FINANCE 251 Practice Exam Questions

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

FINANCE 251 Practice Exam Questions

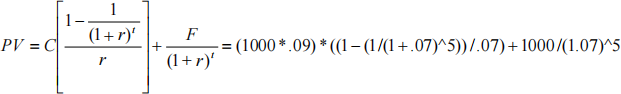

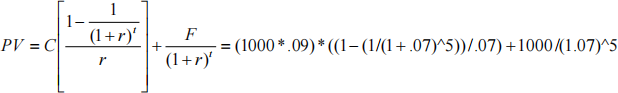

1. How much would an investor expect to pay for a $1,000 par value bond with a 9% annual coupon that matures in 5 years if the interest rate is 7%?

PV = 369.02 + 712.99 = $1,082.01

2. One year ago you bought 200 shares of Potatoes Ltd for $8.00 per share. The stock has just

paid its annual dividend of $0.55, and the stock is now trading at $8.75 per share. What is your total percentage return?

Return = ((8.75 – 8.00) + 0.55)/8.00 = 1.30/8.00 = 16.25%

3. Cuidadoso Company has an equity beta of 0.6. The risk free rate is 4% and the expected return on the market is 11%. Its debt premium is 2%, its debt to value ratio is 40%, and the corporate tax rate is 28%.

What is Cuidadoso’s cost of equity capital?

What is Cuidadoso’s WACC?

E(R) = 4% + 0.6 * (11% - 4%) = 8.2%

WACC = 0.4 * (4% + 2%) * (1 - .28%) + 0.6 * 8.2% = 1.728% + 4.92% = 6.648%

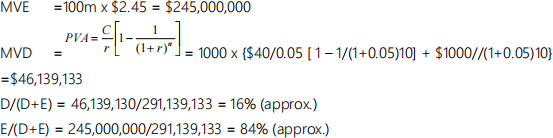

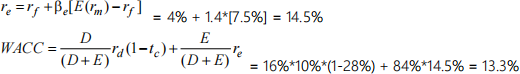

4. City Construction Limited builds commercial and industrial buildings throughout New Zealand. The company is listed on the New Zealand Stock Exchange with 100 million ordinary shares on issue, currently trading at $2.45 per share. City Construction has 50,000 bonds on issue each with a face value of $1,000, a coupon of 8% p.a. payable semi-annually, and a final maturity in exactly 5 years which are trading at a yield of 10% p.a. The company’s equity beta is 1.4 and the 5 year risk free rate is currently 4% p.a. the company tax rate is 28% and the MRP is 7.5%.

Determine the appropriate weights of Debt and Equity for City Construction’s weighted average cost of capital.

5. Calculate City Construction’s weighted average cost of capital.

6. City Construction’s General Manager is planning to diversify the company’s business activities into the shipping and transportation industry by purchasing all the shares of a logistics company. The purchase will be funded by an issue of new shares and debt by City Construction, that will maintain its current capital structure, as in (a) above. Based on the WACC, calculated in (b) above, City Construction estimates that the Net Present Value of this investment will be approximately +$75 million and the General Manager has decided to proceed with the investment.

Explain whether the use of City’s WACC in determining the NPV is a good decision or not (no calculations are required).

The decision to invest should be based on the return required relative to the riskiness of the investment, not the riskiness of the existing business requiring a return of not less than WACC.

The current WACC is an appropriate starting point as the acquisition will be financed by debt and equity in the same proportions as current.

The large NPV of the logistics company at the building company’s WACC would suggest that the riskiness of the two businesses is dissimilar, in particular that the logistics company is ver likely to be more risky than the construction company.

7. What is the goal of the capital structure decision, i.e. what is the financial manager trying to do?

The goal is to maximize the overall market value of all the securities issued by the firm. Think of the financial manager as taking all the firm's real assets and selling them to investors as a package of securities. Some financial managers choose the simplest package possible: all-equity financing.

Others end up issuing dozens of types of debt and equity securities. The financial manager must try to find the particular combination that maximizes the market value of the firm. If firm value increases, common stockholders will benefit.

