Financial Modelling I: Assignment #2

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Financial Modelling I: Assignment #2

Notes:

1. You should submit your assignment electronically using the drop-box on the D2L page for the course.

2. Every student should submit their own individual assignment. However, feel free to work with other students in the class to construct your model. You may work with students from other sections of the course. Make sure that you place your name and student number on the assignment. Also, only submit one file, with a title such as: “Assignment #2 – Your Name.xlsx”

Assignment #2:

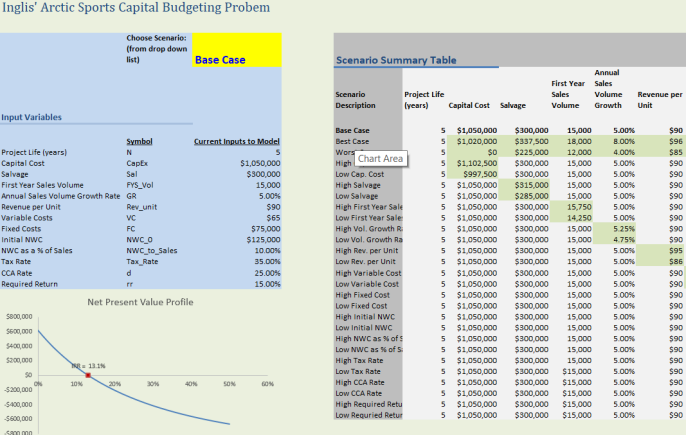

Mike, President and CEO of Inglis’ Arctic Sports would like you to calculate the NPV and IRR of a new project that he is considering. He would also like you to perform some sensitivity and scenario analysis. Basically, your job is to complete the Capital Budgeting Model and build a scenario Manager similar to the one we looked at in the class #2 videos. I have provided an Excel file to help get you started.

There are some notes and suggestions presented in the “Notes” worksheet that you should read and implement in your model. If you are a little rusty on the structure of capital budgeting, then refer to your intro finance text. There is a question in the model (close to the NPV calculation) that you should answer using goal seek.

Your model should be well formatted and well documented. This means that the model should be clear and organized. Use colours where necessary. In addition, your assignment should include a title page that includes your name, the date and professor name as well as a brief description of the objectives assumptions, and how to use the model. Please state all assumptions directly in your solution. Make sure to thoroughly test your model.

I have provided a screenshot of a portion of my completed model dashboard.

2023-09-26