ECON GU4280 Corporate Finance Fall 2013 Midterm Exam

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Corporate Finance

Fall 2013

Midterm Exam

Question 1 [24 points]

Consider an economy with two dates (t=0,1) and three states at t=1. The following three assets are traded:

Asset A has a payoff of xA=(2,0,0)

Asset B has a payoff of xB=(1,3,0)

Asset C has a payoff of xC=(2,2,4)

at t=1. In other words, asset B pays off $1 in state 1, $3 in state 2, and $0 in state 3 at t=1.

(a) Suppose the prices of asset A, B and C at t=0 are pA=1.8, pB=3.3 and pC=6.2 respectively. Explain whether there is an arbitrage. [6p]

(b) A put option on asset C with exercise price E=3 is traded. What is the price of this option at t=0? [3p]

(c) Design a portfolio with payoff (0,0,2) at t=1. What is the price of this portfolio at t=0? [4p]

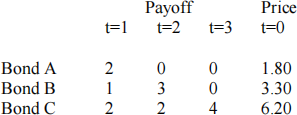

Now consider an (equivalent) economy with three save bonds and four dates (t=0,1,2,3).

In other words, e.g. bond B costs $3.20 at t=0 and pays off $1 at t=1, $3 at t=2, and $0 at t=3.

(d) What is the definition of a yield curve (or term structure of interests)? [2p]

(e) Determine the yield curve in this economy. [6p]

(f) If there is no arbitrage, the yield curve is always flat. Is this statement true? [3p]

Question 2 [12 points]

Consider a firm which current stock price has experienced a sharp decline from above $40 to $20 now (at t=0). Suppose an investor believes that the stock price will rebound to $30 at t=1.

An investment advisor suggests the investor to buy the following portfolio of options.

Sell 1 call option with exercise price E=$20

Buy 2 call options with exercise price E=$30

Sell 1 call option with exercise price E=$36

(a) Draw the payoff of this strategy at t=1. [6p]

(b) Should the investor follow the recommendation? Please explain. [2p]

Suppose at t=0 the price (premium) of the call with E=$30 is $2.40 and the price of the call with E=$36 is $1.30. Suppose there is no arbitrage.

(c) Can you determine the minimum price of the call with E=$20? If so, what is it? If not, what additional information do you need? [4p]

Question 3 [12 points]

Consider an economy with three states which occur with probabilities (0.2, 0.4, 0.4). Suppose an entrepreneur has $140 and owns a firm that has a single project which generates the state dependent cash flows (100, 100, 300) at t=1. The investment costs are $140 at t=0. The

market portfolio generates the payoff (100, 200, 300) and has an expected return of 12%. The risk free rate is 3%. Suppose the CAPM holds.

(a) What is the beta of this project? [4p]

(b) Explain whether the entrepreneur should conduct the project. [6p]

(c) Suppose a private equity company wants to acquire the firm. At what price is the entrepreneur willing to sell the firm? [2p]

Question 4 [22 points]

Suppose a firm has an expected net profit (EBIT) of $1200. The entrepreneur wants to sell the firm and asks an investment bank for financial advice on how to sell the firm so that he can

get a maximum price. All agents are risk neutral. The interest rate is 12%.

(a) What is the value of the firm if 100% equity is issued? [2p]

(b) What is the value of the firm if debt with face value of $600 is issued and the rest is sold as equity? [3p]

Now suppose the firm has to pay corporate taxes. The tax rate is 30%.

(c) Compare the value of the firm in (a) and (b) when there is taxation. [4p]

(d) Suppose a tax specialist can help the entrepreneur reduce the tax rate to 10%. What is the maximum the entrepreneur is willing to pay for that advice when the firm has $600 face value of debt outstanding? [3p]

In subsequent questions, assume there are costs associated with bankruptcy and the probability of bankruptcy is given by

and the costs of bankruptcy are $40.

(e) The tax rate is 10%. What capital structure should the investment bank optimally suggest? What is the value of the firm? [6p]

Given the tax avoidance strategies of firms, the government changes the tax code. Suppose under the new tax code, the optimal capital structure of the firm has debt with face value of $700.

(f) What is the new tax rate? [4p]

2023-10-19