Assessment 2: Written Case Notes Presentation

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Assessment 2: Written Case Notes Presentation

The aim of this assessment is for you to apply foundational microeconomic concepts and theory learned in weeks 1-5 to a scenario and for you to demonstrate written communication skills.

Choose ONLY ONE scenario from the following two topics and develop up to 5-page slides with the script to answer the given questions.

Please note:

1. The given scenario only gives basic information. You are encouraged to do MORE RESEARCH to get evidence to support your points.

2. You must address ALL the given questions for your chosen topic.

3. Submission: please submit ONE document (with both slide page and notes)

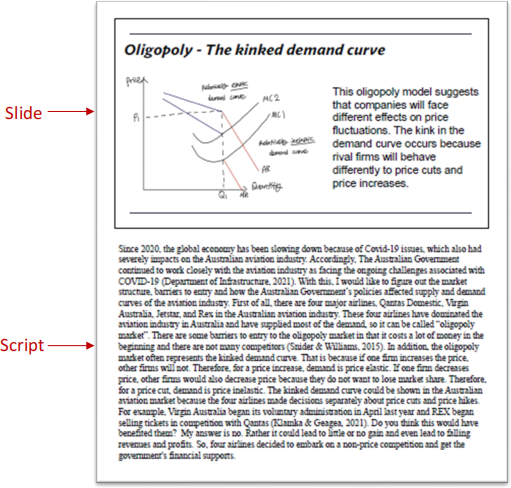

A sample page of assessment 2 submission:

Two optional topics on the NEXT pages:

Topic 1: How will 28% GST on online gaming impact the industry?

The Goods and Service Tax Council, on Tuesday, agreed to impose GST of 28 per cent on online

gaming, horse racing and casinos. The tax will be levied on the full value of the bet made or the chips bought and there will be no differentiation between skill-based games and chance-based games.

Currently, the online gaming companies pay a GST of 18 per cent which is levied on the Gross Gaming Revenue (GGR). Along with this, a TDS of 30 per cent is deducted on the winnings.

Now, however, with the Centre's decision of levying 28 per cent GST on the total game value for

online gaming, a gamer will have to pay 28 per cent GST on the amount they have deposited on the game. Along with this, the user will be made to pay the platform fee and bear 30 per cent TDS on net winnings.

“In most countries the online gaming industry is taxable more or less at par with the current

taxability of 18 per cent, therefore, it's a disadvantage for Indian game companies if the taxability moves to 28 per cent,” said Ankur Gupta, Practice Leader - Indirect Tax at SW India. The tax levy

would mostly lead users to look out for offshore or illegitimate platforms which do not charge GST.

Stocks of gaming firms such as Nazara Technologies Ltd. and Delta Corp Ltd. declined following the move. “This would potentially have devastating implications” including the shutdown of businesses for startups and small- and medium-sized enterprises, according to a letter signed by 127 Indian

companies including Nazara Tech.” This could also have other negative consequences, including loss of revenue for the government.

"We believe this decision by the GST Council is unconstitutional, irrational, and egregious. …This

decision will wipe out the entire Indian gaming industry … and the only people benefitting from this will be anti-national illegal offshore platforms,” said Roland Landers, CEO, The All India Gaming

Federation.

Sources:https://www.deccanherald.com/business/business-news/indias-online-gaming-firms-warn- of-devastating-gst-hike-impact-1237301.html

https://www.deccanherald.com/business/technology/explained-how-will-28-gst-on-online-gaming- impact-the-industry-1237487.html

Do more research and apply what we have learned in “Demand & Supply”, “Elasticity” and “Taxation” to answer the following questions.

1. How does the GST hike (from 18% to 28%) impact the online gaming industry? Discuss the impact on the price and quantity of online gaming. How does it influence the government revenue - Do you agree that the GST hike will likely lead to loss of revenue for the government? Apply the graph related to tax and concept of demand, supply and elasticity to justify your answer. When you draw the graph to illustrate the impact of GST hike, you will need to start from no tax, and then illustrate the impact of GST of 18% and 28%.

2. In your opinion, which side (consumers or gaming companies) will bear more tax burden? Apply the concept of elasticity to justify your answer.

3. Based on your answer for question 2, do you agree that the GST hike will likely lead to the

shutdown of businesses for startups and small- and medium-sized enterprises? Assume

the gaming industry is in a perfectly competitive market. Justify your answer by applying the knowledge you have learned in the chapter of perfect competition.

Topic 2: Price ceilings on drugs with no alternatives must be raised, Czech industry says.

According to the Czech pharmaceutical industry, amid the medicine shortage crisis, current price caps without considering any alternatives could further jeopardise availability.

In the Czech Republic, about 150 different medicines are missing from the market every month. Data from the Czech State Institute for Drug Control showed that 11% of drug groups were affected by

such shortages.

According to Czech Association of Pharmaceutical Companies (ζAFF), dozens of types of drugs in groups where competition is insufficient, meaning that there are only a few suitable alternatives on the market, often no more than three. These are mainly some very cheap but life-saving medicines – for high blood pressure, pain, high cholesterol or antibiotics. Their sales prices are already at the regulatory ceiling.

“Competitiveness has long been threatened by the state’s heavy pressure on price, without caring whether the required savings will affect the number of traded variants of medicines on the Czech market,” Vrubel argued.

The decline in margins is causing pharmaceutical corporations to have second thoughts about the continued presence of some drugs on the market. This is compounded by the unprecedented rise in the cost of manufacturing and importing drugs over the past year, which often cannot be reflected in selling prices due to price caps.

Therefore, “especially for cheap, low-margin medicines, it is unlikely that other competitors will enter the market. The small Czech market, over-regulated and with price capping, attracts no one,” he added.

“Therefore it was necessary to look for a substitute in the form of preparing drugs from raw

materials directly in the pharmacy, special import of the drug from abroad, or changing the

prescription for a drug with a different drug substance,” said Filip Vrubel, executive director of the ζAFF.

Source:https://www.euractiv.com/section/health-consumers/news/price-ceilings-on-drugs-with- no-alternatives-must-be-raised-czech-industry-says/

Do more research and apply what we have learned in “Demand & Supply”, “Price Control”, “ Production Cost” and “Monopoly” to answer the following questions.

1. What is the intention of having such Price Cap? Do you agree that Price Cap contributes to the shortage in 11% of drug groups in Czech? What are some other possible consequences of such Price Control? Apply the theories on Price Control to justify your answer.

2. The news mentioned “it is unlikely that other competitors will enter the market”. Do you agree with this prediction? You can assume a typical drug is in a monopoly market. Apply what you have learned about price control, production cost and monopoly to justify your answer.

3. Filip Vrubel’s remark that “it was necessary to look for a substitute in the form of preparing

drugs from raw materials directly in the pharmacy, special import of the drug from abroad, or changing the prescription for a drug with a different drug substance”. How do these measures help with the drug shortage? Choose one of the three measures to explain and apply the relevant economics theories (production cost, or demand and supply) to justify your answer.

2023-09-02