BFC 3140 – Corporate Finance 2 Week 01

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

BFC 3140 - Corporate Finance 2

Week 01 Tutorial Answers - Introduction

1) A field of finance that deals with financial decisions that companies make, and the tools that they use to make these decisions. Examples: raising new equity capital, acquiring a target company, selling-off a division, repurchasing shares, issuing bonds, paying dividends to shareholders etc.

The primary goal of corporate finance is to maximise shareholder’swealth.

2)

i. Investment decision – This is the decision on which projects should the company invest in to maximise the value of the firm. It is generally accepted that the firm should invest in all positive net present value (NPV) projects.

ii. Financial decision – This is the decision on how should the company raise the capital needed for its operations. There are two main sources of capital – debt and equity. The financing decision involves the selection of the optimum debt-equity mix that maximises the value of the firm.

iii. Disbursement decision – This is the decision on how much should the company distribute to its shareholders as dividends (or through share repurchases). If a company distributes most of its earnings as dividends, it may face the problem of not having enough internally generated funds to invest in projects. This may force the company to go to the capital market to raise funds, which is more expensive. However, if a company does not distribute dividends, it may discourage some investors.

3) Equity Finance is the act of raising money for company activities by selling stock to investors. In return for the money paid, shareholders receive ownership interests in the corporation.

Debt Finance is the act of raising money for company activities by selling bonds, bills, or notes to investors (e.g. borrowing). In return for the money, the investors become creditors and receive a promise that the principal and interest on the debt will be repaid.

4) A dollar today does not equal to a dollar in 1 year. Because of this, we cannot make a comparison between cash flows that occur at different points in time. Therefore, in corporate finance decisions, it is common to discount future cash flows to today’s value, which brings the value of all the cash flows required for the decision to a comparable point.

5) Annuity - A series of equal cash flows paid/received at the end of each period for n number of periods. Example: Mortgage payments (when the interest rate on the mortgage is fixed).

Annuity due – This is also an annuity but the cash flows are paid/received at the beginning of each period.

Perpetuity - A series of equal cash flows that occur at regular intervals but that last forever. Example: If a company pays the same dividend per share, for the purpose of valuing this share using the dividend discount model, we assume that the company pays the same dividend forever.

Growing perpetuity – A series of equal cash flows that occur at regular intervals and grow at a constant rate forever. Example: If a company increases its dividend per share by the same rate every year, for the purpose of valuing this share using the constant growth model, we assume that the company’s dividend grows at a constant rate forever.

6) (i) The free cash flow is calculated as follows:

|

Sales Revenue |

$54,000 |

|

Less: Operating expenses Administrative and sales expenses Depreciation |

$20,000 $10,000 $1,000 |

|

EBIT |

$23,000 |

|

Less: Income tax at 40% |

$9,200 |

|

Unlevered Net Income |

$13,800 |

|

Plus: Depreciation Less: Capital expenditure Less: Increase in networking capital (NWC) |

$1,000 ($8,000) ($500) |

|

Free cash flow |

$6,300 |

The company has generated free cash flows of $6,300 million last year.

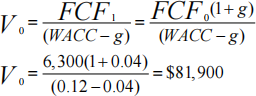

(ii) The value of the firm can be calculated using the constant growth model.

FCF0 =$6,300

WACC = 0.12

g = 0.04

The value of the firm is $81,900 million.

7)

i. 2005 Market Capitalization: 10.6 billion shares x $36.00/share = $381.6 billion. 2009 Market Capitalization: 10.5 billion shares x $10.80/share = $113.4. The change over the period is $113.4 - $381.6 = -$268.2 billion.

ii. 2005 Market-to-Book = ![]() = 3.38 . 2009 Market-to-Book =

= 3.38 . 2009 Market-to-Book = ![]() = 1.08 . The change over the period is: 1.08 - 3.38 = -2.3. The market to book ratio has declined.

= 1.08 . The change over the period is: 1.08 - 3.38 = -2.3. The market to book ratio has declined.

iii. 2005 Book Debt-to-Equity = 1(3)1(7)3(0) = 3.27 . 2009 Book Debt-to-Equity = 105(524) = 4.99 . The

change over the period is: 4.99 - 3.27 = 1.72. Its book value based debt to equity ratio (leverage) has increased.

iv. 2005 Market Debt-to-Equity = ![]() = 0.97 . 2009 Market Debt-to-Equity =

= 0.97 . 2009 Market Debt-to-Equity = ![]() = 4.62 The change over the period is: 4.62 - 0.97 = 3.65. Its market value based debt to equity ratio has also increased.

= 4.62 The change over the period is: 4.62 - 0.97 = 3.65. Its market value based debt to equity ratio has also increased.

2023-08-26

Tutorial Answers – Introduction