FINM7402 Tutorial 1: Introduction & Cost of Capital

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

FINM7402 Tutorial 1: Introduction & Cost of Capital

Nota bene:

I have set more questions than can be covered in a 2 hour session. The questions to be covered by your tutor are indicated by an asterisk (*); the rest should be viewed as extra practice problems.

Solutions are also provided. Resist the temptation to look at the solutions while attempting the questions. It is surprisingly easy to convince yourself that you understand the material if you peek at the solutions first.

Q1*

In the big picture of corporate finance, the first big piece is the investment decision. Which of the following best characterizes that decision?

a. Firms should take investments that make them more profitable

b. Firms should take investments that generate the most cash flows

c. Firms should take investments that earn the highest returns

d. Firms should take investments that earn returns greater than the risk free rate

e. Firms should take investments that earn returns greater than the risk adjusted hurdle rate

Q2*

In the big picture of corporate finance, the dividend principle states that firms should return as much cash as they can to their owners. If firms followed this principle, which of the following would you expect to observe?

a. Firms will pay out all of their earnings as dividends/stock buybacks

b. Firms will not pay out any of their earnings to stockholders

c. Firms that have high earnings and low growth potential will return more cash to stockholders.

d. Firms that have high earnings and high growth potential will return more cash to stockholders.

e. None of the above

Q3:

Suppose Best Buy stock is trading for $20 per share for a total market cap of $6 billion, and Walt Disney has 2.3 billion shares outstanding. If you hold the market portfolio, and as part of it hold 108 shares of Best Buy, how many shares of Walt Disney do you hold?

Q4.*

Standard and Poor’s also publishes the S&P Equal Weight Index, which is an equally weighted version of the S&P 500.

a. To maintain a portfolio that tracks this index, what trades would need to be made in response to daily price changes?

b. Is this index suitable as a market proxy?

Q5:

Suppose that in place of the S&P 500, you wanted to use a broader market portfolio of all U.S. stocks and bonds as the market proxy. Could you use the same estimate for the market risk premium when applying the CAPM? If not, how would you estimate the correct risk premium to use?

Q6. *

From the start of 1999 to the start of 2009, the S&P 500 had a negative return. Does this mean the market risk premium we should have used in the CAPM was negative?

Textbook Questions: Chapter 12: Questions 2; 15*; 17*; 20; 23*; 26

12-2. Suppose the market portfolio has an expected return of 10% and a volatility of 20%, while Microsoft’s stock has a volatility of 30%.

a. Given its higher volatility, should we expect Microsoft to have an equity cost of capital that is higher than 10%?

b. What would have to be true for Microsoft’s equity cost of capital to be equal to 10%?

12-15*. In mid-2009, Rite Aid had CCC-rated, 6-year bonds outstanding with a yield to maturity of 17.3%. At the time, similar maturity Treasuries had a yield of 2%. Suppose the market risk premium is 4% and you believe Rite Aid’s bonds have a beta of 0.39. If the expected loss rate of these bonds in the event of default is 52%.

a. What annual probability of default would be consistent with the yield to maturity of these bonds in mid-2009?

b. In mid-2015, Rite-Aid’s bonds had a yield of 8.8%, while similar maturity Treasuries had a yield of 0.8%. What probability of default would you estimate now?

12-17*. The Dunley Corp. plans to issue 5-year bonds. It believes the bonds will have a BBB rating. Suppose AAA bonds with the same maturity have a 4% yield. Assume the market risk premium is 5% and use the data in Table 2 and Table 3 in the lecture slides.

a. Estimate the yield Dunley will have to pay, assuming an expected 50% loss rate in the event of default during average economic times. What spread over AAA bonds will it have to pay?

b. Estimate the yield Dunley would have to pay if it were a recession, assuming the expected loss rate is 71% at that time, but the beta of debt and market risk premium are the same as in average economic times. What is Dunley’s spread over AAA now?

c. In fact, one might expect risk premia and betas to increase in recessions. Redo part (b) assuming that the market risk premium and the beta of debt both increase by 20%; that is, they equal 1.2 times their value in recessions.