8. Discuss how agency problems can develop between shareholders and bondholders when the firm is experiencing financial distress.

Managers/owners may not have the proper incentives to accept/reject projects when the firm is under severe financial distress. Normally, managers will accept projects when the NPV is positive after being discounted with the appropriate rate for the project's risk. However, in the case of financial distress and when a lender will still advance funds, it may appear to be in the best interest of managers/owners to invest those funds in long-shot projects that will offer high rates of return under perfect conditions. Of course, when probability is factored in, the project's NPV is likely to be negative. The key is that the rewards of the project will be retained by the owners while the costs of failure will be borne entirely by the lender.

Similarly, when financial distress has decreased the value of debt below its book value, managers/owners may be reluctant to accept projects even when they offer a positive NPV. In this case the reasoning is that the rewards of the project will be "seized" by the bondholders in the way of increasing the market value of the debt. Thus, little if any benefit may accrue to equityholders, and they are not properly motivated to accept the project.

9. Google Inc. has very little debt. Its debt to equity ratio is 1.4%. Briefly explain why this might be their optimal capital structure.

Google is an IT/web company

Most of its assets are intangible. It has very few assets with collateral value.

Very vulnerable if it gets into financial distress

It pays little tax, so little benefit of tax deduction (no reason for students to know this, but they pay about 16%)

It needs a reasonable amount of financial slack including unused borrowing capacity

10. Delegat’s Group Limited is a leading producer of Super Premium branded New Zealand wines for export and domestic markets. Its share price has been $4.25, its cost of equity 10.75% and its projected dividend for next year is 11¢ per share.

Based on the above information, what long-term growth does the market appear to be expecting?

11. Comment on this estimate. Is it a reasonable estimate of long-term growth in a perpetuity model? Why or why not?

The 8.16% growth is not reasonable for growth in a perpetuity model. The growth estimate has to be appropriate as an estimate of perpetual growth. That cannot be much different from the long term growth in the NZ economy. That is probably no more than 3%.

Therefore, the growth estimated above is too high

There are two possible explanations.

Because Delegat’s is increasingly selling to an international market, it would be appropriate to use an international measure of growth. But this is probably only a little bit higher – maybe 5% max.

The market is projecting high growth for Delegat’s in the near to intermediate term before settling on a perpetuity growth of 3-5%. So the 8%+ is an average over the whole future.

12. If you insulate your office for $10,000, you will save $1,000 a year in heating expenses, starting

in year one. Assume these savings would last forever and that there are no taxes. What is the NPV of this investment opportunity if the cost of capital is 8%?

NPV = 1,000/0.08 – 10,000 = 12,500 – 10,000 = 2,500

13. What is the IRR of this investment opportunity (to the nearest whole percentage)?

10,000 = 1,000/r

r = 1,000/10,000 = 10%

14. Credible Construction Company has just borrowed $8 million at an interest rate of 6%. It

expects to maintain this debt level into the far future. What is the present value of the interest tax shield if the corporate tax rate is 28%?

15. A $1,000 bond will pay its annual interest of $60 tomorrow. The bonds mature in three years and the yield to maturity is 7%. What is the current price of the bond?

There are at least three ways to solve this problem.

Use the annuity formula for the four coupon payments and adjust that by (1+7%) to bring it from time -1 to time zero and then add the PV of the $1,000 maturity value.

2, Use the annuity formula for the three coupon payments starting in one year, add the coupon payment being made tomorrow and then add the PV of the $1,000 maturity value.

Simply calculate the PV of all the future cash flows and add them together.

The answer is $1,033.76

16. A relative has savings of $2,000,000 and is planning to retire early. They asked you how much their savings could provide them annually for 20 years if the first withdrawal is in exactly one year. The funds in savings will earn 5% per annum. Ignore taxes.

Use the annuity formula with the annuity amount being the unknown.

PV = A* [(1/r) – (1/r)*(1/(1+r)t

So,

A = PV / [(1/r) – (1/r)*(1/(1+r)t ]

A = 2,000,000 / [1/(0.05) – (1/0.05)*(1/(1+0.05)20] = $160,485.17

You could use the annuity factor (12.46221) in place of solving what is inside the brackets above.

