ACF564 TAXATION 2022

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ACF564

TAXATION

January 2022

Time Allowed: 3 HOURS

SECTION A – YOU MUST ANSWER ALL QUESTIONS IN THIS SECTION

QUESTION 1.

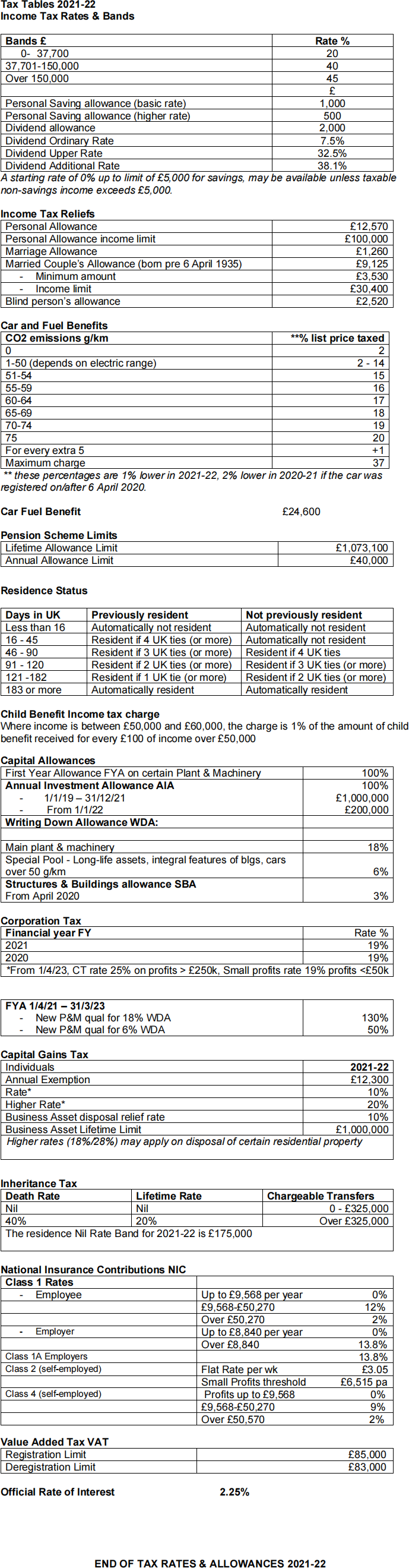

Ben is UK resident for tax purposes. Ben works for an IT firm, Chip Ltd, a company registered in the UK. He is a director of the company and earns a salary of £49,500 per annum which is paid monthly (£4,125 per month before tax). Ben is also provided with a company car and diesel for the car. The car cost the company £25,000 when first provided. It has a CO2 emission rating of 157g/km. All his fuel costs are paid for by the company. He is also provided with a free parking space in a public car park situated across the road from the office. The cost to his employer is £950 per annum.

On 6 April 2019 Ben was provided, by his employer, with the use of a home cinema system which cost £8,500. On 6 April 2021 he purchased the home cinema system from his employer for £1,500 even though the market value was £2,400.

Ben is provided with non-job-related accommodation by his employer, which the

employer purchased 35 years ago at a cost of £72,000. The property has an annual

value of £2,600 and had a market value of £245,000 when first made available 8 years ago. He pays £250 per month to his employer to live in the property.

In June 2021, Ben received a bonus of £28,000 for the successful completion of a large project. He wants to make the most of the money he has received and has mentioned a tax efficient investment; Seed Enterprise Investment Scheme (SEIS). As an alternative to investment, Ben is also considering making payments into a personal pension scheme. He has not previously contributed to any pension scheme.

