, or change to 1 NZD = 0.5 EURO with probability of 0.3, or remain unchanged with probability of 0.3.

Using Decision Tree analysis for two years (i.e., this year and next year), determine whether the manufacturer should buy a new production plant in New Zealand or expand its production capacity in European Union. Shaw a drawing of your Decision Tree. Assume an annual discount rate of 0.1. [Hint: When doing calculations , convert all costs to EURO.]

Question 7 [16 marks]

A raw material supplier located in the South Island receives orders from several manufacturers across New Zealand during summer. Extracting, refining, and processing this raw material takes time, so the supplier has to decide several months in advance how much to have prepared for sales in summer. The supplier only accepts orders in bags of 50 kg as it is the standard bag

weight. The supplier sells each bag for $45. Extracting, refining, and processing of 50 kg of this raw material costs the supplier $15.6. Buyers (i.e., manufacturers) pay for the shipment cost depending on the shipment method they choose.

Once refined, the raw material is good for use only for one year. Hence, leftover materials cannot be sold next summer because no manufacturer will be willing to buy degraded materials . The

supplier can only export the unsold materials to China’s open market, but it has to pay for the shipping cost itself. Taking into account the shipping cost, export fees , etc ., the net price the supplier will receive is $10.3 (NZD) per bag.

Naturally, when planning in advance, the supplier does not know the exact ordering amount it will receive over the summer. However, historical ordering data are kept, which can help the supplier. The historical data shows that the average ordering amount from all manufacturers over one

summer is 15,620 bags with standard deviation of 3,850 bags .

a) Assuming Normal distribution for the data, calculate how much of the raw material (i.e., how

many bags of the raw material) the supplier must have ready for next summer. [12 marks]

b) Was your answer lower or higher than the average ordering amount (i.e., 15,620 bags)? Why is that the case? [4 marks]

2023-11-01