FINM7402 Lecture 2: Capital Structure- MM Theory

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Lecture 2: Capital Structure- MM Theory

Nota bene:

I have set more questions than can be covered in a 2 hour session. The questions to be covered by your tutor are indicated by an asterisk (*); the rest should be viewed as extra practice problems.

Solutions are also provided. Resist the temptation to look at the solutions while attempting the questions. It is surprisingly easy to convince yourself that you understand the material if you peek at the solutions first.

Question 1 *

Consider two firms that are identical in every respect (i.e., industry, risk, cash flows generated, and so on) except for their capital structure. Firm A is financed entirely by equity. A's current share price is $0.70 and there are 10 million issued shares. Firm B also has 10 million shares issued, but also has some debt financing. The market value of B's debt is $2 million and B pays 15% p.a. interest on this debt. Both A and B generate an annual cash income of $3,500,000.

Assume a world in which capital markets are perfect. That is, there are no taxes at the corporate or personal level, no transaction costs, and no financial distress costs.

Required:

a) Modigliani and Miller’s “irrelevance proposition” is that, in a world of perfect capital markets, capital structure choices are irrelevant. Two firms that are identical in all respects except for their capital structure must have the same total value.

If MM's irrelevance proposition holds, what is the market price of B's shares?

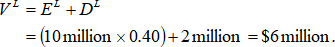

Now let's see what happens if the irrelevance proposition does not hold. Ignore your answer to (a), and assume that B's share price is $0.40. In which case the total value of B is:

Hence, B is cheaper than the otherwise identical Firm A.

b) Assume you purchase 20% of B's shares and 20% of B's debt, both at current market prices. How much will this cost you in total? What is the annual income from your investment in B?

c) Being unlevered, Firm A pays all cash income out as a dividend to shareholders. What proportion of A must you purchase in order to get the same annual income as calculated in (b)? How much will this shareholding cost you?

Commentary:

· You can see the arbitrage opportunity here because your total outlay is less for B than A; yet the annual income from each is identical. Rational investors would invest in B forcing its value up until such time as the values of A and B were equal.

· A slightly different way of illustrating the arbitrage opportunity is to buy the cheaper firm (B) and short-selling the more expensive firm (A). This produces an immediate profit, with no further cash flow implications in the future.

· You could re-do this question again assuming B's shares were valued at (say) $0.80. In that case, A would be cheaper than B. How could you demonstrate that an arbitrage opportunity exists in that case?

Question 2 (* do only (a) as this is just for practice)

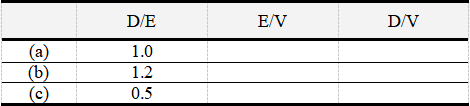

The table below contains the debt-equity (D/E) ratio of several firms. Complete the schedule by calculating the E/V and D/V ratios. (Note that: E/V + D/V = 1.)

Question 3

Assume perfect capital markets and no taxes. A company with D/V = 0.30 pays 6% p.a. interest on its outstanding debt. The firm's weighted average cost of capital is 12% p.a.

a) What is the firm's required rate of return on equity ![]() ?

?

b) Imagine a firm identical to the one described above, except that this new firm is financed entirely by equity. Without doing any calculations, what is the weighted average cost of capital of this firm, and what is the required return on this firm's equity?

Question 4 *

Assume a world with perfect capital markets and no taxes. HotDog Software has a debt-equity ratio of 0.45. HotDog is paying 7.5% p.a. interest on its outstanding debt. The risk-free rate is 4%. The expected return on the market portfolio is 14% p.a. and HotDog's beta is 1.6.

a) What is the return on equity demanded by HotDog's shareholders?

b) What is HotDog's weighted average cost of capital?

Question 5

Assume perfect capital markets and no taxes. A company begins its existence financed entirely by equity. The required rate of return on this company is 10% p.a. Obviously, the WACC on this all-equity company is also 10% p.a.

a) Several years into its life, the company raises some funds by issuing bonds. Interest payments on these bonds are 6% p.a. After the bond issue, borrowings represent 25% of the total value of the firm.