Required:

(a) Calculate Ben’s employment income for taxation purposes and the national

insurance contributions payable by Ben and by his employer, Chip Ltd, in respect of the pay and benefits he receives in the 2021/22 tax year. Specify who will pay each of the amounts calculated. (You should ignore the £4,000 employer’s allowance available against Class 1 Secondary NICs.) (18 marks)

(b) (i) Advise Ben of the income tax relief available in respect of investments into

SEIS, outlining briefly how the relief is obtained and the maximum amount of relief available in a tax year. (You are not required to discuss any of the qualifying company conditions). (4 marks)

(ii) Advise Ben of the maximum amount of gross pension contributions he could contribute into a pension scheme in 2021/22, obtain tax relief and identify

why Ben may not want to contribute the maximum amount possible. (You

should assume that Ben has sufficient other income to maintain his standard of living regardless of the amount he contributes to a pension). (3 marks) [Total 25 marks]

SECTION A – YOU MUST ANSWER ALL QUESTIONS IN THIS SECTION

QUESTION 2.

Sean runs his own stationery supply business in Belfast. He started to trade on 1 June 2021, and he is not yet VAT registered. His taxable supplies (excluding VAT) for the first ten months are estimated as follows:

|

|

£ |

|

June |

5,800 |

|

July |

8,600 |

|

August |

12,300 |

|

September |

15,300 |

|

October |

12,250 |

|

November |

15,400 |

|

December |

16,600 |

|

January |

12,100 |

|

February |

13,200 |

|

March |

13,500 |

Notes:

1. In April 2021 Sean purchased a van from a dealership in Ballymena for £5,000 (VAT inclusive price) to be used solely for stationery deliveries to customers.

2. In May 2021 Sean decided that he should get some legal and accounting advice in relation to the business. He spent £750 plus VAT. He anticipates having to pay £200 plus VAT in December 2021 for accounts preparation work.

Required:

a) Advise Sean when he will have to register compulsorily for VAT and from what date he will have to start charging VAT. (5 marks)

b) Sean is aware that if he does not register by the due date, he may be subject to a late registration penalty. Identify two factors that will influence the amount of the penalty. (2 marks)

c) If Sean registers for VAT when it is compulsory to do so, explain whether he can

reclaim input VAT in respect of the items outlined in notes 1 and 2 above. Give reasons for your answer. (3 marks)

d) State two advantages and two disadvantages of registering early for VAT. (2 marks)

e) With specific reference to notes 1 and 2 above, why might Sean want to register early for VAT? (3 marks)

[Total 15 marks]

SECTION A – YOU MUST ANSWER ALL QUESTIONS IN THIS SECTION

QUESTION 3.

Tutored Ltd is a limited company which provides tutoring for accountancy examinations.

The company prepares accounts to Year ended 31 December 2021.

Profit and Loss Account year ended 31 December 2021

|

|

Note |

£ |

£ |

|

Gross profit |

|

|

180,000 |

|

Less: Costs |

|

|

|

|

Wages |

1 |

64,000 |

|

|

Redundancy |

2 |

6,875 |

|

|

Rent |

|

12,000 |

|

|

Rates |

|

1,825 |

|

|

Motor expenses |

3 |

7,200 |

|

|

Stationery |

|

748 |

|

|

Insurance (re: premises) |

|

820 |

|

|

Light, heat, electric |

|

1,357 |

|

|

Legal fees |

4 |

2,100 |

|

|

Accountancy |

|

650 |

|

|

Depreciation |

|

1,500 |

|

|

Loss on disposal of fixed assets |

|

1,250 |

|

|

Loss on capital investments |

|

45,000 |

|

|

Sundry expenses |

5 |

3,300 |

|

|

Total Costs |

|

|

148,625 31,375 |

|

Income from Property |

6 |

|

15,000 |

|

Profit on disposal of property |

6 |

|

140,000 |

|

Profit for year |

|

|

186,375 |

|

Notes: |

|

|

|

1. This reflects wages paid to the company’s staff.

2. Statutory redundancy of £2,500 was paid to one employee on the loss of her job. An additional amount of £4,375 was also paid to the same employee in respect of redundancy.

