ECMT2160: Computational Assignment

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ECMT2160: Computational Assignment

Due: October 19, 11:59am

This assessment task requires you to use Matlab to perform some calcula-tions based on a simple economic model. You should prepare your submission as a Matlab Live Script file (i.e., a .mlx file). Submit your answers through the Canvas course website. Your submission should include a mixture of written re-sponses formatted as text, blocks of Matlab code, and Matlab output, including graphs. You should submit two versions of your answers: the original .mlx file, and a version exported to .html.

You may work on this assessment individually, or in pairs. If you work in pairs, it is important that you clearly indicate the student ID number of your partner in your submission. Your submission should not be identical to your partner’s submission.

Answer all questions. The assignment is worth a total of 25 points towards your final assessment. Points will be deducted for poor presentation, including: excessive typos, poor written expression, poor organization, etcetera.

In the questions you will be presented with an economic model which you have not been given sufficient information to fully understand, and equations you have not seen before. This is intentional, and a common situation when providing quantitative support to research teams. There is enough information provided to carry out the required computations.

This assignment is based on a simplified version of an economic model de-veloped in 2010 by an economist working for the US Federal Reserve Board. You can find the original FRB discussion paper here if you are interested, but reading it will be difficult and is unlikely to help you solve the questions below.

Imagine you are a research assistant working for the US Federal Reserve Board in 2010. Your boss, Dr. Bernanke, wants you to calculate some numbers based on an economic model he finds interesting. This model has a number of parameters. You should begin by entering these into Matlab.

β = 0.96 (annual discount rate of agents)

γ = 0.12 (fraction of agents who own a business)

α = 0.36 (capital share parameter in Cobb-Douglas production function)

δ = 0.08 (annual depreciation rate of capital)

υ = 0.975 (annual probability that an agent does not retire)

π1 = 0.003 (annual probability that a worker starts a business)

π2 = 0.02 (annual probability that a business closes)

τL = 0.3 (average labor income tax rate)

τK = 0.4 (average capital income tax rate).

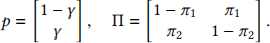

Also enter the following 2 × 1 vector p and 2 × 2 matrix Π into Matlab:

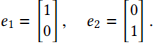

Finally, enter the following simple 2 × 1 vectors into Matlab:

To answer the following questions you will need to know how to define functions in Matlab, and how to use the command fsolve in Matlab to solve systems of nonlinear equations. You can read about how to do this in a separate document I have made available in Canvas, titled Using fsolve.mlx.

1. (2 points) Create a function in Matlab which takes a positive real number w as an input, and returns the following 2 × 1 vector h(w):

Report your calculation of the vector

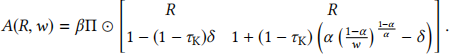

2. (2 points) Create a function in Matlab which takes two positive real num-bers R and w as inputs, and returns the following 2 × 2 matrix A(R,w):

Here, the symbol refers to the entrywise multiplication of matrices, which we implement in Matlab using the “.*” operation. It does not mean ordinary matrix multiplication, implemented in Matlab using the “*” operation.

Report your calculation of the matrix A(1.04, 1.2).

3. (2 points) Dr. Bernanke tells you that the variables R andw in your function A(R,w) refer to the interest rate (plus one) and the average wage in the economy. For instance, when R = 1.04, this corresponds to an interest rate of 4%. The average wage w is measured in multiples of $50,000, so if w = 1 then the average (annual) wage is $50,000.

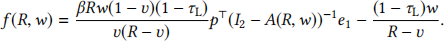

Dr. Bernanke also tells you that, in his model, the aggregate excess supply of money is the following function of R and w:

Here, the notation I2 refers to the 2 × 2 identity matrix.

Create a function in Matlab which takes two positive real numbers R and w as inputs, and returns f (R,w). Report your calculation of f (1.04, 1.2).

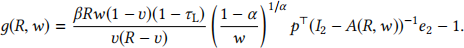

4. (2 points) Dr. Bernanke tells you that, in his model, the aggregate excess demand for labour is the following function of R and w:

Create a function in Matlab which takes two positive real numbers R and w as inputs, and returns g(R,w). Report your calculation of g(1.04, 1.2).

5. (7 points) Dr. Bernanke tells you that his model is said to be in equilibrium when the interest rate and wage are such that the aggregate excess sup-ply of money and the aggregate excess demand for labour are both equal to zero. In other words, in equilibrium, R and w must solve the pair of nonlinear equations

f (R,w) = 0 (1)

g(R,w) = 0. (2)

Use the fsolve command in Matlab to find the values of R and w solv-ing this pair of nonlinear equations. You may assume that there is exactly one value of R and one value of w such that both equations are satisfied. Use R = 1.01 and w = 1 as starting values for fsolve.

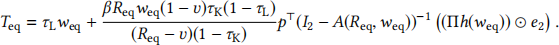

6. (2 points) Let Req and weq be the unique values of R and w solving the pair of nonlinear equations (1) and (2). Dr. Bernanke tells you that, in his model, equilibrium aggregate tax revenue is given by

Calculate the equilibrium aggregate tax revenue in Matlab.

7. (6 points) Dr. Bernanke tells you that he would like you to use his model to explore the economic effects of increasing the average capital income tax rate. Specifically, he is interested in cases where τK is somewhere between 0.4 and 0.6, and wants to know what the effect would be on the equilibrium interest rate and wage, and on equilibrium aggregate tax revenue.

Using a “for loop” in Matlab, recalculate Req, weq and Teq for every value of τK in a fine grid extending from 0.4 to 0.6. (Say, about 20 evenly spaced points between 0.4 and 0.6.) Create three plots in Matlab showing how Req,weq andTeq vary with τK. Set the options for fsolve so as to stop this command producing a large amount of unnecessary output during your loop.

8. (2 points) In your answer to the previous question, what was the general effect of raising the capital income tax upon the equilibrium wage? Do you have any economic intuition which may help to explain this effect?

2023-10-19