ACC 440 Apple Tax Case

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ACC 440 Apple Tax Case:

ProfOrpurt

. Students should use this document to answer case questions.

. This online case version was created from: “Apple’s taxing times: An analysis of its

recent tax strategies and disclosures” by Steven F. Orpurt, PhD, Arizona State University and Stephen Brown, PhD, University of Maryland. Originally published: Journal of

Business Cases and Applications, April 2016, Vol 16.

INTRODUCTION

In December 2017 the Tax Cuts and Jobs Act (TCJA) was signed into law. Apple’s

September 2018 year end 10-K disclosures are explored to understand Apple’s disclosed reaction to the new tax law.

Apple, Inc. (Apple) states, “Apple believes every company has a responsibility to pay its taxes, and as the largest taxpayer in the world, Apple pays every dollar it owes in every country around the world. We’re proud of the economic contributions we make to the countries and

communities where we do business.” Yet, numerous news articles have insinuated that Apple

aggressively avoids taxes. Apple certainly is not the only multinational facing these accusations because multinational corporations seem almost synonymous with aggressive tax avoidance to

the point where companies domiciled in the British Virgin Islands, a tax haven, were the second largest investors in China, after only Hong Kong according to analysis by the Economist

magazine. Aggressive tax avoidance is perceived to be so widespread and important that the

Organization of Economic Co-operation and Development (OECD) initiated a substantial project to establish fair world-wide tax systems.1 Illustrating the acuteness of the issue, the OECD drew attention to what it called “stateless income,” that is, income earned by corporations that is not

subject to tax in any jurisdiction in the world.2

For years, U.S. corporations lobbied for the U.S. Congress to lower the corporate income tax rate (which at a top marginal rate of 35 percent was one of the highest, if not the highest, in the developed world), arguing that they cannot compete internationally in the face of such a high tax rate. With the passage of the recent 2017 Tax Cuts and Jobs Act (TCJA) the U.S. corporate tax rate is now a flat 21% and this rate started immediately after the TCJA was signed into law, effecting U.S. corporations starting January 2018.

To explore how Apple has reacted to the TCJA this case explores Apple’s disclosures

after the TCJA. Interestingly, despite headline rates of tax (35% before TCJA and 21% after),

U.S. corporations typically pay taxes at rates ranging from 12 to 18 percent. Apple, for example, was well known to have negotiated a 2 percent tax rate in Ireland and recorded almost all its non- U.S. profits there.

SUMMARY OF TCJA

Primary Source: Tax Policy Center (at www. taxpolicycenter.org)

The Tax Cuts and Jobs Act (TCJA) reduced the top corporate income tax rate from 35 percent to a flat 21 percent. It also eliminated the graduated corporate rate schedule (for which many are relieved due to its complexity).

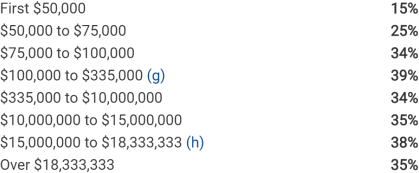

Recall the complex graduated U.S. corporate tax rate schedule, now replaced with a flat 21% tax rate:

(As a sidenote, marginal tax rates in the U.S. have been as high as 94% (world war II era) and for lengthy periods of time above 70%)

With this new 21 percent corporate rate, the U.S. falls below the average for most G7 economics and Organisation for Economic Co-operation Development (OECD) countries.

Importantly, the TCJA made substantive changes to the treatment of foreign sourced income and financial flows.

Before discussing the TCJA, recall that prior to TCJA, all income for U.S. multinational firms was taxed at the appropriate graduated U.S. tax rate, regardless of where, worldwide, it was earned. A credit was given for foreign taxes incurred. However, the tax payments to U.S. taxing authorities due on foreign-source income of foreign subsidiaries were deferred until the assets

associated with the income (e.g. cash) was repatriated, often as a dividend from the foreign

subsidiary to the U.S. parent company. As a result, unless U.S. parent companies needed direct

control the assets associated with the earnings (e.g. needed cash), they tended to leave the foreign assets generated by foreign earnings under the control of their foreign subsidiaries, thus

perpetually deferring tax payments.

