SMM173 Applied Appraisal

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

MSc Real Estate

Alternative Timed Assessment

SMM173

Applied Appraisal

April/May 2022

2hrs 45mins

SECTION A

Answer all questions, each answer carries 10 marks.

You must start each answer on a new page.

Use calculation inputs correct to 4 decimal places. Show all steps in your calculations.

Question 1

With the use of real estate valuation examples, appraise what the following three terms mean in relation to information contained in RICS Valuation Global Standards (31 January 2022):

1. Price.

2. Value

3. Worth (10 Marks)

Question 2

With the use of worked examples, define, compare and contrast hope and synergistic value. You may wish to refer to RICS Valuation Global Standards (2022). (10 Marks)

Question 3

Appraise why a hereditament would NOT have a Rateable Value ascribed to it and thus no liability to business rates. (10 Marks)

Question 4

The compulsory purchase arena has seen a progressive approach to compensating claimants where NO land is taken (acquired). With the use of valuation examples, evaluate how valuers would approach these types of claims. (10 Marks)

Question 5

When undertaking valuations by comparison, property measurement is often key to the process where a unit rate is applied to a measured area. Compare and contrast the 3 main bases of measurement used by commercial property practitioners in the context of why these adopted approaches are widely used in the UK. You may wish to support your answers with simple sketches. (10 Marks)

SECTION B

Answer ONE question from four. Each answer is graded at 50 marks overall.

Use calculation inputs correct to 4 decimal places. Show all steps in your calculations and ensure all ASSUMPTIONS are clearly stated and support your workings.

Question 6

You are advising a developer who is negotiating to purchase the freehold of a site located on a town centre bypass. The site has planning permission to build 60,000 sq. ft. of offices (Gross Internal Area, GIA) although it is currently occupied by

dilapidated and vacant storage buildings.

You understand from the Local Planning Authority (LPA) that a payment of £275,000 will be necessary to fund improvements to the highway under section 278 Highways Act 1980. In addition, a Community Infrastructure Level (CIL) payment of £155,000 will become due on implementing the planning application. You can assume construction costs are £170.00 psf GIA and the current market rent of £37.00 psf based on a net internal area (NIA).

Marketing Agents are likely to agree a direct cost of £50,000 ex. VAT for marketing of the proposed development, whilst agent’s fees for selling are 2% and legal costs at 0.5% (all ex. VAT). The construction period is assumed to be 12 months.

There is an issue over a restrictive covenant which requires removal from the

freehold title. This could delay completion of the sale by up to 12 months and involve legal fees approaching £25,000.

(a) In this question, assume that the title issue is resolved successfully on the basis as noted above (12 months’ time period and legal costs of £25,000). Making any other appropriate assumptions and stating explanations as to the inputs you have used, carry out a residual valuation of the site

assuming your client (the developer) will purchase the site with a minimum of 15% profit on Gross Development Value. (35 marks)

(b) If resolution of the legal title issue might stand a 40% chance of failure, recast your valuation under part (a) to reflect this downside with an appropriate discursive appraisal. (15 marks)

(Total: 50 marks)

Question 7

(a) In respect of assets which are valued using the profits method, define the terms Reasonably Efficient Operator (REO), Fair Maintainable Operating Profit (FMOP) and Exceptional Profits or Losses, comparing and contrasting these terms against the actual accounting figures a trading entity may produce. (10 marks)

