ACW1100 INTRODUCTION TO FINANCIAL ACCOUNTING

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ACW1100 INTRODUCTION TO FINANCIAL ACCOUNTING

Question 1

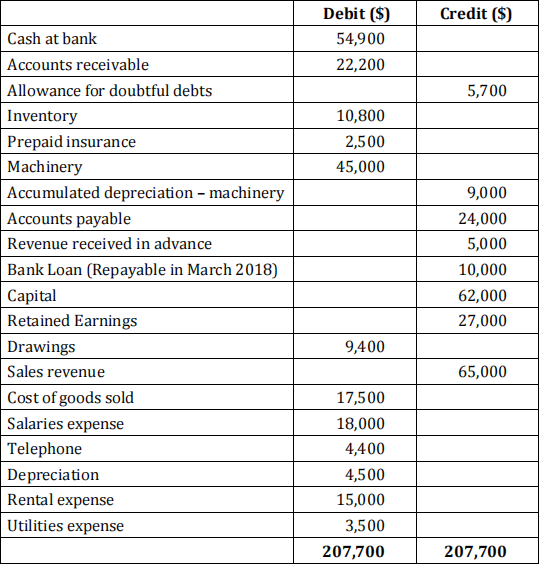

The following trial balance was prepared by Jacky & Co. for the year ended 30 June 2016. Jacky & Co. is a trading company.

The following events have not yet been considered in the preparation of this trial balance.

(i) A physical stocktake revealed that the inventory on hand as at June 30, 2016 amounted to $12,000.

(ii) Two day’s salaries for three employees are outstanding. The daily salary rate of each person is $200.

(iii) The work associated with revenue received in advance was only partially (50%) completed as at June 30, 2016.

(iv) Interest on the loan is 12% per annum on the balance outstanding. The previous payment of loan interest was made on December 31, 2015.

(v) Jacky has withdrawn $500 each week from the bank account during the last 2 weeks of June 2016 for his personal use.

(vi) Rental expenses is charged at $1,000 per month. The rental expenses of $15,000 as at June 30, 2016 include 3 months of prepaid rental for July- September 2016.

(vii) Prepaid insurance as at June 30, 2016 amounted to $1,400 after considering the expired portion.

(viii) Utility expenses for June 2016 amounted to $250 and have not been recorded as at June 30, 2016.

Required:

(a) Prepare the necessary journal entries for the year ended June 30, 2016 (ignore narrations).

(b) Prepare the Income Statement for the year ended June 30, 2016 of Jacky & Co. using classification of revenue and expenses (ignore Goods and Service Tax and income tax).

(c) Prepare the Statement of Financial Position as at June 30, 2016 of Jacky & Co. using classification of current and non-current portion of assets and liabilities. (16 + 6 + 6 = 28 marks)

Question 2

Jay is preparing the monthly bank reconciliation of Jay Ltd as at June 30, 2016.

The company’s bank statement from ANZ Bank as at June 30, 2016 is showing a balance of $7,000. The company’s unadjusted Cash at Bank account in the General Ledger as at June 30, 2016 is showing $5,659. Upon investigation, the following matters are discovered:

(i) Cash of $5,200 was deposited into ANZ Bank on June 30 and was recorded on the company's General Ledger but this amount does not appear on the June bank statement.

(ii) The bank statement shows a bank charge for cheque books of $40 debited by ANZ Bank on June 25.

(iii) Cheque No. 964138 was correctly paid by ANZ Bank for $409. The cash payment journal reflects an entry for Cheque No. 964138 as a debit to ‘Accounts Payable’ account and a credit to ‘Cash at Bank’ account for $490.

(iv) The total amount of cheques still unpresented at ANZ Bank as at June 30 is $5,800.

(v) The ANZ Bank returned a dishonoured cheque from a customer for $560 and directly debited the June bank statement.

(vi) The ANZ Bank had directly credited Jay Ltd in the June bank statement for $1,260, which represents collection of a note receivable with principal amount of $1,200 and interest income of $60.

Required:

(a) Show the adjusted “Cash at bank” account as at June 30, 2016 in Jay Ltd’s general ledger.

(b) Prepare the bank reconciliation statement as at June 30, 2016.

(c) List TWO (2) main principles of cash management. (4 + 4 + 2 = 10 marks)

Question 3

Sand Ltd has the following equity accounts as at July 1, 2015:

Share Capital (100,000 shares) $200,000

Retained Earnings 48,000

During the year ended June 30, 2016, the following events occurred:

October 1, 2015 An interim dividend of $0.08 per share was declared and paid.

June 30, 2016 A final dividend of $0.12 per share was declared.

The final dividend is paid on August 1, 2016.

Required:

Prepare the necessary journal entries for the above transactions (narrations are not required). (6 marks)

Question 4

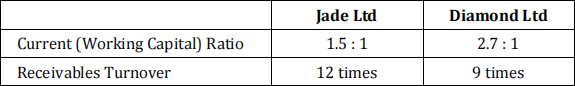

Your financial advisor has recommended you consider investing in one of the following two companies: Jade Ltd or Diamond Ltd. Both businesses are in the same industry. Two ratios for each company are presented below:

Required:

Interpret the above liquidity ratios of Jade Ltd and Diamond Ltd and advise on what the ratios reveal about the company’s liquidity. (6 marks)

Question 5

(a) Justin operates a trading company for sport products. He receives a deposit of $2,000 from his customer Raymond as a down payment for 10 units of badminton rackets ordered. The rackets are not delivered as at June 30, 2016.