This means that if a U.S. company has $100,000 worth of income from a foreign

subsidiary and $200,000 in earnings from its U.S. operations, the consolidated company would owe tax on the $300,000 (less a credit for any foreign taxes incurred on the $100,000 of foreign income). But the consolidated company would only pay tax on the foreign income of $100,000 when the U.S. parent decided to repatriate the associated assets (e.g. $100,000 of cash) to itself. Therefore, U.S. companies would owe and pay tax on the $200,000 earned from U.S. operations and most would then perpetually defer paying tax on the $100,000 foreign earnings simply by

never repatriating it.

The new TCJA law attempts to address this perpetual deferral (i.e. perceived underpayment) of tax via three main components:

First, the TCJA eliminates the tax on repatriated dividends that previously caused U.S. multinationals to perpetually defer repatriating foreign earned assets (e.g. cash).

But second, TCJA imposed a one-time tax law transition tax on past earnings of U.S.

foreign subsidiaries that had been deferred (i.e. never repatriated). However, the one-time tax

was 15.5% on cash assets and only 8% on non-cash assets. Credit was also given for foreign

income taxes already incurred (but reduced since the U.S. rate dropped from 35% to 21%). The TCJA transition tax is payable over eight years.

Third, the TCJA sets a “guardrail” imaginatively labeled “GILTI” (for Global Intangible Low Tax Income). This guardrail is a lower bound on foreign taxes incurred and paid. It is

designed to combat U.S. companies using foreign tax havens which feature extremely low tax

rates. GILTI is complicated, but essentially if a U.S. company’s foreign subsidiary earns income in a tax haven with an effective tax rate less than 13.125%, then GILTI kicks in and extra tax is owed up to the 13.125%. GILTI reduces the incentive for using extremely low tax havens but

does not appear to substantively reduce tax incentives to report earnings in low-tax non-U.S. countries.

The TCJA is complicated, and includes other guardrails, including “FDII” (Foreign- Derived Intangible Income) designed to eliminate incentives for U.S. companies to locate

intangible assets in tax havens when selling to non-U.S. markets. The TCJA also includes “BEAT” (Base Erosion Alternative Minimum Tax). Both FDII and BEAT as well as other provisions in the TCJA are interesting, but beyond the discussion in this case.

Table 1

Apple FY2018 Income Statement and Balance Sheet

Table 2

Apple FY2018 Tax Footnote

ACC 440 Apple Tax Case:

ProfOrpurt

Refer to the case document to answer the following questions.

1. Apple’s Net sales for fiscal year ended 2018 (September 29, 2018) were and from fiscal year ended 2016.

a. “$265,595 million” and “increased about 23%”

b. “$265,595 thousand” and “increased about 23%”

c. “$265,595 million” and “stayed about the same”

d. “$215,639 million” and “decreased about 19%”

2. Apple’s Gross margin is which is percent of Net sales. Likewise, Apple’s Net income is which is percent of Net sales.

a. “$101,839 million”; “38% of Net sales” and “$59,531 million”; “22% of Net sales”

b. “$101,839 thousand”; “38% of Net sales” and “$59,531 thousand”; “22% of Net sales”

c. “$84,263 million”; “39% of Net sales” and “$45,687 million”; “21% of Net sales”

d. “$84,263 thousand”; “39% of Net sales” and “$45,687 thousand”; “21% of Net sales”

3. The effective tax rate for a company is defined as income tax expense divided by pre-tax income. However, companies use different names for income tax expense with many

companies using the name “provision for income taxes” or something similar. Referring to Apple’s income statement, Apple’s effective tax rate for FY2018 is:

a. 18.3% calculated as $13,372 ÷ $72,903

b. 5.0% calculated as $13,372 ÷ $265,595

c. 21% the TCJA tax rate

d. 25.6% calculated as $15,685 ÷ $61,372

e. Not determinable from the information given.