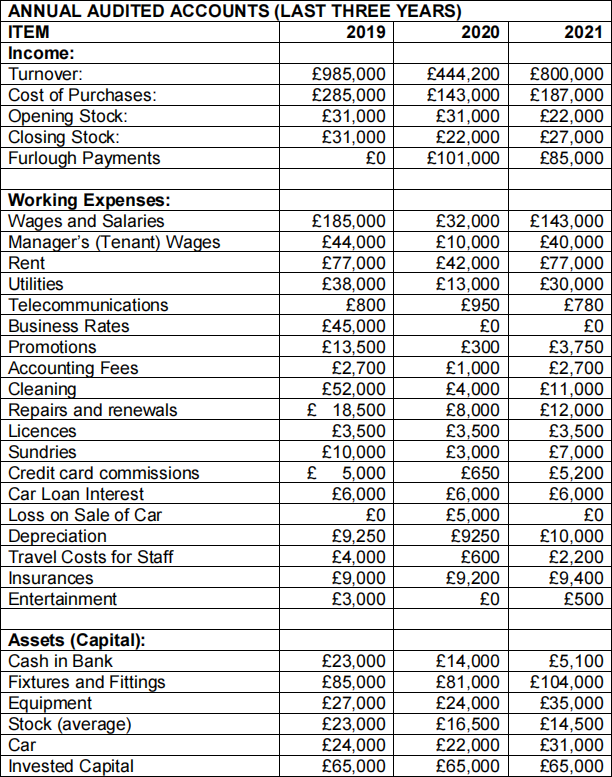

(b) Stating any relevant assumptions and attaching an explanation as to how you have effected your calculation, derive the Fair Value of the following asset which is held by a private investor (freeholder) based on the

undernoted annual trade figures. The trading pattern for the establishment was heavily curtailed in 2020 with a strong continuing recovery in 2021

during the COVID-19 pandemic lockdown periods. You may assume a market yield of 6% and a return on capital employed of 9%. (40 marks)

Property: The Anvil Public House

Purpose of Valuation: Accounting Purposes

Basis of Value: Fair Value

(Total: 50 marks)

Question 8

Using appropriate assumptions and annotated comments to your valuations, prepare the three undernoted valuation scenarios in the following property interests where the freehold yield for a sound covenant on a rack rented property is 6% and for short leasehold interests,10% (no tax applied).

The retail premises are held on a 10-year protected business tenancy with 1 year remaining. The lease is on FRI terms with the rent last reviewed 4 years ago to full rental value at £200,000 pa. The current Market Rent based on a 5-year FRI lease is £230,000 pa with 6 months’ rental incentive. The tenant’s covenant strength indicator shows a low risk of business failure and a net asset value in excess of £35 million.

Market knowledge suggests that the property could take 6 months to re-let. The Rateable Value of the premises is £160,000.

The landlord has just served notice to determine the lease in 12 months’ time on the basis he wishes to upgrade the premises at a cost of £1.0 million over 6 months upon vacation. He anticipates that the property could then re-let at £325,000 pa with 3 months’ rent-free incentive. The marketing would be carried out whilst the works are being carried out.

Value the following interests:

(a) Market Value of the freehold interest as existing (without improvements). (15 marks)

(b) Market Value of the freehold interest, special assumption all upgrade works are to be completed. (15 marks)

(c) Market Value of the leasehold interest on the basis the landlord regains possession at the end of the fixed term.(20 marks)

(Total: 50 Marks)

Question 9

A retail warehouse extending to 5,000 sq. m (Gross Internal Area) has been let on a 15-year full repairing and insuring (FRI) lease with 5-yearly upward only rent reviews and with a tenant’s break option at the end of year 10. The passing rent is based off £140 per sq. m (psm) with comparable evidence showing a net effective rent of £171 psm. The rent is due for its first review in year 5 in 1 year and 5 months’ time. Market evidence shows the freehold investment if fully rented would sell off a yield of 6.25% with a mark-up of 2.75% over the freehold yield when valuing the leasehold interest.

The landlord (ABC Ltd) has agreed with the tenant (Sonjay Ltd) to surrender the current lease and look to a re-granting situation on the basis of a new 15-year FRI lease without break and 5-yearly upward only reviews.

You may assume all benefits of any renewal agreement are split on a 50:50 basis and ignore the inclusion of purchaser’s costs.

(a) Calculate the market rent which the parties could agree if the existing lease was surrendered and the new lease granted. (20 marks)

(b) Calculate the premium payment the landlord would pay to the tenant if the surrender and regrant deal transacted. (15 marks)

(c) Calculate the geared rent percentage over the life of the new 15-year lease if the parties agreed the surrender and regrant. (15 marks)

(Total: 50 Marks)

2023-08-05