3. Motor expenses includes the following:

|

|

£ |

|

Petrol for car used by a director |

5,400 |

|

Other motor expenses |

1,800 |

|

|

7,200 |

4. Legal fees include the following:

|

|

£ |

|

Recovery of bad debts |

600 |

|

Advice re: potential sale of the company |

1,500 |

|

|

2,100 |

5. The following amounts are included in sundry expenses:

|

|

£ |

|

Fee to advertise |

850 |

|

Bad debt write-off regarding a specific college who has gone into administration |

225 |

|

Interest on late payment of VAT |

30 |

|

Insurance for car |

250 |

|

Insurance for office |

300 |

|

New “state of the art” software for online tutorials |

1,500 |

|

Staff Christmas dinner |

65 |

|

Sundry |

80 |

|

|

3,300 |

6. Income from Property

During the year Tutored Ltd disposed of one of its rental properties. The property

had been acquired in February 2001, for £50,000. The property was extended in

April 2003 at a cost of £26,000. The property was sold for £216,000 in August 2021 and Tutored Ltd incurred selling fees of £4,000. Indexation allowance is £380.

7. Capital Allowances

The tax written down value of the main pool of Tutored Ltd Ltd was £86,559 as at 1 January 2021. On 1 March 2021, the company paid £38,000 for a new petrol car (CO2 = 199kg/km) for one of the director’s use. In May 2021, new computers were purchased for £26,000 replacing old equipment which was sold for £10,000.

Tutored Ltd had a trade loss brought forward as at 1 January 2021 of £26,000 which arose in the previous year.

Required:

a) Calculate Tutored Ltd’s corporation tax liability for the year ended 31 December 2021. (25 marks)

b) The company is considering expanding its services into the market for tutoring school examinations and hiring additional staff. The managing director has asked for advice on how a company can obtain tax relief for Research & Development and whether Tutored Ltd would qualify. (5 marks) [Total 30 marks]

SECTION B You must Answer TWO questions out of THREE

Question 4

Grainne has taxable income for 2021/22 of £24,000. In addition, she has made the following disposals during the year:

. Sold 2,000 shares in Alpha Plc to her brother for £7 each when the market value was £10.00 each. She had purchased 4,800 shares for £9,000 in June 2010. In March 2012 there was a 1:4 rights issue at £5.00 per share. Grainne took up all of her rights.

. Sold a painting for £25,900 (original cost £5,100 in 2006).

. Sold a vintage car for £13,000 (original cost £6,000 in 2007)

. Sold 10 acres of land for £100,000. She had bought 30 acres in 2006 for £80,000 and the value of the remaining 20 acres is £170,000.

Required:

(a) Calculate the capital gains tax payable by Grainne for 2021/22 and state when it must be paid by. (12 marks)

(b) Define the term ‘Business Asset Disposal Relief’ and outline when it is available for taxpayers to claim to reduce their CGT liability (3 marks) [Total 15 marks]

Question 5

(a) Ryan commences trading on 1 January 2021 and chooses 30 June as his annual

accounting date. His first accounts are made up for the 18 months to 30 June 2022 and show an adjusted trading profit of £29,500.

Compute Ryan’s trading income for the first 3 tax years and calculate the amount of any overlap profits. (5 marks)

(b) The G7 group of the wealthiest countries in the world have suggested a global minimum rate of corporation tax of 15% in June 2020.

Describe why this suggestion has been considered necessary by the global community.

[Your answer should include reference to examples of academic articles and contemporary cases]

(10 marks) [Total 15 marks]

Question 6

James died on 10 March 2022 leaving a surviving spouse and daughter. James’s estate at death comprised the following assets and liabilities:

House (half share, jointly owned with his wife) £200,000

Cash £434,000

Personal chattels £50,000

Allowable debts and funeral expenses £30,000

In his will James left £5,000 to the Red Cross (a registered charity), his share of the house to his wife and the rest of his estate to his daughter.

James had made only one gross chargeable transfer during his life in May 2017 of £90,000.

Required:

(a) Calculate the Inheritance Tax payable as a result of James’s death. (12 marks)

(b) Describe what is meant by the term ‘Gift with Reservation’ . (3 marks) [Total 15 marks]

2023-08-10