ACW1120-Practice Questions

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ACW1120-Practice Questions

Question 1

As an accounts clerk of Dawson Trading, one of your monthly routine tasks is to prepare a bank reconciliation statement. For the month of December 2012, you have collected the following information:

1. The opening (1 December 2012) cash at bank ledger account balance is RM1,866 (Dr) and the bank statement as at 31 December 2012 showed a debit balance of RM1,255.

Cash journals prepared for the month has the following totals:

Cash receipt journal RM18,652

Cash payment journal RM17,408

2. There have been errors detected by both parties, the accounts clerk and the banker. The cash receipt journal had overstated a receipt from a debtor by RM220 and the banker had wrongly included a cheque deposit amounting to RM540 in Dawson’s bank account.

3. Deposits in transit amounted to RM6,826.

4. The following cheques drawn by Dawson Trading have not been presented for payments:

|

Cheque No: |

RM |

|

2158 |

611 |

|

2162 |

302 |

|

2164 |

128 |

|

2175 |

500 |

5. The proprietor has given standing instruction to the bank for monthly rent of RM750 and insurance premium of RM150. These transactions have been recorded in the bank statement.

6. Bank charges for the month amounted to RM36.

7. It has been noted that there were two credit transfers during the month. A debtor transferred RM896 directly into Dawson’s Trading bank account. Similarly, a dividend of RM640 from an investment was credited to the firm’s bank account.

Required:

(a) Prepare the cash at bank ledger account after correcting and updating the cash journals.

(b) Prepare the bank reconciliation statement for the month of December 2012.

Question 2

Widgets Ltd has the following information on transactions of its inventory of widgets for the year ended 31 December 2015.

|

Date |

Purchased |

Sold |

Balance |

|

1.1.2015 |

|

|

110 units @ $5 |

|

10.2.2015 |

80 units @ $6 |

|

|

|

14.4.2015 |

|

60 units |

|

|

9.5.2015 |

110 units @$7 |

|

|

|

24.7.2015 |

|

120 units |

|

|

21.10.2015 |

100 units @ $8 |

|

|

|

12.11.2015 |

|

90 units |

|

|

Total |

290 |

270 |

|

Required:

(a) Assuming a perpetual system of inventory is used, calculate the Cost of Goods Sold and ending inventory under:

(i) FIFO

(ii) LIFO

(b) Why is it important to account for inventory using the lower of cost and net realizable value basis?

(c) The estimated net realizable value of widgets is $5 per unit. Do you need to make any adjustments, if using the FIFO basis to the lower of cost and net realizable rule under AASB1002 Inventories?

(d) Prepare the journal entry to record the adjustment, if any.

Question 3

On 1 July 2015, West Port Exploration Ltd acquired a silver extraction plant by issuing 8 million ordinary shares at $1 each to Silver Supplier. A further $1.5 million was spent to bring the plant in line with governmental environmental regulations. The cost of advertising in the media of the opening of its new plant in Sydney is $3.5 million. The useful life of the plant is estimated as 10 years with zero residual value. West Port’s accounting policy is that plant is depreciated on a straight – line basis.

The management of West Port decided to revalue the plant due to the volatility in the gold price. On 30 June 2016, the gold price had fallen, and the Fair Value was $7 million. At the same date the Recoverable Amount is $7.3 million.

Required:

(a) Explain the cost principle in determining the acquisition cost of Property, Plant and Machinery

(b) Prepare journal entries to record the acquisition of the plant by West Port Ltd.

(c) Explain the accounting treatment for revaluation of assets.

(d) Prepare journal entries relating to the plant for the years 30 June 2016.

Question 4

Meggido Ltd has presented the following information regarding its equity at 1 January 2013:

|

Shareholder’s Equity |

$ |

|

Paid up capital – 5,000,000 ordinary shares |

5,000,000 |

|

General reserve |

575,000 |

|

Retained earnings |

2,830,000 |

|

|

8,405,000 |

On 15 May 2013, the board of directors declared a $0.20 interim dividend on the ordinary shares. The interim dividends were paid on 15 June 2013.

On 31 December 2013, the company reported a profit after tax of $1,944,000. Directors transferred $300,000 to reserves, and declared a final dividend of $0.15 per share.

The final dividend was paid on 22 January 2014.

Required:

Prepare general journal entries for the transactions and events above. Narrations are not required.

Question 5

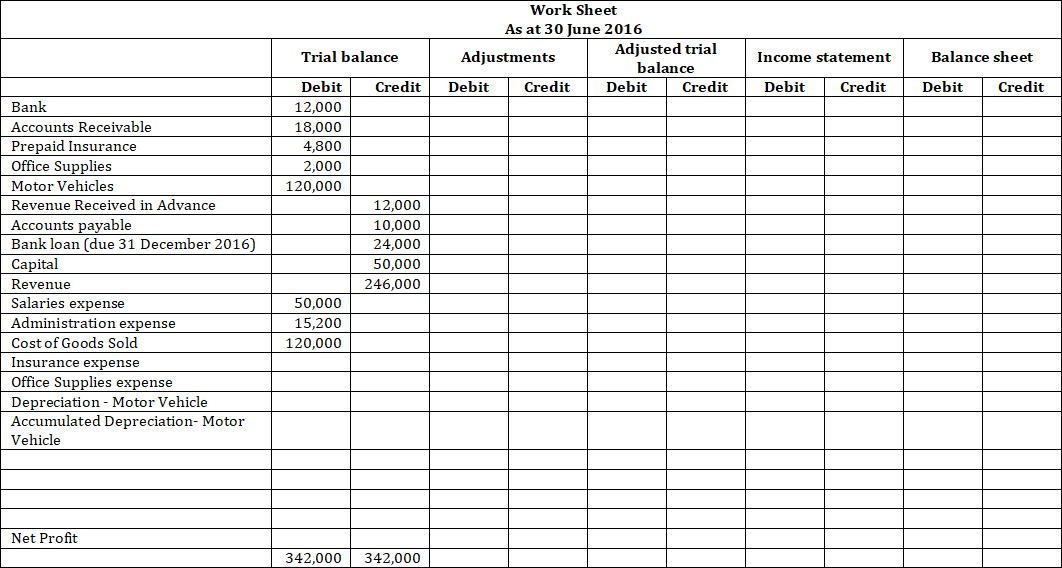

The following is the trial balance before adjustments for Sunshine Retailer as at 30 June 2016:

Question 5 (con’t)

Additional Information:

(i) A 12-month insurance policy was paid in advance on 1 April 2016.

(ii) A physical count of supplies on 30 June 2016 disclosed office supplies on hand of $360.

(iii) Motor Vehicle was purchased on 1 January 2016. The useful life was estimated to be five years, and its residual value was estimated to be $1,200. It will be used equally throughout its working life.

(iv) The service associated with revenue received in advance was only partially (25%) completed as at 30th June 2016.

(v) Two day’s salaries for two employees are outstanding. Their daily salary rate is $200.

Required:

Complete the worksheet above incorporating the adjustments for the year ended 30 June 2016.

2023-08-15