Intermediate macro Assignment #1

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Intermediate macro

Assignment #1

Due Monday September 11th 2pm AEST

The assignment is marked out of 25 points. The weight for each part is indicated following the question text.

Style requirements [1 point]: This assignment requires the submission of a spreadsheet or a simple script. Please keep THREE decimal places in your answers and include your spreadsheet or script as an appendix. You can use Excel, Google Sheets, Matlab, Python etc. in your calculations. Please take care in presenting your work and answers clearly.

Question 1 — Labor Market Model [8 points]

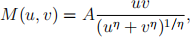

A model of the labor market. In this question, your task is to understand how the labor market responds to an economic downturn using the model we developed in Lecture 8. Suppose the matching function is given by

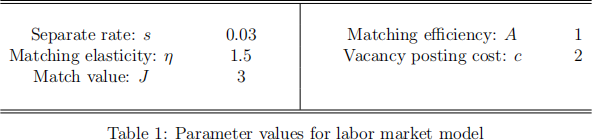

where A governs the efficiency of the matching process, u is the unemployment rate and v is the vacancy rate. Here, η is a parameter that governs the elasticity of the matching function. Assume each period in the model corresponds to a month. Parameter values are provided in Table 1.

(1) Using the parameter values in Table 1, calculate the steady-state values of labor market tightness θ, unemployment rate u and vacancy rate v. (2 points)

(2) Suppose the economy is initially in steady state (t = 0). At t = 1, a recession causes the value of filled jobs J to decrease to J = 2.5 for 15 months. Starting from the steady state, use the other parameter values in Table 1 and a spreadsheet or script to calculate and plot the time paths of market tightness, unemployment rate and vacancy rate for 15 months (t = 0, 1, ..., 15) after the economy was hit by the recession. Describe how market tightness, unemployment rate and vacancy rate respond to the decrease in J. Has the economy settled to a new equilibrium by the end of 15 months? Explain your findings. (2 points)Intermediate macro: Assignment #1 2

(3) Some economists believe that the matching process becomes less efficient in recessions, as in-dicated by the shifting out of the Beveridge curve. Suppose the economy is initially in steady state. At t = 1, a recession causes the matching efficiency parameter A to decrease to A = 0.75 for 15 months. Starting from the steady state, use the other parameter values in Table 1 and a spreadsheet/script to calculate and plot the time paths of market tightness, unemployment rate and vacancy rate for 15 months (t = 0, 1, ..., 15) after the economy was hit by the recession. Describe how market tightness, unemployment rate and vacancy rate respond to the decrease in A. Has the economy settled to a new equilibrium by the end of 15 months? Explain your findings. (2 points)

(4) Recessions are associated with mass layoffs, as indicated by a countercyclical job separation rate. Suppose the economy is initially in steady state. At t = 1, a recession causes separation rate s to increase to s = 0.04 for 15 months. Starting from the steady state, use the other parameter values in Table 1 and a spreadsheet/script to calculate and plot the time paths of market tightness, unemployment rate and vacancy rate for 15 months (t = 0, 1, ..., 15) after the economy was hit by the recession. Describe how market tightness, unemployment rate and vacancy rate respond to the increase in s. Has the economy settled to a new equilibrium by the end of 15 months? Is the implied Beveridge curve consistent with the empirical observations discussed in lecture? Explain your findings. (2 points)

Question 2 — DAS-DAD Model [16 points]

Dynamic AS-AD model. The recession caused by the COVID-19 pandemic has reduced demand for Australian goods. Your task is to understand how this adverse aggregate demand shock affects the Australian economy and the use of monetary policy in stabilizing the economy. You will use the Dynamic Aggregate Supply-Aggregate Demand model (developed in Lectures 10, 11 and 12) in your analysis.

