FINM7402 Tutorial 4: Corporate & Project Valuation

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

FINM7402 Tutorial 4: Corporate & Project Valuation

Additional Question*:

The 2017 balance sheet and income statement for Ushuaia Inc. is provided below. Prepare a 2018 pro-forma income statement and balance sheet for the firm where revenues are expected to grow by 20% in 2018. Make the following assumptions in making your forecast of the firm’s balance sheet for 2018.

a. The income statement expenses are a constant percentage of revenues except for interest, which remains equal in dollar amount to the 2017 level, and taxes, which equal 40% of earnings before taxes.

b. Cash and marketable securities balance remains equal to $500, and the remaining current asset accounts increase in proportion to revenues for 2017.

c. Net PP&E increase in proportion to the increase in revenues and depreciation expenses for 2018 is $2000.

d. Accounts payable increases in proportion to firm revenues.

e. Owner’s equity increases by the amount of firm net income for 2018 (no cash dividends are paid)

f. Long-term debt remains unchanged and short-term debt changes in an amount that balances the balance sheet.

|

Balance Sheet |

2017 |

|

Cash and Marketable Securities |

$ 500 |

|

Accounts Receivable |

6,000 |

|

Inventories |

9,500 |

|

Current Assets |

$ 16,000 |

|

Net Property Plant & Equipment (PP&E) |

17,000 |

|

Total |

$ 33,000 |

|

|

|

|

Accounts Payable |

$ 7,200 |

|

Short-term Debt |

6,800 |

|

Current Liabilities |

$ 14,000 |

|

Long-term Debt |

7,000 |

|

Total Liabilities |

$ 21,000 |

|

Total Owners' Equity |

12,000 |

|

Total Liabilities and Owners' Equity |

$ 33,000 |

|

|

|

|

Income Statement |

2017 |

|

Revenues |

$ 30,000 |

|

Cost of Goods Sold |

(20,000) |

|

Gross Profit |

$ 10,000 |

|

Operating Expenses |

(8,000) |

|

Net Operating income |

$ 2,000 |

|

Interest Expense |

(900) |

|

Earnings before Taxes |

$ 1,100 |

|

Taxes |

(440) |

|

Net Income |

$ 660 |

Text book Questions:

Chapter 8: Questions 4, 5, 6*, 7*, 9*, 10, 12*, 19

8-4. Hyperion, Inc. currently sells its latest high-speed color printer, the Hyper 500, for $349. It plans to lower the price to $300 next year. Its cost of goods sold for the Hyper 500 is $192 per unit, and this year’s sales are expected to be 26,100 units.

a. Suppose that if Hyperion drops the price to $300 immediately, it can increase this year’s sales by 30% to 33,930 units. What would be the incremental impact on this year’s EBIT of such a price drop?

b. Suppose that for each printer sold, Hyperion expects additional sales of $89 per year on ink cartridges for the three-year life of the printer, and Hyperion has a gross profit margin of 65% on ink cartridges. What is the incremental impact on EBIT for the next three years of a price drop this year?

8-5. After looking at the projections of the HomeNet project, you decide that they are not realistic. It is unlikely that sales will be constant over the four-year life of the project. Furthermore, other companies am likely to offer competing products, so the assumption that the sales price will remain constant is also likely to be optimistic. Finally, as production ramps up, you anticipate lower per unit production costs resulting from economies of scale. You therefore decide to redo the projections under the following assumptions: Sales of 50,000 units in year 1 increasing by 51,000 units per year over the life of the project, a year 1 sales price of $260/unit, decreasing by 11% annually and a year 1 cost of $120/unit decreasing by 21% annually. In addition, new tax laws allow you to depreciate the equipment, over three rather than five years using straight-line depreciation.

a. Keeping the underlying assumptions in Table 8.1 the same, recalculate unlevered net income (that is, reproduce Table 8.1 under the new assumptions, and note that we are ignoring cannibalization and lost rent).

b. Recalculate unlevered net income assuming, in addition, that each year 20% of sales comes from customers who would have purchased an existing Cisco router for $100/unit and that this router costs $60/unit to manufacture.