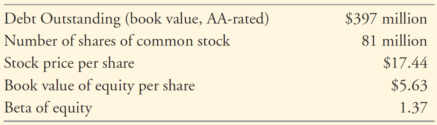

12-20. IDX Tech is looking to expand its investment in advanced security systems. The project will be financed with equity. You are trying to assess the value of the investment, and must estimate its cost of capital. You find the following data for a publicly traded firm in the same line of business:

What is your estimate of the project’s beta? What assumptions do you need to make?

12-23*. Weston Enterprises is an all-equity firm with two divisions. The soft drink division has an asset beta of 0.53, expects to generate free cash flow of $76 million this year, and anticipates a 4% perpetual growth rate. The industrial chemicals division has an asset beta of 1.14, expects to generate free cash flow of $44 million this year, and anticipates a 2% perpetual growth rate. Suppose the risk-free rate is 2% and the market risk premium is 4%.

a. Estimate the value of each division.

b. Estimate Weston’s current equity beta and cost of capital. Is this cost of capital useful for valuing Weston’s projects? How is Weston’s equity beta likely to change over time?

12-26. Unida Systems has 42 million shares outstanding trading for $10 per share. In addition, Unida has $94 million in outstanding debt. Suppose Unida’s equity cost of capital is 16%, its debt cost of capital is 8%, and the corporate tax rate is 35%.

a. What is Unida’s after-tax debt cost of capital?

b. What is Unida’s weighted average cost of capital?

Topic 1 Solutions

Q1: e. Firms should take investments that earn returns greater than the risk adjusted hurdle rate. It is not enough that the investments are profitable & increase growth or that they earn more than the risk free rate. The projects earning the highest returns may not be good enough, if they are very risky.

Q2: c. Firms that have high earnings and low growth potential will return more cash to stockholders. It is a combination of having lots of earnings (cash flows) and not that much to invest those cash flows in that creates the opportunity to return more cash.

Q3: Remember that the market portfolio is the total supply of securities. Therefore the proportion of each security in the market portfolio corresponds to the proportion of the total market that each security represents. We can then say that the market value, or market cap, of security i is given by:

MVi = (Number of shares of i outstanding)_(Price of i per share)

In this case Best Buy has

$6 billion / $20 = 0.3 billion shares outstanding

Because the amount of each security held in a market portfolio is proportional to the amount of shares outstanding of that security, we call the market portfolio a value weighted portfolio. In this case, since we know the shares outstanding for Walt Disney (WD) and Best Buy (BB), and how much we hold of Best Buy shares, we can calculate how much we hold of Walt Disney shares:

108 BB shares * (2.3 billion shares outstanding of WD / 0.3 billion shares outstandingBB ) = 828 shares WD

Q4: The S&P 500 is a market index that represents a value weighted portfolio of 500 of the largest U.S. stocks. As opposed to a value weighted portfolio an equally weighted portfolio, such as the S&P Equal Weight Index, is one in which the same amount is invested in each security held. In the case of value weighted, in order to maintain a portfolio that tracks the index, we need only trade when the number of shares outstanding of some security changes. For an equally weighted index, on the other hand, we would need to sell shares in accordance to price changes in order to maintain a portfolio that tracks the index. Specifically, we would have to sell shares whose prices increase, and buy shares whose prices decrease.

A good market proxy is one which represents well the aggregate portfolio of all investors. The aggregate portfolio of all investors necessarily holds more of the securities which have larger market capitalization. Therefore the market proxy should be value weighted not equally weighted.

Q5. Remember that government bonds represent a risk free investment. Therefore the beta of a portfolio which included all U.S. stocks and bonds would be lower than that of one which only included securities such as the S&P 500.

In order to estimate the correct risk premium to use for this broader market portfolio, we could calculate the historical average excess return of this portfolio over the risk free interest rate. Of course we would have to choose an appropriately long time period over which to collect data to generate even moderately accurate estimates of expected returns.