Explain whether you would recognise the deposit of $2,000 as revenue in the Statement of Profit or Loss for the year ended June 30, 2016. Refer to the recognition criteria outlined in the AASB118 Revenue to support your answer.

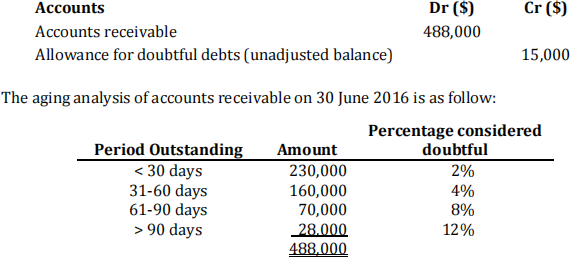

(b) An extract of account balances from the ledger of Best Ltd for the year ended June 30, 2016 is given below:

After examining the balances of accounts receivable, it was decided to write off further debts of $5,000, which were outstanding for more than 24 months.

Required:

(i) Calculate the desired ending balance of ‘Allowance for Doubtful Debts’ account as at June 30, 2016.

(ii) Construct the ‘Allowance for Doubtful Debts’ account for Best Ltd as at June 30, 2016.

(iii) Journalise the adjusting journal entries for bad debt expenses for the year ended June 30, 2016 (ignore narrations).

(iv) Do you think the unadjusted balance of Allowance for Doubtful Debts of $15,000 as at June 30, 2016 is adequate for bad debts that turned bad during the financial year? Give reasons for your answer. (5 + [2 + 4 + 2 + 1] = 14 marks)

Question 6

(a) Below is the summary of the total payroll expenses of James Trading for the month of May 2016. Payment of the wages and liabilities are made in June.

Note: EPF represents Employee Provident Fund and SOCSO represents Social Security Organization.

Required:

Journalise the payroll expenses and liabilities for the month of May 2016 (narrations are not required).

Question 6 (cont’d)

(b) Power Ltd offers a 12-month warranty to its customers with the watches that it sells and its financial year ends on June 30.

On 1 July, 2015, the balance of the Warranty Provision account was $2,000.During the year ended June 30, 2016, warranty repair cost $2,500, of which $1,800 was for inventory parts and $700 was for wages.

During the financial year ended June 30, 2016, revenue from the sale of watches is $28,000, an increase of more than 10% from the previous year. There have been no changes in suppliers, product quality or prices. The management of Power Ltd estimated warranty liabilities at 10% of sales for the previous 12 months.

Required:

(i) Construct the Warranty Provision account.

(ii) Prepare the journal entries to record balance-day adjustments during the year ended June 30, 2016 (ignore narrations).

(iii) Do you think the warranty provision of $2,000 as at July 1, 2015 is adequate to cover warranty claims made during the financial year ended June 30, 2016? Give reasons for your answer. (4 + [4 + 2 + 1] = 11 marks)

Question 7

(a) Rita Ltd provides cleaning services and reported the following transactions:

June 2 Purchased repair services on account for $1,100 (GST inclusive).

June 10 Invoiced customer for cleaning services for cash $2,200 (GST inclusive).

Note: GST rate is 10%.

Required:

Prepare the journal entries for the above transactions. No narration is required. (Note: Do NOT use GST clearing account).

(b) Puriflower sells air purifiers and its financial year ends on June 30. The business uses a perpetual inventory system and FIFO inventory cost flow method.

On June 1, 2016, Puriflower has an inventory of 200 units of air purifiers at a cost of $150 each.

During the month of June, the following transactions occurred:

June 6 – Purchased 140 units of air purifiers at $160 each on credit.

June 16 – Sold 150 units of air purifiers for cash at $500 each.

June 20 – Sold 120 units of air purifiers on credit at $550 each.

June 30 – A physical stock count revealed that there were 68 units of air purifiers left in the warehouse.

The total net realisable value for air purifiers as at June 30, 2016 is $10,000.

Required:

(i) Journalise the June 2016 transactions (ignore narrations).

(ii) Determine the cost of ending inventory for air purifiers as at June 30, 2016.

(iii) Determine the cost of sales for air purifiers for the month ended June 30, 2016.

(iv) What should be the reported value of ending inventory for air purifiers as at June 30, 2016? Give reasons for your answer. (3 + (6 + 1 + 1 + 2) = 13 marks)

Question 8

(a) Fish Service Ltd uses the straight-line method of depreciation. The company's financial year end is June 30. The following transactions and events occurred during the first two years.

2016 January 1 Purchased a computer from the Computer Centre for $7,000 cash and delivery costs of $250.

March 3 Paid ordinary repair costs of $440.

June 30 Recorded 2016 depreciation using straight-line method of

depreciation. The useful life of the computer equipment is four years with estimated residual value of $1,250.

2017 June 30 Recorded 2017 depreciation.

Required:

Prepare the necessary journal entries for Fish Ltd. Ignore the effects of GST. Show all your workings. Narrations are not required.

(b) Santa Ltd has a financial year of June 30, and measures its assets using the fair value basis in accordance with AASB 116 Property, Plant and Equipment.

On July 1, 2013, Santa Ltd acquires a piece of land at a cost of $500,000 and a building at a cost of $195,000, both for cash. The company uses the straight-line method of depreciation and the useful life of the building is 10 years.

On June 30, 2014, the land is revalued to $650,000.

On June 30, 2015, the building is revalued to $145,000.

Required:

Prepare the necessary journal entries for Santa Ltd for years 2013 to 2015 including depreciation. Show all your workings. Narrations are not required. (4 + 8 = 12 marks)

2023-08-28