ACW1100 INTRODUCTION TO FINANCIAL ACCOUNTING – PAPER 1 Semester Two 2017

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Semester Two 2017

Examination Period

Faculty of Business and Economics

Department of Accounting

ACW1100

INTRODUCTION TO FINANCIAL ACCOUNTING – PAPER 1

2 hours writing time

10 minutes

Question 1

Sheeran Ltd’s financial year ends on June 30 and the company values its assets using the fair value basis in accordance with AASB 116 Property, Plant and Equipment.

On July 1, 2015, Sheeran Ltd acquires a building at a cost of $185,000 for cash. The company uses the straight‐line method of depreciation and the useful life of the building is 10 years with zero residual value.

On June 30, 2017, the fair value and recoverable amount of the building was estimated at $150,000 and $130,000 respectively.

Required:

(a) Prepare the necessary journal entries of Sheeran Ltd for years 2015 to 2017 including annual depreciation.

Show all your workings clearly. Narrations are NOT required.

(b) Assume Sheeran Ltd is now considering valuing their building on the cost basis in accordance with AASB 136 Impairment of Assets. The accountant wants to determine the impact on the financial statements if this alternative treatment is applied in year 2016.

On June 30, 2016, the fair value and value in use of the building was estimated at $155,000 and $160,000 respectively.

Prepare the necessary journal entries on June 30, 2016 including annual depreciation for this alternative treatment.

Show all your workings clearly. Narrations are NOT required.

(10 + 6 = 16 marks)

Question 2

(a) An extract of account balances from the ledger of SurePass Ltd for the year ended June 30, 2017 is given below:

Accounts Dr ($) Cr ($)

Accounts receivable 204,000

Allowance for doubtful debts (unadjusted balance) 6,500

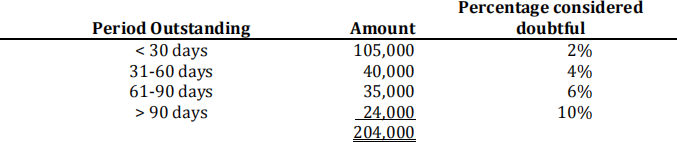

The aging analysis of accounts receivable on 30 June 2017 is as follow:

After examining the balances of accounts receivable, SurePass Ltd decided to write off an invoice owed from James Enterprise of $6,000 which was dated May 15, 2017. The showroom of James Enterprise was found closed down and the owner James disappeared.

Required:

(i) Construct the ‘Allowance for Doubtful Debts’ account for SurePass Ltd as at June 30, 2017. Show workings.

(ii) Do you think the unadjusted balance of Allowance for Doubtful Debts of $6,500 as at June 30, 2017 is adequate for bad debts that turned bad during the financial year? Give a reason for your answer.

(b) Tomorrow Fashion received a sum of $1,500 in advance from a customer, Jeanne, in January 2017 for a set of costumes. The costs of material and labour to complete the costumes amounted to $650. The designer completed and delivered the costume set to the customer in the month of April 2017.

Required:

Explain whether you would recognise $1,500 as revenue in the statement of profit or loss of Tomorrow Fashion for the month ended April 30, 2017. Refer to the recognition criteria outlined in the AASB118 Revenue to support your answer.

([8 +1] + 6 = 15 marks)

Question 3

(a) On May 14, 2017, Pink Diamond Ltd paid $96,000 to a radio station for a 3 months advertising campaign to commence on June 1, 2017. Pink Diamond Ltd used the

ASSET approach to record the transaction.

Required:

(i) Record the above transaction that occurred in May 2017.

(ii) Prepare the necessary adjusting journal entries for the year ended June 30, 2017.

Ignore narrations.

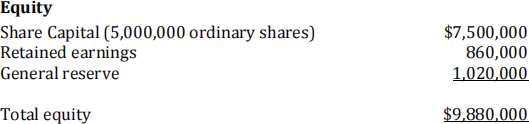

(b) Premium Ltd had the following equity balances as at July 1, 2016:

An interim dividend of 5 cents per share for the 2016/2017 financial year was

declared and paid on the January 25, 2017. A final dividend of 10 cents per share for the 2016/2017 financial year had been declared on June 30, 2017 and was paid on September 20, 2017.

Profit after income tax for the year ended June 30, 2017 was $700,400.

An increase of $100,000 in the general reserve was made on the same date.

Required:

Prepare a statement of changes in equity for the year ended June 30, 2017. Show the movement for each of the equity items.

Question 3 (cont’d)

(c) Your uncle Mr. Carson is the sole owner of ACW11 Enterprise. Today he is very pleased to share his joy with you:

“I am really happy to have had Joseph as my accountant for the past three years. He performs work in four areas of the business: Accounts Receivable (customer billing), Accounts Payable (supplier invoices), Warehousing (receipts and delivery of inventory) and the General Ledger. He also suggests that I add him as the second signatory whereby he can sign cheques without me so that I can enjoy my overseas trips with few interruptions. Since he joined, he rarely takes annual leave. It is good that I don’t need to keep on checking on him as long as the company still makes money. He is truly a person I can rely on.”

You learn internal control in your ‘Introduction to Financial Accounting’ course and you sense that something is not right.