Calculate the return required by equityholders after the bond issue. Also calculate the firm's new WACC.

b) Assume a further bond issue is made. The interest on debt remains at 6% p.a. Borrowings now represent 40% of the total value of this firm.

Calculate the return required by equityholders after the second bond issue. Also calculate the firm's new WACC.

Commentary:

· From MM, we know that leverage does not affect the total value of a firm or its WACC (assuming perfect capital markets and no taxes). Hence, the WACC will not change in (a) and (b). We have seen this on the graph in lectures where WACC is a flat line.

· The return required by equityholders increases as more debt is issued (equityholders are last in line for annual payments and in the event of liquidation). We have seen this upward-sloping line for ![]() on the graph in the lecture, and your calculations in (a) and (b) should confirm this.

on the graph in the lecture, and your calculations in (a) and (b) should confirm this.

Question 6 *

Assume perfect capital markets and no taxes. Currently ABC Limited is all equity financed. The shareholder’s demand a 12.6% return and the firm’s equity beta is 1.1. The Chief Financial Officer for ABC Limited states: “we should borrow funds and retire some existing equity with the proceeds since this will make shareholders better off”.

a) Show that the shareholder’s return will be enhanced by adopting some leverage. For this purpose assume that the firm is now financed with three parts debt to seven parts equity and that the cost of debt is 6%.

b) Calculate the new equity beta for ABC Limited under this scenario.

c) Does the greater return on equity earned under leverage, as calculated in part (a), mean that shareholders are better off? Use the CAPM to explain why or why not. Assume for this purpose that the market risk premium is 6% and that the debt is riskless.

Question 7

Assume perfect capital markets, no taxes, and corporations and investors can borrow and lend at the same interest rate of 6% p.a.

XYZ Ltd. is a private company held by a single investor, Martha, who intends to cash out by selling her entire holding. The investment bank that is advising Martha on this deal presents two options. First, they suggest that they would be able to issue one million shares at $50 each, giving Martha a total of $50 million. However, they suggest that most companies that are comparable to XYZ have considerable leverage and that the market just doesn’t like pure equity firms because the return to shareholders is not high enough. Therefore, they suggest that before the float, XYZ should take on $25 million of bank debt and use this to make a special repayment of capital to Martha, the sole shareholder. They would then be able to sell the one million shares for $30 each, yielding a total of $55 million for Martha.

If unlevered, XYZ would be expected to pay dividends of $5 million per year in perpetuity.

a) Do you believe the claims of the investment bank? Why, or why not?

b) Show, using the homemade leverage argument, that a buyer with $1,000,000 could easily replicate the leverage available under the second option for themselves, even if Martha had decided on the 100% equity sale.

Question 8 *

The Motley Corporation, which operates in a perfect capital market, has two financing alternatives for its operating assets that are valued at $1,000,000. These assets are risky and so have an uncertain income generating ability. With equal probability they are expected to earn $100,000 or $200,000 each year. The two financing alternatives are:

i) 100 percent equity: that is there is a million dollars of equity capital

ii) 50 percent debt and 50 percent equity: $500,000 equity capital and $500,000 of bank debt borrowed at 12 percent.

The following table summarises the information:

|

|

$ |

$ |

|

Earnings before interest |

100,000 |

200,000 |

|

|

|

|

|

100% Equity |

|

|

|

Earnings available for distribution to shareholders |

100,000 |

200,000 |

|

|

|

|

|

50% Equity, 50% Debt |

|

|

|

Interest expense |

60,000 |

60,000 |

|

Earnings available for distribution to shareholders |

40,000 |

140,000 |

a) Explain what happens to the expected return on equity when we introduce leverage and what is meant by financial risk.

b) Does the firm’s weighted average cost of capital change as leverage is introduced?

c) Explain the reasons for your result in part (b).

2023-08-31