ACW1100 INTRODUCTION TO FINANCIAL ACCOUNTING - PAPER 1 Semester One 2018

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Semester One 2018

Examination Period

Faculty of Business and Economics

ACW1100

INTRODUCTION TO FINANCIAL ACCOUNTING - PAPER 1

2 hours writing time

10 minutes

Question 1

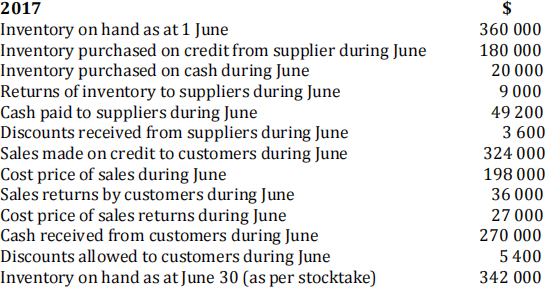

a) Flora & Co is a retailer and its financial year ends on June 30. The following information relates to the cost of goods sold in the month of June 2017:

Required:

(i) Show the ‘Cost of Goods Sold’ (COGS) ledger account for June 2017 using the Perpetual Inventory method of accounting for inventory.

(ii) Show the ‘Cost of Goods Sold’ (COGS) ledger account for June 2017 using the Periodic Inventory method of accounting for inventory.

(iii) Compare the COGS of June 2017 arrived at using Perpetual Inventory method with the COGS derived using the Periodic Inventory method. What is the reason for the difference? Show all your workings clearly.

Question 1 (con’t)

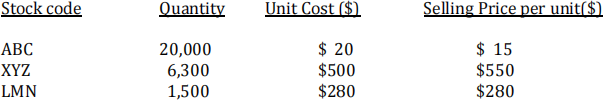

b) The following data are available for the ending inventory of Smart Stationery as at June 30, 2017:

(i) What should be the reported value of total ending inventory as at June 30, 2017? Show all your workings clearly.

(ii) Prepare the journal entries to record the write-off of inventory value. Show all your workings clearly and ignore narrations.

([3 + 5 + 4] + [5 + 3] = 20 marks)

Question 2

(a) Future Fashion received a sum of $3,500 in advance from a customer, Nicholas, in

January 2018 for a set of costumes. The costs of material and labour to complete the costumes amounted to $2,000. The designer completed and delivered the costume set to the customer in the month of May 2018.

Required:

Explain whether you would recognise $3,500 as revenue in the statement of profit or loss of Future Fashion for the year ended April 30, 2018.

Refer to the recognition criteria outlined in the AASB118 Revenue to support your answer.

![]()

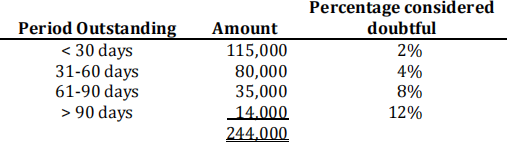

(b) An extract of account balances from the ledger of Winwin Ltd for the year ended June 30, 2017 is given below:

Accounts Dr ($) Cr ($)

Accounts receivable 244,000

Allowance for doubtful debts (unadjusted balance) 7,500

The aging analysis of accounts receivable on 30 June 2017 is as follow:

After examining the balances of accounts receivable, it was decided to write off

further debts from Zachary & Co of $8,000, which was dated March 15, 2017. The owner Zachary cannot be traced for payment.

Required:

(i) Construct the ‘Allowance for Doubtful Debts’ account for Winwin Ltd as at June 30, 2017.

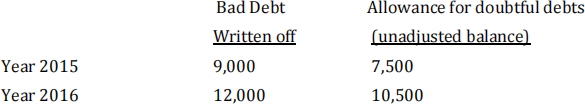

(ii) Below is the bad debt written off history of Winwin Ltd for the past two years:

Do you think the allowance for doubtful debts made are adequate to cover bad debt written off for years from 2015 to 2017? Give reason(s) for your answer. Show all your workings.

What is the recommendation you would suggest to the management of Winwin Ltd on their bad debts policy?

(10 + [6 + 4] = 20 marks)

Question 3

Chill Ltd’s financial year ends on June 30 and commenced its business from July 1, 2015.

The accountant, Ms Worry, is uncertain as to whether to value the company assets using the cost or revaluation basis in accordance with AASB 116 Property, Plant and Equipment.

