FINS5548 Financial Technology - 2023

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

FINS5548 Financial Technology - 2023

Course Code : FINS5548

Year : 2023

Term : Term 3

Teaching Period : T3

Delivery Mode : Multimodal

Delivery Format : Standard

Delivery Location : Kensington

General Course Information

Course Code : FINS5548

Year : 2023

Term : Term 3

Teaching Period : T3

Is a multi-term course? : No

Faculty : UNSW Business School

Academic Unit : School of Banking and Finance

Delivery Mode : Multimodal

Delivery Format : Standard

Delivery Location : Kensington

Campus : Sydney

Study Level : Postgraduate

Units of Credit : 6

Useful Links

Course Details & Outcomes

Course Description

This course deals with the implications of technological advances on current and future state of the fnancial industry. The intention is to trigger a disruptive and innovative thinking process and to enforce the notion that recent structural changes across the fnancial industry provide a

spectrum of valuable internal and external opportunities. It introduces computational fnance

and banking technology applications using the open-source programming language in the

context offnance theory and applications. Case studies to be explored include lending, regtech, crypto, capital markets, wealth management and real-estate.

Course Aims

Technology is a disruptive factor that is transforming the banking and fnance industry, it is

important that fnance graduates are informed of this development and have a basic

understanding of the underlying technology so they could contemplate, adapt, innovate and

shape an increasingly technology-driven world. This course builds on basic fnance theory and capital market courses and complements other fnance courses with a unique technology and innovation perspective.

Relationship to Other Courses

Technology is a disruptive factor that is transforming the banking and fnance industry, It is

important that fnance graduates are informed of these development and have a basic

understanding of the underlying technology so they could contemplate, adapt, innovate and shape an increasingly technology driven world. This course builds on basic fnance theory and capital market courses and complement other fnance courses with a unique technology and innovation perspective.

Course Learning Outcomes

|

Course Learning Outcomes |

Program learning outcomes |

|

CLO1 : Understand global FinTech landscape and describe the role of banks and fnancial service providers in shaping and responding to innovation and disruption. |

Knowledge |

|

CLO2 : Describe banking and fnance ecosystem and the role of consumers in shaping up current environment. Link behavioral fnance theories to technological advances in banking. |

Knowledge |

|

CLO3 : Think holistically and generate FinTech ideas. Understand the forces behind technological changes in the industry and apply disruption methodologies to practical case studies. Disruption is opportunity not a threat. |

Knowledge

Solving

Communication

|

|

CLO4 : Evaluate FinTech proposals. Recognise what type of innovation and disruption is value added with a potential to reshape legacy environment. Appreciate various challenges and complexities in the process of FinTech innovation. |

Communication

Business Practice |

|

CLO5 : Pitch FinTech proposal. Gain practical exposure to FinTech style of presentation to open audience. Possess the ability to critically discuss and present realistic proposal from idea generation |

Communication

|

|

to implementation. |

|

|

CLO6 : Gain introductory programming skills in the context of fnance theory and application using Python platform. Appreciate the possibilities and boundaries of technology. |

Knowledge

Solving |

|

Course Learning Outcomes |

Assessment Item |

|

CLO1 : Understand global FinTech landscape and describe the role of banks and fnancial service providers in shaping and responding to innovation and disruption. |

|

|

CLO2 : Describe banking and fnance ecosystem and the role of consumers in shaping up current environment. Link behavioral fnance theories to technological advances in banking. |

|

|

CLO3 : Think holistically and generate FinTech ideas. Understand the forces behind technological changes in the industry and apply disruption methodologies to practical case studies. Disruption is opportunity not a threat. |

Assignments |

|

CLO4 : Evaluate FinTech proposals. Recognise what type of innovation and disruption is value added with a potential to reshape legacy environment. Appreciate various challenges and complexities in the process of FinTech innovation. |

|

|

CLO5 : Pitch FinTech proposal. Gain practical exposure to FinTech style of presentation to open audience. Possess the ability to critically discuss and present realistic proposal from idea generation to implementation. |

|

|

CLO6 : Gain introductory programming skills in the context offnance theory and application using Python platform. Appreciate the possibilities and boundaries of technology. |

Assignments

|

Learning and Teaching Technologies

Moodle - Learning Management System | Blackboard Collaborate | EdStem

Learning and Teaching in this course

This is a practical and hands on course. Teamwork is essential. Students undertake a group presentation simulating pitch proposal to open audience. The project requires all stages and steps of the proposal to be fully contemplated, from idea generation to implementation. Each student is expected to take on a role in the team and deliver as a team as well as an individual. The course will draw on concepts, problems and practical implications from textbooks,

academic papers, fnancial press articles as well as relevant fnancial regulators and government agencies.