Magnificent Mattress Company (MM) has asked you to calculate its WACC. It has supplied the following information:

Cost of debt is 6%

Book value of debt is $80,000

There are 64,000 ordinary shares outstanding

The yield on government bonds is 4%

The company plans to pay a dividend of $32,000 (in total) in a year

The company’s ROE is 14% and its plowback ratio is 50%

The company’s tax rate is 28%

You have used compco analysis to estimate that an appropriate beta for MM is 1.1. You also believe that the expected return on the market is 11%.

17. What is MM’s cost of equity?

re = rf + Beta * MRP

MRP = E(Rm) – Rf = 11% - 4% = 7%

re = 4% + 1.1*7% = 11.7%

18. What is the value of equity?

E = Div1 / (r – g)

g = ROE * plowback = 14% * 50% = 7%

E = 32,000 / (11.7% - 7%) = 32,000 / 4.7% = $680,851.06

19. What is MM’s WACC?

WACC = D/V * rd * (1-Tc) + E/V * re

V = 80,000 + 680,851 = 760,851

D/V = 80,000/760,851 = 10.5%

E/V = 680,851/760,851 = 89.5%

WACC = 10.5%*6%*(1-0.28) + 89.5%*11.7% = 10.9%

20. Tangshan Antiques has an equity beta of 1.40, the annual risk-free rate of interest is currently 10 percent, and the required return on the market portfolio is 16 percent. The firm estimates that its future dividends will continue to increase at an annual compound rate of 8%. Assume that today is the last day in 2014 and the firm has just paid the $3.40 dividend Estimate the value of a Tangshan Antiques share.

rs = 0.10 + 1.4(0.16 - 0.10) = 0.184 = 18.4%

growth rate of dividends = ($3.40/$2.70)1/3 - 1 = 8%

Po = $3.40(1.08)/(0.184 - 0.08) = $35.31

21. The firm has increased its debt level dramatically and as a result its equity beta has increased to 1.6. What is the estimated price of a share following this change?

rs = 0.10 + 1.6(0.16 - 0.10) = 0.196 = 19.6%

Po = $3.40(1.08)/(0.196 - 0.08) = $31.66

22. Discuss the statement, "Only market risk matters to a diversified investor."

It is relatively easy for an investor to diversify a portfolio sufficiently to the point where nearly all of the remaining risk is market risk. This can be achieved by combining somewhere between 15 and 20 different securities. At that point, then, the investor does not care about a strike at The Warehouse because that element of unique risk has been offset by a boom in say the telecommunications industry. Any investor who chooses not to diversify and thus retain the unique risk should be prepared to suffer the consequences; basically, risk level will increase without a corresponding increase in expected yield. These statements should show that diversified investors are concerned only with the market risk in their portfolios, rather than any elements of unique risk.

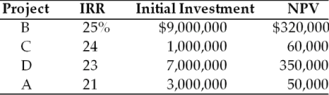

Galaxy Satellite Co. is attempting to select the best group of independent projects competing for the firm's fixed capital budget of $10,000,000. Any unused portion of this budget will earn less than its 20 percent cost of capital. A summary of key data about the proposed projects follows.

23. Use the NPV approach to select the best group of projects.

Choose Projects C and D, since this combination maximizes NPV at $410,000

and only requires $8,000,000 initial investment.

24. Use the IRR approach to select the best group of projects.

Choose Projects B and C, resulting in a NPV of $380,000.

25. Which projects should the firm implement? Explain why and discuss any qualifications.

Projects C and D

because NPV is better than IRR

26. Plasti-Tech Ltd. is financed 60% with equity and 40% with debt. Currently, its debt has a

before-tax interest rate of 12%. Plasti-Tech's ordinary shares trade at $15.00 per share and its most recent dividend was $1.00. Future dividends are expected to grow at 4%. If the tax rate is 34%, what is Plasti-Tech's WACC?

re = (1(1 + 0.04))/$15) + 0.04 = 10.93%

WACC = 0.4[0.12(1 -0.34)] + 0.6(0.1093) = .0317 + .0656 = 9.73%

27. The Chief Financial Officer at Plasti-Tech notes that its cost of debt is below that of equity. He reasons that the firm should ensure that it is able to increase its borrowings, because otherwise the firm will be forced to use more expensive equity to finance its new projects. Then, the firm may have to reject some projects that it would have accepted when evaluated at the lower cost of debt. Comment on this reasoning.

