MAN00012C Financial Accounting 2019-2020

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

MAN00012C

BA and BSc Degree Examinations 2019-2020

Financial Accounting

Question 1

a. Explain what is meant by the ‘accruals basis’. Discuss why the

‘accruals basis’ is more appropriate for calculating profit than the ‘cash basis’ . (10 marks)

b. Using appropriate examples, explain the difference between tangible and intangible assets. (2 marks)

c. Critically evaluate the need for a conceptual framework in financial accounting? (5 marks)

d. Using examples, examine how the qualitative characteristics of comparability and verifiability enhance the usefulness of general purpose financial statements. (4 marks)

e. Discuss the rationale behind the treatment of the following items in the statement of financial position in the current year:

i. Rent for the following year received in advance as a current liability.

ii. Debentures appearing as a non-current liability. (4 marks)

(TOTAL 25 MARKS)

Question 2

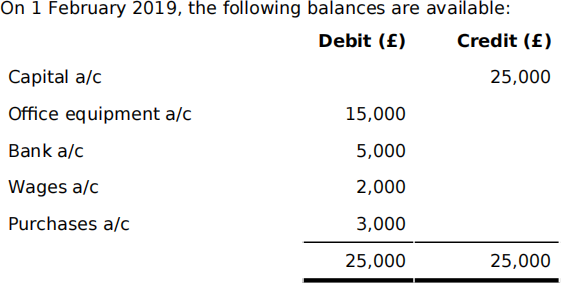

Fabian has recently started a small business that sells leather bags to high street retailers. Fabian manages all aspects of the business, from manufacturing to delivery. The business accounts are balanced at the end of each month.

During February, the following transactions took place:

a. Fabian takes out a £20,000 bank loan from HSBC.

b. He buys a delivery van for £7,000 .

c. He buys raw leather from Jerome plc on credit £10,000.

d. He pays monthly wages £2,000 and monthly rent £3,000. e. He sells leather bags for £15,000 cash.

f. He pays Jerome plc £5,000 as part payment for the raw leather purchased earlier in the month.

g. He withdraws £4,500 from the business bank account for personal use.

Required:

Fabian has requested that you prepare the following for his second month of trading:

i. Journal entries for the above transactions. (7 marks)

ii. Post the above journal entries to “T accounts” and round off the “T accounts” . (14 marks)

iii. A trial balance at 28 February 2019. (4 marks)

(TOTAL 25 MARKS)

Question 3

Hambach plc provides you with the following trial balance at 31 December 2019:

Additional information:

a. The inventories at the year end cost £50,000 but are estimated to have a net realisable value of £55,000.

b. Bad debts to be written off amount to £5,000.

c. The equipment rental income relates to 2020.

d. Wages outstanding amount to £1,000.

e. On 1 January 2019, an office motor vehicle costing £15,000 was

disposed of for £2,000. The total depreciation charged on the motor vehicle amounts to £10,000. The accountant did not know how to record the item and credited the proceeds to the Sale of Motor

Vehicle a/c (included in the Trial Balance above).

f. Depreciation is to be provided on equipment using the reducing balance method at 15% per annum and that on motor vehicles using the straight line method at 10% per annum.

Required

Prepare a Statement of Profit or Loss for the year ended 31 December 2019 and a Statement of Financial Position as at 31 December 2019, in a form that complies with IAS 1 Presentation of Financial Statements. (25 marks)

(TOTAL 25 MARKS)

Question 4

Z plc has embarked on a programme of growth through acquisitions and

has X Ltd and Y Ltd as companies in the same industrial sector, as

potential targets. The financial statements of the two companies are as follows:

Required

a. State the formula and calculate the following ratios for X Ltd and Y Ltd:

i. Gearing ratio

ii. Return on ordinary shareholders’ funds

iii. Quick ratio (acid test ratio)

iv. Trade receivables days

v. Asset turnover ratio

vi. Dividend cover ratio (15 marks)

b. Using the above figures and additional ratios, prepare a

performance report for consideration by the directors of Z plc,

indicating which of the two companies you consider to be a better acquisition. (10 marks)

(TOTAL 25 MARKS)

2023-08-19