IAB320 Business ProcessImprovement Assignment 2

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

IAB320 Business ProcessImprovement

Assignment 2

Analysis of Business Processes

Aim:

The aim of the 2nd assignment is to get familiar with the analysis of business processes.

Objectives:

O1. Increase your awareness for the challenges related to business process redesign.

O2. Apply the principles of business process redesign.

O3. Use process redesign approaches to fix issues in business processes.

O4. Demonstrate knowledge of process redesign approaches.

O5. Complete redesign tasks independently and within groups.

O6. Appreciate the social and organisational impacts of Process Redesign projects and effectively.

O7. Communicate your findings to stakeholders.

O8. Work effectively in team leadership roles in team projects.

1 Key Information

Group size: at most 4 students

Deadline: 27 October 2023, 23:59 (AEST)

Suggested page limit: at most 25 pages (excluding Title page, abstract, table of content, references & appendices)

Weight: 30%

Submission: One PDF file + .bpmn (redesigned process) file per group on Blackboard

Questions: contact the teaching team during the tutorials, support sessions or via email:

. Dr Rehan Syed ( [email protected])

. Rob McMullen(r2.mcmullen@qut.edu.au)

2 The Assignment

Working in groups of at most four (4) students, you are asked to redesign the Health Insurance Claims Handl ing process of 360-Degree Insurance as described in Section 3 and verify if the redesign will be beneficial. You should deploy the following techniques:

1. Heuristics Process Redesign

2. BPR principles

3. Queueing theory

4. Simulation

Moreover, you need to consolidate the change option in a PICK chart along the dimensions of impact and cost.

You need to produce a short report (not exceeding at most 25 pages (including everything) pages including all figures), which includes the above items. An example report structure is shown in Section 4. See the

Marking Criteria in Section 5 for how we'll grade your assignment.

2.1 Handing-in

Please first register your group on Blackboard, and then submit the report as one PDF on Blackboard. Put the names and student numbers of all students on the first page.

DECLARATION

By submitting this assignment, I am/We are aware of the University rule that a student must not act in a manner which constitutes academic dishonesty as stated and explained in the QUT Manual of Policies and Procedures. I/We confirm that this work represents my individual/our team’s effort, I/we have viewed the final version and does not contain plagiarised material.

|

# |

Full Name |

Student No. |

Contribution |

Signature |

|

1 |

|

|

|

|

|

2 |

|

|

|

|

|

3 |

|

|

|

|

|

4 |

|

|

|

|

2.2 Other things. ..

For anything else regarding the unit and assignments, please refer to the study guide on Blackboard. In addition to the rules stated in the study guide, please observe the following:

. This is a 100% group assignment, and you are expected to work as a cohesive team.

. Some teams may have had non-contributing members.

. Close to the deadline, other students had to take over their work, on top of their own contribution to not sacrifice their grade. Do not put yourself into such a position and start (& finish) the assignment well before the deadline.

. The teaching team will only assist you up to one week before the deadline. Thanks.

3 Scenario

3.1 Health Insurance Claims Handling at 360-Degree Insurance

The insurance company 360-Degree Insurance as result of the process analysis that you conducted is now aware of several issues affecting their core business process. In particular, they acknowledge that their process is extremely inefficient and slow. To begin with, they are executing a lot of activities that are not beneficial for the company, and that on the other hand, are only introducing extra costs.

In addition, during the handling of a claim, a lot of waste is produced due to handover of work between employees (which causes the average time of the following activity to be 20% greater than needed), delays

caused by unresponsive customers and health providers, and excessive processing of claims which often leads to rejections. Finally, they also realised that their senior claim handlers are over-utilised and result in being bottlenecks for the entire process.

Due to all these issues, the company lost almost 70% of its customers. To prevent further losses, 360-Degree Insurance decided to start a redesign initiative and placed you in charge of it. The following section describes (same as assignment 1) the current insurance claims handling process at 360-Degree Insurance.

The process starts when a customer lodges a claim. To do so, the customer fills in a form including a 2-page questionnaire describing the issue. The customer can submit the form physically at one of the branches of 360-Degree Insurance, by postal mail, fax or simply via e-mail (digitally signed document).

When a claim is received, a junior claims officer first reviews the claimants claims history to ensure a duplicate claim has not been lodged. Next, the junior claims officer enters the claim details into the insurance information system. Data entry usually takes 25 minutes. The same junior claims officer performs a basic check to ensure that the customer’s insurance policy is valid and that the type of claim is covered by the insurance policy. This operation takes on average 30 minutes. It is rare for the claim to be rejected at this stage (it only happens in 7% of cases), in case of a rejected claim the customer is notified about the rejection (operation that takes 15 minutes). Otherwise, the claim is marked as “eligible” and moves forward in the process. Next, the claim is moved to a senior claims officer who performs an in-depth assessment of the reported issue and estimates the monthly benefit entitlement (i.e., how much monthly compensation is the claimant entitled to, and for what period of time). This operation takes on average 2 hour.

In the case of short-term benefits, the senior claims officer can perform the benefit assessment without requiring further documentation. In these cases, the assessment is straightforward (despite tedious) and takes 45 minutes. As part of the benefit assessment, the senior claims officer also checks if the claim is associated with an issue for which there is already an ongoing payment. A positive result to this check results in a desk reject (which occurs in 4% of the cases). Once a decision is made, the senior claims officer registers the entitlement on the insurance information system and informs the customer of the outcome via e-mail or postal mail.