This reasoning is faulty in that it implicitly treats the discount rate for the project as the cost of debt if the project is debt financed, and as the cost of equity if the project is equity financed. In fact, if the project poses risk comparable to the risk of the firm's other projects, the proper discount rate is the firm's cost of capital, which is a weighted-average of the costs of both debt and equity.

28. In addition to the tax shield offered by tax regulations, debt has a lower required rate of return than equity. Why is it not common to see firms that have much larger debt components in their capital structure?

At least three factors need to be mentioned when answering this question.

First, when normal proportions of debt are included in capital structure, the required return on debt is commonly below that of equity

However, as the proportion of debt rises to levels that investors consider risky, that required return will increase rapidly to reflect the increased uncertainty of repayment. That is the explicit cost of debt.

Second, as more debt is included in the capital structure the equity investors will also require a higher rate of return to reflect the fact that more of the firm's cash flows have been promised to other stakeholders. This is the implicit cost of adding more debt.

Finally, a tax shield is of questionable value if the firm is not profitable (ignoring the possibility of loss carry-back) or, at worst, bankrupt.

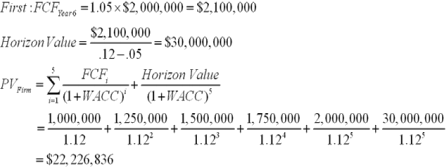

29. What is the present value of a company with a WACC of 12%, and the following cash flows for years 1 to 5, respectively: $1 million, $1.25 million, $1.5 million, $1.75 million, and $2 million?

Assume the firm will then grow at 5% per year, indefinitely.

30. Explain why bond issuers might voluntarily choose to put restrictive covenants into a new bond issue. In your answer be sure to explain what restrictive covenants are and why they might be used.

Restrictive covenants in bond agreements place requirements/restrictions on the bond issuer. Common restrictions include no senior debt will be issued without agreement, regular financial

statements will be provided, no significant asset sales or purchases without approval, minimum working capital to be maintained, keep insurance in place, dividend paying restrictions.

Bond covenants reduce the risk to the lenders and therefore should reduce the interest rate that they require.

The willingness of the issuer to provide covenants can reduce information asymmetry and also is a positive signal to lenders.

31. How much would an investor expect to pay for a $1,000 par value bond with a 9% annual coupon that matures in 5 years if the interest rate is 7%? (4 marks)

32. How does competition among investors lead to efficient markets?

The search for information and insightful analysis makes investor assessments of stock values as

reliable as possible. Since the rewards accrue to the investors who uncover relevant information before it is reflected in stock prices, competition among these investors means that there is always an active search for mispriced stocks. This competition between investors will tend to produce an efficient market—that is, a market in which prices rapidly reflect new information, and investors have difficulty making consistently superior returns. Of course, we all hope to beat the market, but if the market is efficient, all we can rationally expect is a return that is sufficient on average to compensate for the time value of money and for the risks we bear.

33. Describe how adding depreciation expense to net income can approximate cash flow from operations. Does depreciation expense really reflect a cash flow?

Depreciation is a noncash expense that is intended to approximate the decline in economic value over the life of an asset. Since it can be counted as an expense, it reduces net income and, accordingly, tax liability. Therefore, by the time you reach the bottom line on an income statement— net income—you have already experienced the impact of depreciation through lower taxes. Depreciation creates a tax shield, which is a valuable factor. Since no cash was currently expended for the depreciation expense, it is added back to net income to approximate cash flows from operations.

34. Why is it important to use market values rather than book values when determining the weighted-average cost of capital?