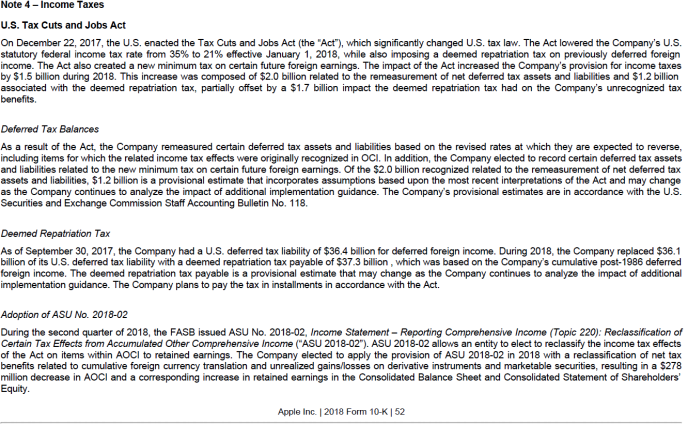

4. True or false. Apple’s fiscal year 2018 tax footnote is entitled “Note 4 – Income Taxes.” It includes four tables that all companies disclose. The first table at the start of the note is the provision for income taxes table. It sums to Apple’s Provision for income taxes

amount of $13,372 (which ties to Apple’s income statement) and is separated into

federal, state, and foreign taxes. To read the table, “Current” refers to Income tax payable and “Deferred” is the net change in deferred tax assets and liabilities. Your textbook

describes this table with Illustration 19.47 and surrounding text. Based on this table, Apple’s summarized tax journal entry for fiscal year 2018 was:

|

Dr. Income tax expense |

13,372 |

|

|

Dr. Deferred taxes, net |

32,590 |

|

|

Cr. Income tax payable |

|

45,962 |

a. True

b. False

5. Using Apple’s Note 4 – Income Taxes footnote information, specifically the provision for income tax table, we can calculate Apple’s effective tax rate for its foreign earnings for

FY2018, the first year after passage of the TCJA. Previously Apple negotiated a 2% tax rate with Ireland and then recorded almost all its non-U.S. profits in Ireland, leading to a foreign earnings effective tax rate of about 2%. However, due to pressure from the

European Union, Ireland and Apple, Apple now pays the Ireland statutory rate of 12.5%. We can compare the foreign effective tax rate to this new 12.5% rate to determine if

Apple maintained its Ireland tax strategy after the new TCJA.

Recall that the effective tax rate is income tax expense divided by pre-tax income. To

calculate Apple’s foreign earnings effective tax rate use the foreign provision for income taxes and Apple’s disclosed foreign pre-tax earnings shown immediately below the

provision for income tax table.

Based on Apple’s Note 4 Income Taxes provision for income tax table, the foreign effective rate is: 10.8%.

a. True

b. False

6. True or false. Apple’s fiscal year 2018 tax footnote is entitled “Note 4 – Income Taxes.” It includes four tables that all companies disclose. The second table is the effective tax rate table. It reconciles the expected tax based on the statutory rate (24.539% for fiscal year 2018 due to the transition from 35% to the new TCJA 21%) to the Provision for

income taxes of $13,372. In the table, the computed expected tax is $17,890. It is calculated as Income before provision for income taxes multiplied by the 24.539% statutory rate. Ignore any minor rounding.

a. True

b. False

7. Apple’s fiscal year 2018 tax footnote is entitled “Note 4 – Income Taxes.” It includes

four tables that all companies disclose. The second table is the effective tax rate table. It reconciles the expected tax based on the statutory rate (24.539% for fiscal year 2018 due to the transition from 35% to the new TCJA 21%) to the Provision for income taxes of

$13,372. In this table, the line item, “State taxes, net of federal effect” is a positive $271. State taxes:

a. Are added to the Computed expected tax of $17,890 because the computed

expected tax only includes the federal expected taxes and Apple pays state taxes in addition to federal taxes.

b. Decreases Apple’s provision for income taxes and its effective tax rate.

c. Increases Apple’s provision for income taxes but decreases its effective tax rate.

d. Not determinable from the information given.