She wishes to compare the impact to the profit before tax for the year ending on June 30, 2016 and June 30, 2017 using both methods for a new machine.

Chill Ltd acquires a machine at a cost of $925,000 for cash on July 1, 2015. The company

uses the straight-line method of depreciation and the useful life of the machinery is 5 years with zero residual value.

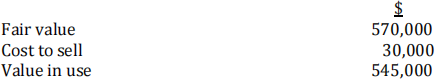

Ms Worry estimates the following value as at June 30, 2017:

Required:

a) Prepare the necessary journal entries of Chill Ltd for financial years 2016 and 2017 including annual depreciation.

(i) Cost basis

(ii) Fair Value basis

Show all your workings clearly. Narrations are NOT required.

b) Compare the impact of both valuation methods on the profit before tax of Chill Ltd for both financial years 2016 and 2017.

Show all your workings clearly.

c) Assuming you are the Chief Financial Officer of Chill Ltd and Ms Worry has presented to you the results in (b).

Which method would you prefer to use to value the machinery and why? Give one reason to support your decision.

([7 + 7] + 4 + 2 = 20 marks)

Question 4

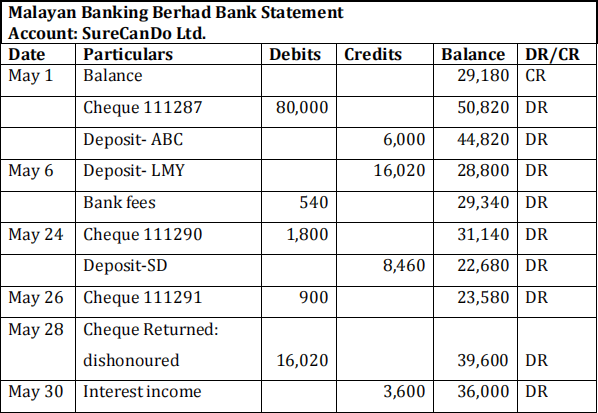

SureCanDo Ltd prepares a bank reconciliation once a month. The following information relates to the preparation of bank reconciliation for the month of May 2018. All entries to the Cash Receipts Journal and Cash Payment Journal are correctly made.

Question 4 (con’t)

Required

(a) Determine the adjusted ‘Cash at Malayan Banking Berhad’ account as at May 31, 2018.

(b) Prepare the monthly bank reconciliation statement as at May 31, 2018.

(10 + 10 = 20 marks)

Question 5

(a) Sandy Ltd has the following equity accounts as at July 1, 2015:

|

Share Capital (100,000 shares) |

$500,000 |

|

Retained Earnings |

48,000 |

During the year ended June 30, 2017, a final dividend of $0.15 per share was declared. The final dividend is paid on August 1, 2017.

Required:

Prepare the necessary journal entries for the above transactions (narrations are not required).

Question 5 (con’t)

(b) John Ltd’s financial year ends on June 30. On January 1, 2017, John Ltd issues a $100,000, 12%, 6-month note to Hong Leong Bank to borrow $100,000 from the bank. The note matures on July 1, 2017.

Required:

(i) Prepare the journal entry to record the issuance of the above note on January 1, 2017. Ignore narrations.

(ii) Prepare the necessary adjusting journal entries on June 30, 2017. Show your workings and ignore narrations.

(iii) Prepare the journal entry to record the settlement of the note inclusive of

interest expense at maturity on July 1, 2017. Ignore narrations.

(c) Jimmy Ltd offers a 12-month warranty to its customers with the electrical

appliances that it sells. Warranty liabilities are estimated at 10% of sales for the previous 12 months.

On July 1, 2016, the balance of the Warranty Provision account was $20,000. During the year ended June 30, 2017, warranty repair cost is $25,000, of which $18,000 was for inventory parts and $7,000 was for wages.

Revenue from the sale of electrical appliances in the current financial year is $180,000. There have been no changes in suppliers, product quality or prices.

Required:

(i) Construct the Warranty Provision account.

(ii) Do you think the warranty provision of $20,000 as at July 1, 2016 is adequate to cover warranty claims made during the financial year ended June 30,

2017? Give a reason for your answer.

([2+2] + [2 + 2 + 3] + [7+2] = 20 marks)

2023-08-05