FINM7405 Financial Risk Management 2

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

FINM7405

** These questions will be discussed in the tutorial; questions not marked with ** are for you to try at home

Question 1

Consider a European call option with an exercise price of $4 and six months to maturity. The underlying share is currently trading at $5.20. The variance of the return on the share is 0.81, and the riskfree rate of interest is 10% per annum.

a) Use the Black-Scholes formula to calculate the value of this call option. Divide the option's value into its intrinsic and time value components.

b) If the underlying shares were trading at $3.80, what is the Black-Scholes price? Before you do the calculation, have a think about whether the price will be higher or lower than in part a. Why does this option have value if it is out-of-the-money?

c) Ignore b. Calculate the value of a call option with six months to expiry and strike price of $3.00. Before you do the calculation, do you expect the option value to be higher or lower than in part a?

d) Ignore b and c. Assume the call option has nine months to expiry. Do you expect the option value to be higher or lower than part a? Calculate the value.

Question 2

Consider again the information presented in Question 1. A European put option is also written on the stock. Like the call option, it has a strike price of $4 and six months to expiry. Using your answers to Question 1 and the put-call parity formula:

a) If share price is $5.20, what is the value of the put option? Why does the put option have value when it is out-of-the-money?

b) If the underlying shares were trading at $3.80, what is the put option value?

c) Ignore b. Calculate the value of a put option with six months to expiry and strike price of $3.00. Before you do the calculation, do you expect the option value to be higher or lower than in part a?

d) Ignore b and c. Assume the put has nine months to expiry. Do you expect the option value to be higher or lower than part a? Calculate the value.

Question 3**

Today is 1 August. The spot interest rate for 90-day bills is quoted at 94.00. In September, you will invest some surplus cash by buying thirty $100,000 face value 90-day bills. You are worried interest rates will fall between now and September and, hence, you will earn less interest on your investment.

We could, of course, lock-in the interest to be received using 90-day bank bill (BAB) futures. This will be great if interest rates do in fact fall. If they rise, however, we will not earn higher interest since we are locked-in.

The screenshot below shows call and put options on the 90-day bank bills that are available with September expiry and with different quoted strike prices:

https://www.asx.com.au/prices/asx-futures.htm (accessed in August 2018)

For the purpose of this question, focus on the quoted strike price = $98.00 B (ignore the yellow highlight in the table above). Assume the standard contract size of the options is $1m face value.

a) To hedge against a fall in rates, will you buy a call or put option on the 90-day bank bills?

b) Assume that, on maturity in September, the spot rate for 90-day bills has fallen with the quoted price= $99.00. Calculate (i) the gain/loss on the option, (ii) the interest received from the thirty bank bills over September-December, and (iii) the net of these two amounts.

c) Ignore b. Assume that, on maturity in September, the spot rate for bills has risen with the quoted price= $96.00. Calculate (i) the gain/loss on the option, (ii) the interest received from the thirty bank bills over September-December, and (iii) the net of these two amounts.

d) Draw the payoff diagram, in terms of bill price, for the option that you bought. Then, draw the payoff diagram, in terms of interest rate, for the option that you bought.

Question 4**

The price of a European put that expires in 6 months and has a strike price of $10 is $2. The underlying stock price is currently valued at $9, and risk-free rate is 2% p.a.

a) What is the price of a European call with the same strike price and maturity as the put?

b) Suppose that the European call is currently priced at $1.20. Devise a strategy to

arbitrage from this situation. What is the net payoff of your arbitrage strategy at t=0 and at t=T (i.e. at the maturity of the options)? Explain what happen at t=T.

c) Ignore part (b). Suppose that the European call is currently priced at $1.00. Devise a strategy to arbitrage from this situation. What is the net payoff of your arbitrage strategy at t=0 and at t=T (i.e. at the maturity of the options)? Explain what happen at t=T.

Question 5

Value the following options written on a dividend-paying stock with a strike price of $700. The current price of the stock is $690, σ = 30% p.a., the risk-free rate of interest is 7% p.a. and the estimated dividend yield is 4% p.a.:

i. The price of a 3-mth European call option

ii. The price of a 3-mth European put option

Question 6 **

Value the following options written on a dividend-paying stock with a strike price of $55. The current price of the stock is $50, σ = 25% p.a.., and the risk-free rate of interest is 8% p.a. The firm is expected to pay dividends valued at $1.50 per share in 4 months and $2 per share in 10 months.

i. The price of a 12-mth European call option

ii. The price of a 12-mth European put option

Question 7 **

A call option and a put option are written on a non-dividend paying stock. Both options, which are European in nature, expire in 9 months and each has a strike price of $15. The current share price is $20 and the stock volatility (σ) is 30% p.a. Risk free rate of interest is 5% p.a.

a) Without performing any calculations, do you think the probability that the call option will be exercised in the risk-neutral world will be high or low?

b) What is the probability that the call option will be exercised in the risk-neutral world?

c) What is the ‘risk-neutral’ probability that the terminal share price will be greater than the strike price?

d) What is the ‘real-world’ probability that the terminal share price will be greater than the strike price?

e) Without performing any calculations, do you think the probability that the put option will be exercised in the risk-neutral world will be high or low?

f) Based on your answer to part (c), what is the risk-neutral probability that the terminal share price will be less than the strike price?

g) Based on your answers to part (f), what is the relationship between an in-the-money call and an out-of-the-money put?

h) Without any calculations, do you think the call option premium will be high or low? Next, calculate the call premium to confirm your intuition

i) Without any calculations, do you think the put option premium will be high or low? Next, calculate the put premium to confirm your intuition

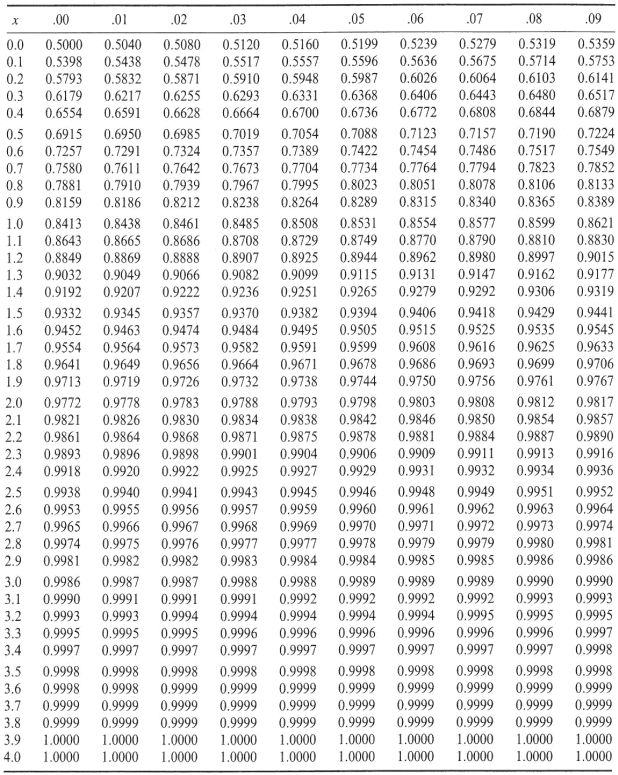

Probability tables to compute N(d1) and N(d2)

Probability table for N(x) when x ≤ 0

Probability table for N(x) when x ≥ 0

2023-09-01