ACCFIN5008P Corporate social responsibility and firm default risk: Evidence from Chinese market

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Research Proposal

Title: Corporate social responsibility and firm default risk: Evidence from Chinese market

1. Introduction

1.1 Research question

In this paper, I attempt to investigate whether and how corporate social responsibility would influence firm possibility of default in real estate Industry in Chinese market.

1.2 Background and motivation for research question

Corporate social responsibility (CSR) has gained significant attention in recent years as companies recognize the importance of sustainable development and meeting the needs and interests of stakeholders beyond shareholders. As globalization continues to advance, businesses are prioritizing CSR activities as a mean to fulfill their social and environmental obligations. At the same time, as global economic development and competition intensify, strengthening social responsibility can help companies establish a good social image, maintain good relationships with financial institutions, and reduce related uncertainties and risks. Over the past few years, default risks in developing countries have continued to increase. As one of the largest developing countries in the world and with prominent default risks in its real estate industry, China is highly representative. Therefore, this article chooses the real estate industry in the Chinese market as the main research object.

1.3 Contributions

In the past few decades, CSR has gained growing attention from both academic researchers and business management. Previous studies have shown that companies can effectively improve their performance by building a strong corporate image and reputation through social responsibility activities. However, there has been little research on the relationship between CSR and corporate risk factors, particularly default risk. This study fills this gap and reveals a negative correlation between CSR and default probability.

2. Literature review

A review of the literature is conducted for three parts: the concept of the CSR, the concept of default risk, and previous literature on the relationship between CSR and firm default risk.

The paper hypothesizes that CSR is negatively related to corporate default risk.

3. Methodology

3.1 Data and sample

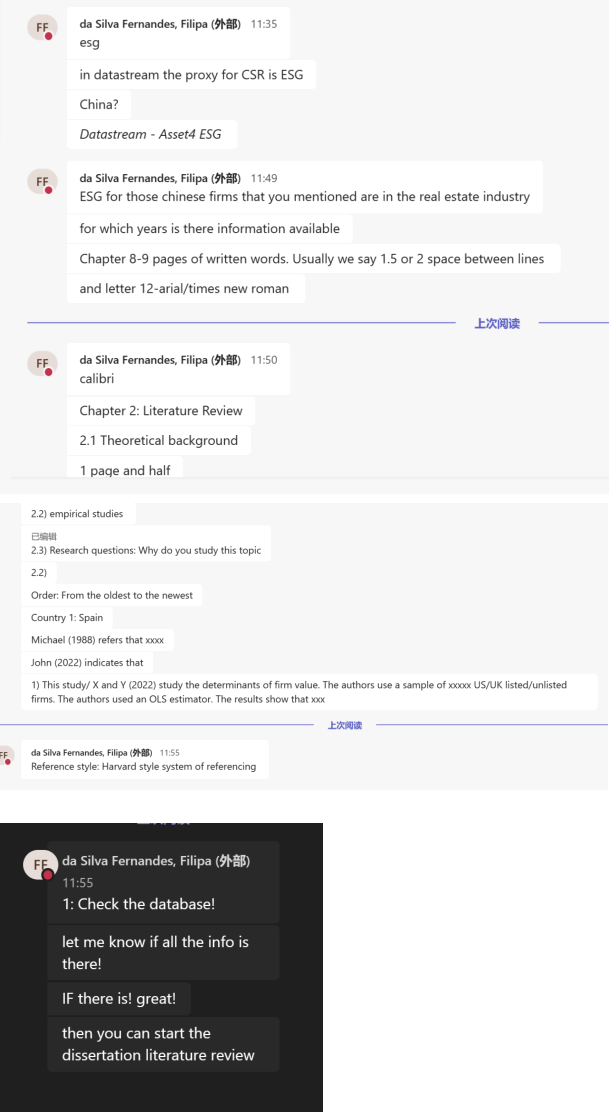

The sample consisted of 100-200 Chinese real estate public companies listed in A-share, covering the period 2017-2021. The data is available from database such as Eikon Datastream etc.

3.2 Main variables

The primary variable that the study focuses on is the default risk of the firm, which is the dependent variable. By looking at previous academic research, this paper decided to use the z-score model proposed by Altman (1968) to measure default risk. The model predicts the probability of default of a firm by using accessible historical accounting data. In detail, Calculation of Altman's z-score involves the following formula:

Z=1.2X1 + 1.4X2 + 3.3X3 + 0.64X4 + 1.05X5

(Z is the overall index that represents the firm default risk, X1=working capital/total assets, X2=retained earnings/total assets, X3=the earnings before interest and taxes/total assets, X4=market value of equity/market value of total liabilities, X5=sales/total assets)

Corporate social responsibility (CSR) is the primary independent variable that the study focuses on. The CSR for the sample is obtained from the Eikon Datastream database of CSR scores.

3.3 Control variables

In this paper, several firm-level factors that may influence firm possibility of default, such as firm size, debt ratio, market-to-book value are considered as control variables.

3.4 Econometric model

The panel data regression model is:

PDit = β0 + β1CSRit + β2 SIZEit + β3 LEVit + β4 MTBit + εit

(PDit is the firm probability of default measured by Altman’s z-score, CSRit is the independent variable measured by CSR score, SIZEit is measured as the logarithm of total assets; LEVit is the ratio of long-term debt to total assets, MTBit is the market-to-book ratio).

4. Initial bibliography

Badayi, S.A., Matemilola, B.T., A.N, B. & Wei Theng, L. 2021, "Does corporate social responsibility influence firm probability of default?", International journal of finance and economics, vol. 26, no. 3, pp. 3377-3395.

Shahrour, M.H., Girerd-Potin, I. & Taramasco, O. 2021, "Corporate social responsibility and firm default risk in the Eurozone: a market-based approach", Managerial finance, vol. 47, no. 7, pp. 975-997.

2023-08-08