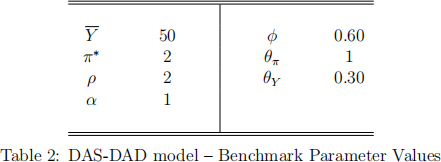

For simplicity, suppose the natural level of output is constant. Each period in the model corresponds to a year. Interest rate and inflation are expressed in percentage points. The parameter values of the model are provided in Table 2.

(1) Using the parameter values in Table 2, calculate the long-run equilibrium values of inflation, output, and the nominal and real interest rates. (1 point)

(2) Suppose the economy was initially in its long-run equilibrium. At year t = 1 the economy was hit by a persistent adverse aggregate demand shock (captured by ε < 0) that lasts for four years and then reverts to zero. In particular, the adverse aggregate demand shock takes the value εt = −2 for four years (t = 1, 2, 3, 4) before reverting back to zero at t = 5. Starting from the long-run equilibrium at t = 0, use the parameter values in Table 2 to calculate the magnitudes of the impact effects at t = 1 on inflation, output, nominal and real interest rates. Also explain how you can recover the values of inflation, output, nominal and real interest rates from t = 2 onward. (3 points)

(3) Now use a spreadsheet/script to calculate and plot the time paths of inflation, output, nominal and real interest rates for 50 years after the initial shock (t = 0, 1, ... , 50). Describe inflation, output, nominal and real interest rate dynamics associated with this adverse aggregate demand shock. Explain how monetary policy responds to the inflation and output gaps. (3 points)

(4) Suppose the RBA decides to respond more aggressively to output gap by setting θπ = 0.3 and θY = 1. Keeping all other parameters as in Table 2, recompute the time paths of output, inflation, nominal and real interest rates for 50 years after the initial shock (t = 0, 1, ... , 50). Explain how the policy change affects the time paths of inflation, output, nominal and real interest rate. Is there a policy tradeoff between inflation and output? Explain. (3 points)

For the remainder of this question consider the implications of a modified version of the dynamic AS-AD model, where people’s inflation expectations may be subject to random shocks.

(5) Suppose that people’s expectations of inflation are subject to random shocks. That is, instead of being merely adaptive, expected inflation in period t, as of period t−1, is Et−1(πt) = πt−1+ηt−1, where ηt−1 is a random shock. This shock is normally zero, but it deviates from zero when some event beyond past inflation causes expected inflation to change. Similarly, Et(πt+1) = πt + ηt . Derive both the DAD and the DAS equations in this slightly more general model. (3 points)

(6) Following part (5), suppose that the economy experiences an inflation scare. That is, at year t = 1, people come to believe that inflation in year t = 1 is going to be higher, so η1 = 1 for this year only. Starting in the long-run equilibrium, use the parameter values in Table 2 and the new DAD and DAS equations to calculate and plot the time paths of inflation, output, nominal and real interest rates for 50 years after the inflation expectation shock hits the economy (assuming no other shocks). In what sense are inflation scares self-fulfilling? Explain. (3 points)

Deadline and format

This assignment contributes 12.5% toward your final grade. The assignment is due by 2pm on Monday September 11th. Your assignment should not exceed 1500 words in length. You should use relevant diagrams and/or algebra to reinforce your argument where appropriate. Citations, labels in diagrams, symbols in equations and numbers in tables will not count towards the word limit.

The assignment can be done in groups subject to the following rules: All members of the group will be given the same mark. No more than three students may make up a group. Students may choose to work and hand in an assignment on their own. No two groups may hand in the same assignment. All assignments will be electronically screened for plagiarism.

Assignments must be submitted in electronic format by 2pm on the due date. No extension will be considered. You can apply for special consideration if you cannot complete the assignment because of illness or other circumstances. In case that your application is successful, the weight of this assignment will be shifted to the final exam in the overall assessment. Moreover:

• You must keep a copy of your assignment.

• Plagiarism or other forms of academic dishonesty will result in disciplinary proceedings being brought against you.

• 10% of the available marks will be deducted for each full hour of delay after the due date for up to 10 hours.

2023-09-05