The aims of this course are:

Develop disruptive and innovative thinking process to enforce the notion that technological advances across the industry create spectrum of valuable opportunities

Develop skills in collaboration and teamwork to be able to adapt and innovate in an increasingly technology driven world

This course is thus designed and developed for students aiming to understand the connections between banking,fnance and technology.

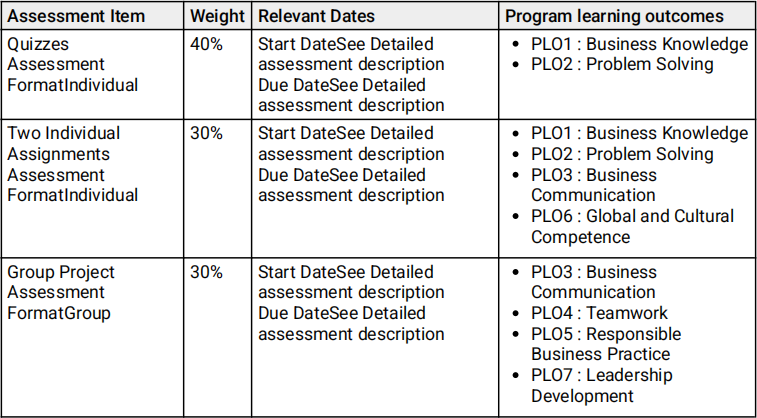

Assessments

Assessment Structure

Assessment Details

Quizzes

Assessment Overview

The quizzes assess students’ understanding offnancial technology.

Assesses: PLO1, PLO2

Detailed Assessment Description

Weight Assessment Name Assessment Due Date

20% Quiz 1 Week 4

20% Quiz 2 Week 8

Quiz #1 tests the material covered in Week 1-3. Quiz #2 tests materials covered in Week 4-7. This will be in a format of Multiple Choice Questionnaire. This is aimed to allow you to receive early

feedback on your performance and understanding of covered topics.

Submission notes

See Detailed assessment description

Assignment submission Turnitin type

Not Applicable

Two Individual Assignments

Assessment Overview

The two individual assignments assess students’ understanding of the FinTech and application of Python in FinTech

Assesses: PLO1, PLO2, PLO3, PLO6

Detailed Assessment Description

Weight Assessment Name Assessment Due Date

15% Python 1 Week 5

15% Python 2 Week 9

Pything programming quizzes and iLab exercises allowing students to construct technological solutions to real world case study in PropTech through the application of disruption

methodologies in a form of base machine learning models. We seek to expose intermediate level Python programming skills in the context of FinTech.

Submission notes

See Detailed assessment description

Assignment submission Turnitin type

Not Applicable

Group Project

Assessment Overview

The group project simulates FinTech project proposal for external stakeholders.

Assesses: PLO3, PLO4, PLO5, PLO7

Detailed Assessment Description

Weight Assessment Name Assessment Due Date

30% FinTech Proposal Week 10

Teamwork is essential component of current workplace. As a team of fnTech specialists you propose solution for one of your companies, prepare pitch presentation for Accelerator/

Incubator or internal Change Management Program. Small groups (5 students) will be formed around Week 2. By default groups are formed following the alphabetical order. Each student is expected to take on a role in the team and deliver as a team as well as an individual. Group

presentation is assessed on group component (30%). The team members are responsible to decide on team's governance structure and member's role allocation. Further details on group formation and tips on how to make a good sales pitch presentation will be posted on Moodle.

Submission notes

See Detailed assessment description

Assignment submission Turnitin type

Not Applicable

General Assessment Information

As a student at UNSW you are expected to display academicintegrity in your work and

interactions. Where a student breaches the UNSWStudentCode with respect to academic

integrity, the University may take disciplinary action under the Student Misconduct Procedure. To assure academic integrity, you may be required to demonstrate reasoning, research and the process of constructing work submitted for assessment.

To assist you in understanding what academic integrity means, and how to ensure that you do

comply with the UNSW Student Code, it is strongly recommended that you complete the Working withAcademicIntegrity module before submitting your frst assessment task. It is a free, online self-paced Moodle module that should take about one hour to complete.

Grading Basis

Standard

Requirements to pass course

In order to pass this course students must:

• Achieve a composite mark of at least 50 out of 100

• Engage actively in course learning activities and attempt all assessment requirements

2023-09-22