Required:

Identify two principles of internal control that you feel maybe violated in ACW11 Enterprise and provide an example of each principle identified.

([2+2] + 8 + 6= 18 marks)

Question 4

(a) Below is the extract of the mortgage schedule of Gentleman Ltd for a $100,000 loan obtained in Jan 2016 to purchase a property that has been offered as a security for the loan. Interest payable is 12% per annum with quarterly payment of $10,000.

Required:

(i) What portion of the mortgage liability should be classified as a current liability on June 30, 2016? Show your workings.

(ii) What portion of the mortgage liability should be classified as a non‐current liability on June 30, 2016?

(iii) Why is important to classify liabilities as current and non‐current? Explain from the perspective of decision making.

Question 4 (cont’d)

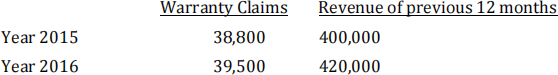

(b) Ruler Ltd offers a 12‐month warranty to its customers with the electrical appliances that it sells. Warranty liabilities are estimated at 12% of sales for the previous 12 months.

On July 1, 2016, the balance of the Warranty Provision account was $50,000. During the year ended June 30, 2017, warranty repair cost is $40,500, of which $24,000 was for inventory parts and $16,500 was for wages.

Revenue from the sale of electrical appliances in the current financial year is $600,000. There have been no changes in suppliers, product quality or prices.

Required:

(i) Construct the Warranty Provision account.

(ii) Below is the claim history of Ruler Ltd for the past two years:

Do you think the warranty provisions made are adequate to cover warranty claims for years from 2015 to 2017? Give reason(s) for your answer.

What is the recommendation you would suggest to the management of Ruler Ltd on their warranty policy?

([2+1+2] + [6 + 4] = 15 marks)

Question 5

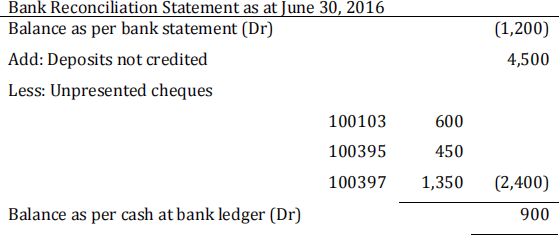

You joined Andrew & Co as trainee on 10 August 2016. The bank statement for the month

ended 31 July 2016 was just printed out by Mr. Andrew, which shows a credit balance of $3,734. He has also given you the Bank Reconciliation Statement as at 30 June 2016 and both the cash payment journal and cash receipts journal. The total in the cash receipts journal and cash payments journal of the month of July 2016 is $27,289 and $26,400 respectively.

After checking the records, you find the following differences:

(1) Entries in the cash journals of July that do not appear in the July bank statement are:

‐ Cheque 100415 for $4,430

‐ Deposit not yet credited to the bank account is $4,090

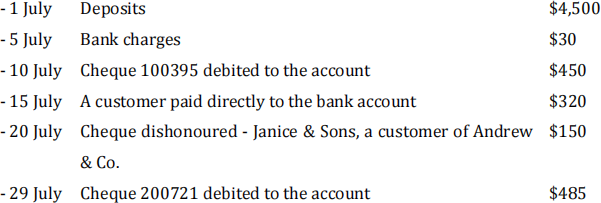

(2) Entries in the July bank statement that are not recorded in the cash journals of July are:

Question 5 (cont’d)

Cheque 200721 did not coincide with the cheque numbering on the business’s current cheque book, this matter was referred to the bank manager for investigation. The bank acknowledged on 2 August that this cheque has been wrongly debited to account of Andrew & Co. The bank will make a correction to the August bank statement.

(3) Cheque 100103 of $600 was issued to a supplier on January 10, 2016. On August 3, the supplier informed Mr Andrew that he had misplaced the cheque and requested a new cheque. Cheque 100103 was cancelled and reissued on August 4.

Required:

(a) Determine the adjusted cash at bank account as at July 31, 2016.

(b) Prepare the monthly bank reconciliation statement as at July 31, 2016.

(10 + 10 =20 marks)

Question 6

(a) Good Sound sells DVDs of classical music and its financial year ends on June 30. The business uses a perpetual inventory system and FIFO inventory cost flow method.

On June 1, 2017, Good Sound has an inventory of 2,000 units of DVDs at a cost of $15 each.

During the month of June, the following transactions occurred:

June 8 – Purchased 1,400 units of DVDs at $16 each on credit.

June 18 – Sold 1,500 units of DVDs for cash at $50 each.

June 25 – Sold 1,200 units of DVDs on credit at $55 each.

June 30 – A physical stock count revealed that there were 680 units of DVDs left in the warehouse.

Required:

(i) Construct the ‘Inventory’ account for the month of June 2017.

(ii) Construct the ‘Cost of Goods Sold’ account for DVDs as at June 30, 2017.

(b) The following data are available for the ending inventory of Proud Stationery as at June 30, 2017:

(i) What should be the reported value of total ending inventory as at June 30, 2017? Show all workings.

(ii) Prepare the journal entries to record the write‐off of inventory value. Show workings and ignore narrations.

([6 + 3] + [4 + 3] = 16 marks)

2023-08-05