Book values represent the amount and terms of funding for a firm or a project as it was originally placed into existence. Because firms and projects are often long-lived, circumstances can change current values substantially from their original book values. These current, or market, values represent the consensus of the investment community as to the value of the firm or project at this point in time. Recalling that past values may represent sunk costs, it is imperative that values be determined with an eye toward their future benefits.

35. What is the relationship between the market risk of a security and the rate of return that investors demand of that security?

The extra return that investors require for taking risk is known as the risk premium. The capital asset

pricing model states that the expected risk premium of an investment should be proportional to both its beta and the market risk premium. The expected rate of return from any investment is equal to the risk-free interest rate plus the risk premium, so the CAPM boils down to r = rf + β(rm - rf). The security market line is the graphical representation of the CAPM equation. The security market line relates the expected return investors demand of a security to the beta.

36. A firm sells a product that it realizes is short-lived and thus the firm plans to close after 2 more years. The firm expects to have free cash flows of $398,000 next year and $211,000 in Year 2 after incurring the costs of closing. The firm's cost of equity is 14% and its cost of debt is 5.5%. What is the present value of the firm if its debt to value ratio is 40%?

WACC = 0.4(5.5%) + (1 - 0.4)(14%) = 10.6%

PV = $398,000/1.106 + $211,000/1.1062 = $532,349

37. It is easy to imagine that a financial manager would be reluctant to abandon a project in which large sums of money have been invested with no cash return. Discuss the important concept here that should be the manager's guiding policy.

Financial managers should recall that previously expended sums are "sunk" and, as such, have no relevance in future decisions. While it may be difficult to scrap a project that has received considerable investment and attention, only the expected future cash flows have any relevance. Thus, managers should ignore sunk investments unless it can be justified that future expenditures will be appropriately rewarded.

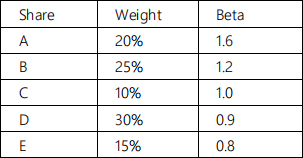

38. Calculate the expected rate of return for the following portfolio, based on a Government bond yield of 4% and an expected market return of 13%: (Show your workings)

βPortfolio = (0.2 × 1.6) + (0.25 × 1.2) + (0.1 × 1) + (0.3 × 0.9) + (0.15 × 0.8) = 1.11

E(R) = 4% + 1.11(13% - 4) = 13.99%

39. Discuss the statement, "Changes in working capital necessitated by a project represent only an opportunity cost to the firm."

Most capital budgeting projects require an increase in working capital, typically from the excess of increased inventories and accounts receivable over that of increased accounts payable. However, capital budgeting practices allow for this "increase" in investment to be automatically reversed at the end of the project's life. While immediate reversal at a discretionary point in time may be questioned, it should be true that if the working capital was actually required for an investment that is no longer in use, then the levels should return to their previous level. Since changes in working capital are reversed, the only "cost" to the firm is the opportunity cost of funds while the working capital is increased.

40. Calculate the NPV for the following capital budgeting proposal: $100,000 initial cost for

equipment, straight-line depreciation over 5 years to a zero book value, $5,000 pre-tax salvage value of equipment, 35% tax rate, $45,000 additional annual revenues, $15,000 additional annual cash expenses, $8,000 initial investment in working capital to be recouped at project end, and a cost of capital of 11%. Should the project be accepted or rejected? (Show your work computing the NPV.)

OCF = ($45,000 - 15,000)(1 - .35) + ($100,000/5)(.35) = $26,500

NPV = -$108,000 + $26,500{(1/.11) - [1/.11(1.115)]} + {[$5,000 × (1 - .35)] + $8,000}/1.115 = -$3,382.40; The project should be rejected.

41. What is a firm's weighted-average cost of capital if its shares have a beta of 1.45, Treasury bills yield 5%, and the market portfolio offers an expected return of 14%? In addition to equity, the firm finances 30% of its assets with debt that has a yield to maturity of 9%. The firm pays tax at 33%.

re = 5% + 1.45(14% - 5) = 18.05%

rd = 9%(1 - 0.33) = 6.03%

WACC = (0.3 × 6.03%) + (0.7 × 18.05%) = 14.44%

2023-10-30