However, in the case of long-term claims (more than three months), the senior claims officer requires a full medical report in order to assess the benefit entitlements. Senior claims officers perceive that these medical reports are essential in order to assess the claims accurately and to avoid fraud (which only occurs in 3% of the cases). Once the senior claims officer has received the medical report, they can assess the benefits in about one hour on average. The senior claims officer then sends a response letter to the customer (by e- mail and post) to notify the customer of their monthly entitlement and the conditions of this entitlement (e.g., when will the entitlement be stopped or when is it due for renewal). The entitlement is recorded in the insurance Information System.

Later, a finance admin triggers the first entitlement payment manually and schedules the monthly entitlement for subsequent months. The finance admin takes on average 30 minutes to handle an entitlement. Finance admin handle payments in batches, once per working day.

When a medical report is required, a junior claims officer contacts the customer (by phone or e- mail) to notify them that their claim is being assessed, and to ask the customer to send a signed form authorizing 360-Degree Insurance to request medical reports from their health provider (hospital or clinic). Health providers will not issue a medical report to an insurance company unless the customer has signed such an authorization. In general, the authorization is received within 5 days from its request (requesting it only takes 05 mins), despite in 2% of the cases the customer does not provide the authorization and after a waiting period of 14 days the claim is withdrawn.

Once the authorization has been received, the junior claims officer sends (by post) a request for medical reports to the health provider together with the insurer’s letter of authorization, requesting the medical report takes on average 25 minutes. Hospitals reply to 360-Degree Insurance either by post or in some cases via e-mail. On average, it takes about 14 working days for 360-Degree Insurance to obtain the medical reports from the health provider (including 3 working days required for the back-and-forth postal mail). This average however hides a lot of variance. Some health providers are very cooperative and respond within a couple of working days of receiving the request. Others however can take up to 30 working days to respond.

As a result, the average time between a claim being lodged and a decision being made may take several days. Naturally, so long waiting times cause anxiety to customers. In the case of long-term claims, a customer would on average call or send an e-mail enquiry twice, while the claim is being processed. Such enquiries are answered by the junior claims officer, and it takes about 10 minutes per enquiry. In about a third of cases, junior claims officers end up contacting the health provider to enquire about the estimated date to obtain a medical report. Each of these enquiries to health providers takes 10 minutes to a junior claims officer.

The total benefit paid by the insurance company for a short-term issue is AUD$ 5K (typically spread across 2 or 3 months). For long-term issue, this amount is 30K, but some claims can cost up to 45K to the insurance company. In case of long-term issue, the duration of the benefit (number of months) cannot be determined in advance when the claim is lodged. In these cases, the benefit is granted for a period of 3 months and the entire process is repeated (a new claim needs to be submitted) to determine if the benefit should be extended. It often happens that the renewal takes too long, and customers stop receiving their monthly benefit temporarily during the renewal process.

The insurance company receives 2855 claims per year (including resubmitted claims), out of which 25% are for short-term issue and 75% for long-term issue.

The company employs three full-time junior claims officers, two full-time senior claims officers, and one full- time financial officer. Their salaries are respectively $65,000 pa, $80,000 pa, and $95,000 pa. The employment contact requires a full-time employee to works 8 hours a day (including 45 minutes unpaid lunch break).

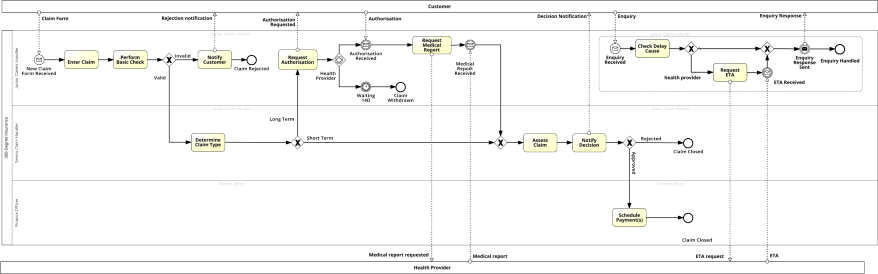

Finally, Figure1 contains model of their “Health Insurance Claims Handling” process.

Figure 1: The health insurance claim process of 360-Degree Insurance.

4 Example report structure (your report MUST include the following sections)

|

. Cover page . Executive summary . Table of contents 1. Process redesign Present the results of the redesign: for each change applied, justify the change via the redesign heuristics or the BPR principles. 2. Queueing Theory Compare queue length of the current AS-IS process with the expected queue length of the TO- BE process assuming zero delays. Limit your analysis to a single server (M/M/1) 3. Simulation Compare the performance of the AS-IS process with the expected performance of the TO-BE process and highlight the points of improvement. 4. Change Option Consolidation Consolidate all the issues in a PICK (Possible, Implement, Challenge, Kill) chart. 5. Conclusion Based on the above results, provide a well-structured summary on how to solve the issues affecting the business process in the scenario. 6. References (APA Style) 7. Appendices Please include all calculations in this section Please ensure that your .bpmn file is attached |

5 Report Formatting Requirements

5.1 Guidelines for using Headings.

Please use the number headings format (see example)

|

1.0 2.0 … |

Level 1 |

|

1.1 1.2

|

Level 2 |

|

1.1.1 1.2.1 … |

Level 3 |

|

... |

Level 4 |

5.2 Page margins.

25mm (top), 25mm (bottom), 25mm (left), 25mm (right)

o All tables and figures must be captioned. Sources (if applicable) must be provided.

5.3 Font

o Calibri or Times News Roman

5.4 Referencing

o Please use APA for all intext citations and referencing

o Additional information is available at the following link

2023-10-28

Analysis of Business Processes