Q6. The time period for which you collect data from which to determine expected return on the market portfolio must have relevance for investor’s expectations of the market risk premium today. Just looking at the period from 1999 to 2009 would not be appropriate.

Chapter 12 – Question 2

a. No, volatility includes diversifiable risk, and so it cannot be used to assess the equity cost of capital. Recall, beta is systematic risk and you only get compensated for this type of risk.

b. Microsoft stock would need to have a beta of 1.

Chapter 12 – Question 15

(a) The yield to maturity (YTM) is calculated using promised interest and principal payments and can be considered to be a fairly reasonable estimate of the cost of debt only if the probability of default is very low. To reiterate, the promised return on a bond (also known as the yield) is the return in case the bond does not default. The cost of debt (Rd or rd) is the expected return and it takes into account the probability of default.

The expected return is equal to the promised return if the probability of default is zero.

rd = 2% + 0.39 (4%) = 3.56%

= YTM – p×L = 17.3% – p×(0.52)

p = (17.3% – 3.56%)/0.52 = 26.42%

(b) p = (8.8% – 0.8% – 0.39 (4%))/0.52 = 12.38%

Chapter 12 – Question 17

a. We use the CAPM to estimate expected return and is described below. From Table 2, we find that the default rates for AAA rated bond is 0%. The beta on debt for a bonds rated A and better is given to be 0.05 and for a BBB rated bond it is 0.10 (Table 3). We need to determine the risk-free rate.

To calculate the yield spread, we need to know the yield (YTM) on a BBB rated bond.

![]() ;

; ![]()

![]()

Since Dunley is a BBB rated firm, its cost of debt can be written as follows

![]() and we can use this to determine its yield.

and we can use this to determine its yield.

![]()

The yield spread between the AAA and BBB rated bonds is 0.005 (0.5%)

When expected loss is non-zero, the promised rate of return has to be higher than the expected rate of return (i.e. the cost of debt).

b. As in (a)

![]()

![]()

![]() and we can use this to determine its yield.

and we can use this to determine its yield.

![]()

The Spread is 2.38%

c. To calculate the yield spread, we need to know the yield (YTM) on a BBB rated bond. Recall in this question beta and MRP are 20% higher. So beta (for AAA) is 0.5×1.2 = 0.6 and MRP is 5%×1.2 = 6%

![]() ;

; ![]()

![]()

![]() and we can use this to determine its yield.

and we can use this to determine its yield.

![]()

The spread is 2.49%

Chapter 12 – Question 20

Assume debt is risk-free (as no information has been provided) and market value = book value. Assume comparable assets have same risk as project.

βe = 1.37, βd = 0

E = 17.44 ´ 81 = 1412.64

D = 397; E + D = 1809.64

βa = (1412.64/1809.64) ´ 1.37 + (397/1809.64) ´ 0 = 1.06945

As an alternative to assuming that debt is risk-free, one could use the information in Table 12.3 to determine the beta of debt. I leave it you to plug in those numbers.

Chapter 12 – Question 23

a. Soft drink

Ru = 2% + 0.53 ´ 4% = 4.12%

V = 76/(4.12% – 4%) = 63.333.33

Chemical

Ru = 2% + 1.14 ´ 4% = 6.56%

V = 44/(6.56% – 2%) = 964.91

Total = 63,333.33 + 964.91 = $64,298.24billion

b. Weston Beta

Portfolio beta = weighted average of individual portfolio holding betas

Weston Beta = 63,333.33/64,298.24 ´ 0.53 + 964.91/64,298.24 ´ 1.14 = 0.52205 + 0.01711 = 0.539

Re = 2% + 0.539 ´ 4% = 4.16%

Not useful! Individual divisions are either less risky or more risky. Over time, Weston’s equity beta will decline towards 0.53 as the soft drink division has a higher growth rate, and so will represent a larger fraction of the firm.

Chapter 12 – Question 26

a. RD =8% ´ (1 – 35%) = 5.2%

b. Rwacc = 420/(420+94) ´ 16% + 94/(420+94) ´ 5.2% = 14.02%

2023-08-31