FINM2415 Corporate Finance Lecture 2

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Tutorial 2 Questions

Lecture 2: Project Evaluation

A. Fundamentals of Capital Budgeting

8-1. Pisa Pizza, a seller of frozen pizza, is considering introducing a healthier version of its

pizza that will be low in cholesterol and contain no trans fats. The firm expects that sales of the new pizza will be $19 million per year. While many of these sales will be to new customers, Pisa Pizza estimates that 30% will come from customers who switch to the new, healthier pizza instead of buying the original version.

a. Assume customers will spend the same amount on either version. What level of incremental sales is associated with introducing the new pizza?

b. Suppose that 52% of the customers who will switch from Pisa Pizza’s original pizza to its healthier pizza will switch to another brand if Pisa Pizza does not introduce a healthier pizza. What level of incremental sales is associated with introducing the new pizza in this case?

8-3. Home Builder Supply, a retailer in the home improvement industry, currently operates

seven retail outlets in Georgia and South Carolina. Management is contemplating building an eighth retail store across town from its most successful retail outlet. The company already owns the land for this store, which currently has an abandoned warehouse located on it. Last month, the marketing department spent $12,000 on market research to determine the extent of customer demand for the new store. Now Home Builder Supply must decide whether to build and open the new store.

Which of the following should be included as part of the incremental earnings for the proposed new retail store?

a. The cost of the land where the store will be located.

b. The cost of demolishing the abandoned warehouse and clearing the lot.

c. The loss of sales in the existing retail outlet, if customers who previously drove across town to shop at the existing outlet become customers of the new store instead.

d. The $12,000 in market research spent to evaluate customer demand.

e. Construction costs for the new store.

f. The value of the land if sold.

g. Interest expense on the debt borrowed to pay the construction costs.

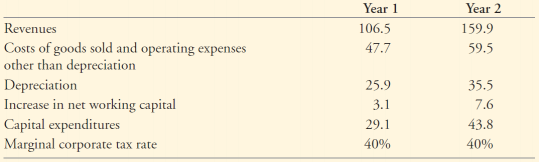

8-9. Elmdale Enterprises is deciding a project of whether to expand its production facilities.

Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars):

a. What are the incremental earnings for this project for years 1 and 2?

b. What are the free cash flows for this project for the first two years?

c. If the project requires an initial investment of $10 million with the cost of capital of 10%, what is the NPV of this project? Should the firm accept the project?

B. Project uncertainty analysis

1. You are evaluating an energy drink project of your firm and initially forecast its marketing and support costs at $500,000 per year and its revenue at $10,000,000 during years 1–3. Assume that the project pays a 39% tax rate on its pre-tax income and its cost of capital is 9%. You are now analysing a situation that competitors can run their big promotion programs during these years. The marketing division proposes one solution to the situation by increasing its marketing and support costs by 80% of the originally forecasted level and simultaneously lowering the forecasted revenue by 20% of the originally forecasted level. How would these changes impact the NPV of the proposed energy drink project?

C. Decision Tree Analysis with Real Options

1. Martin Development Co. is deciding whether to proceed with Project X. The cost would be $9 million in Year 0. There is a 50% chance that X would be hugely successful and would generate annual after-tax cash flows of $6 million per year during Years 1, 2, and 3. However, there is a 50% chance that X would be less successful and would generate only $1 million per year for the 3 years. If Project X is hugely successful, it would open the door to another investment, Project Y, which would require an outlay of $10 million at the end of Year 2. Project Y would then be sold to another company at a price of $20 million at the end of Year 3. Project X’s cost of capital is 11%.

a. Draw the decision tree for all possible outcomes.

b. If the company does not consider real options, what is Project X’s NPV? c. What is X’s NPV considering the growth option?

d. How valuable is the growth option?

2. The Bush Oil Company is deciding whether to drill for oil on a tract of land that the company owns. It estimates that the project will cost $8 million today and that once drilled, the oil will generate positive net cash flows of $4 million a year for the next 4 years. While the company is fairly confident about its cash flow forecast, it recognizes that if it delays one year, it will have more information about the local geology as well as the price of oil even through it has to give up any positive cash flows during the waiting time. The company also estimates that if it delays one year, the project will cost $9 million. Moreover, if it delays one year, there is a 90% chance that the net cash flows will be $8 million a year for the remaining 3 years, and there is a 10% chance that the cash flows will be $3 million a year for the remaining 3 years. Assume that the project cost of capital is 10%.

a. Draw the decision tree for all possible outcomes.

b. If the company chooses to drill today, what is the project’s net present value?

c. Would it make sense to delay one year before deciding whether to drill? Explain. d. What is the value of the option to delay?

e. What disadvantages might arise from delaying a project such as this drilling project?

3. Carlson Inc. is evaluating a project in India that would require a $6.2 million investment today (t = 0). The after-tax cash flows would depend on whether India imposes a new property tax. There is a 50-50 chance that the tax will pass, in which case the project will produce after-tax cash flows of $1,350,000 at the end of each of the next 5 years. If the tax doesn't pass, the after-tax cash flows will be $2,000,000 for 5 years. The project has a WACC of 12.0%. The firm would have the option to abandon the project 1 year from now, and if it is abandoned, the firm would receive the expected $1.35 million cash flow at t = 1 and would also sell the property for $4.75 million at t = 1. If the project is abandoned, the company would receive no further cash inflows from it. What is the value of the option to abandon the project?

2023-08-24