8-6. Cellular Access, Inc. is a cellular telephone service provider that reported net income of $241 million for the most recent fiscal year. The firm had depreciation expenses of $128 million, capital expenditures of $159 million, and no interest expenses. Working capital increased by $10 million. Calculate the free cash flow for Cellular Access for the most recent fiscal year.

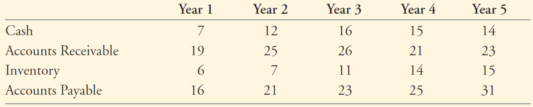

8-7. Castle View Games would like to invest in a division to develop software for video games. To evaluate this decision, the firm first attempts to project the working capital needs for this operation. Its chief financial officer has developed the following estimates (in millions of dollars):

Assuming that Castle View currently does not have any working capital invested in this division, calculate the cash flows associated with changes in working capital for the first five years of this investment.

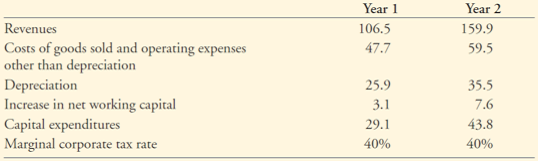

8-9. Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars):

a. What are the incremental earnings for this project for years 1 and 2?

b. What are the free cash flows for this project for the first two years?

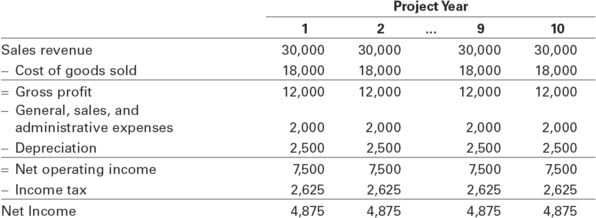

8-10. You are a manager at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing. Your boss comes into your office, drops a consultant’s report on your desk, and complains, “We owe these consultants $1 million for this report, and I am not sure their analysis makes sense. Before we spend the $25 million on new equipment needed for this project, look it over and give me your opinion.” You open the report and find the following estimates (in thousands of dollars):

All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new equipment that will be purchased today (year 0), which is what the accounting department recommended. The report concludes that because the project will increase earnings by $4.875 million per year for 10 years, the project is worth $48.75 million. You think back to your halcyon days in finance class and realize there is more work to be done!

First, you note that the consultants have not factored in the fact that the project will require $10 million in working capital upfront (year 0), which will be fully recovered in year 10. Next, you see they have attributed $2 million of selling, general and administrative expenses to the project, but you know that $1 million of this amount is overhead that will be incurred even if the project is not accepted. Finally, you know that accounting earnings are not the right thing to focus on!

a. Given the available information, what are the free cash flows in years 0 through 10 that should be used to evaluate the proposed project?

b. If the cost of capital for this project is 14%, what is your estimate of the value of the new project?

8-12. A bicycle manufacturer currently produces 298,000 units a year and expects output levels to remain steady in the future. It buys chains from an outside supplier at a price of $1.90 a chain. The plant manager believes that it would be cheaper to make these chains rather than buy them. Direct in-house production costs are estimated to be only $1.50 per chain. The necessary machinery would cost $292,000 and would be obsolete after 10 years. This investment could be depreciated to zero for tax purposes using a 10-year straight-line depreciation schedule. The plant manager estimates that the operation would require $31,000 of inventory and other working capital upfront (year 0), but argues that this sum can be ignored since it is recoverable at the end of the 10 years. Expected proceeds from scrapping the machinery after 10 years are $21,900.

If the company pays tax at a rate of 35% and the opportunity cost of capital is 15%, what is the net present value of the decision to produce the chains in-house instead of purchasing them from the supplier?

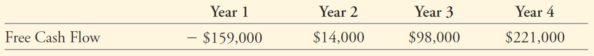

8-19. Bay Properties is considering starting a commercial real estate division. It has prepared the following four-year forecast of free cash flows for this division:

Assume cash flows after year 4 will grow at 3% per year, forever. If the cost of capital for this division is 14%, what is the continuation value in year 4 for cash flows after year 4? What is the value today of this division?

2023-09-01