8. True or false. Apple’s fiscal year 2018 tax footnote is entitled “Note 4 – Income Taxes.” It includes four tables that all companies disclose. The second table is the effective tax

rate table. It reconciles the expected tax based on the statutory rate (24.539% for fiscal

year 2018 due to the transition from 35% to the new TCJA 21%) to the Provision for

income taxes of $13,372. In this table, the line item, Earnings of foreign subsidiaries is

$(5,606) (a subtraction from the Computed expected tax). As a subtraction, it implies that the tax rates on foreign income are less than the U.S. statutory rate and Apple does not

expect to pay the full 21% TCJA statutory rate on these earnings.

a. True

b. False

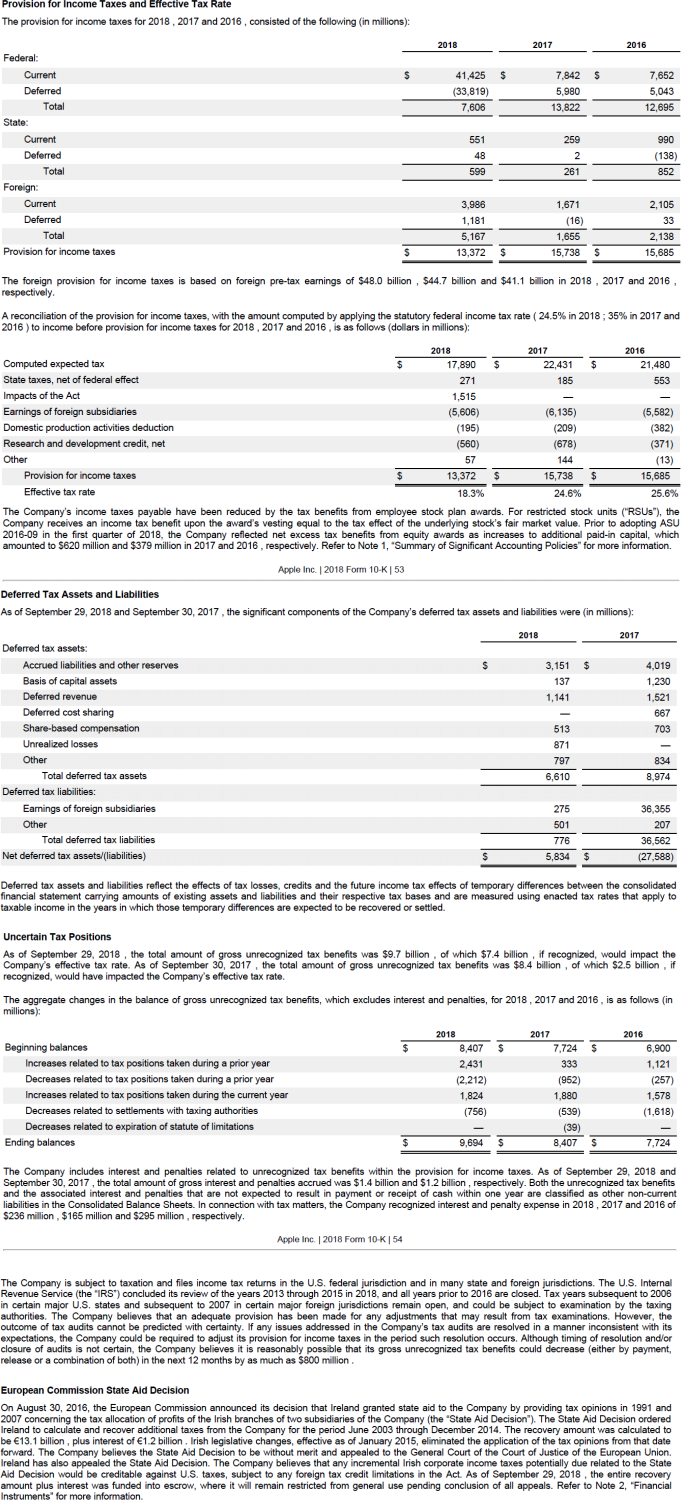

9. True or false. Apple’s fiscal year 2018 tax footnote is entitled “Note 4 – Income Taxes.” It includes four tables that all companies disclose. The third table lists Apple’s significant deferred tax assets and liabilities. The table does not disclose any valuation allowance on its deferred tax assets (DTA). This means that Apple does not expect future taxable

income.

a. True

b. False

10. Apple’s fiscal year 2018 tax footnote is entitled “Note 4 – Income Taxes.” It includes four tables that all companies disclose. The fourth (and last) table reconciles Apple’s uncertain tax positions from the beginning to end of the year. For FY2018, Apple’s

uncertain tax positions:

a. Increased

b. Decreased

2023-07-24