FINS5516 International Corporate Finance Term 2, 2023 Data Exercise

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

FINS5516 International Corporate Finance

Term 2, 2023

Data Exercise

DUE: Friday 28 July 2023, 5pm (Sydney, Australia time)

Weighting

This assessment is worth 15% of your final grade for FINS5516 - International Corporate Finance. Next to each question is the allocation of marks. There are a total of 30 marks for this assignment.

Assignment Learning Objectives

The purpose behind this assignment is to get students to:

1. apply and assess the relevance of the International Parity Conditions and Purchasing Power Parity (PPP) Theory in a practical setting,

2. think outside the textbook and homework questions framework,

3. conduct their own research,

4. using actual data and statistical methods (regression and regression analysis),

5. explore and visualize macroeconomic data and improve their familiarity with statistical tools in Microsoft Excel.

This assignment is designed to give students an insight into how economists and analysts in industry approach the topic of exchange rate modelling.

This assignment is individual work and must be submitted as individual work only.

FINS5516 - Data Exercise

The LIC will randomly assign each student one of five countries in the list below:

1. Denmark (DKK)

2. Italy (EUR)

3. Mexico (MXN)

4. New Zealand (NZD)

5. South Korea (KRW)

Once assigned a country, the student will analyse the exchange rate eh/f comprising that country’s currency in relation to that of the United States (USD). The USD is the base currency irrespective of which currency you have been allocated. Thus, if you are assigned Mexico, then you need to complete the iLab assignment on the MXN/USD exchange rate.

Download the Excel file uploaded on Moodle to see which country you have been allocated.

You are constructing a regression model to forecast an estimate of the exchange rate. You expect changes in future exchange rates depend on a set of key macroeconomic variables:

− the countries’ real GDP growth rates

− the inflation rate differential

− long-term interest rate differential

Section 1 - Downloading the Data and Setting up the Excel File.

1.1 - Using FACTSET, obtain quarterly data from 2001Q1 to 2022Q3 on:

- The exchange rate eh/f you have been randomly assigned.

- Economic growth rates for both countries, defined as the year-on-year % change in real GDP.

- Inflation rates for both countries, defined as the year-on-year % change in the CPI.

- Long-term interest rates for both countries.

1.2 - Using the data you collected from FACTSET, calculate the following:

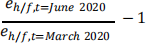

- The change in exchange rates over (i) 1 quarter, (ii) 1 year, and (iii) 3 years. These

must be forward looking. Calculating a forward-looking change in the exchange rate is best illustrated by an example. Thus, for example, the one-quarter change in the exchange rate, eh/f, for March 2020 is:

- Economic growth rates for both countries as a decimal. This is done by dividing the FACTSET value by 100.

- The inflation rate differential as a decimal (ensure that you divide the FACTSET

value by 100), which for simplicity, we define as the term currency rate (h) less the base currency rate (f).

- The long-term interest rate differential as a decimal (ensure that you divide the

FACTSET value by 100), which for simplicity, we define as the term currency rate (h) less the base currency rate (f).

Section 2 - Data Exploration and Visualisation

Using the data you collected from FACTSET, answer the following questions (limit for each question is 100 words):

2.1 - What is the average exchange rate over your sample period? (0.5 mark)

2.2 - What is the average year-on-year percent change in real GDP for each country assigned over the entire sample period? (0.5 mark)

2.3 - What is the average inflation rate for each country assigned over the entire sample period? (0.5 mark)

2.4 - What is the average long-term interest rate for each country assigned over the entire sample period? (0.5 mark)

Analysts use charts and graphs they normally paste from a spreadsheet into a presentation to analyse and communicate insights in their everyday work. Data can be better understood and more compelling for colleagues and clients by presenting them in a visual context in a simple and logical manner.

2.5 - Plot the quarterly exchange rate over your sample period in a line chart. Do not use the default graph from FACTSET. You need to use the functions in Excel to complete this section and ensure it is labelled and easy to comprehend. (1 mark)

Identify a period of significant increase or decrease in the exchange rate. What factors might have contributed to such changes? (2 marks)

2.6 - Compare the differences in GDP growth rates over the sample period for both

countries in a chart of your choice and provide comments on any large differences over the period. (2 marks)

2.7 - Plot the inflation rate and long-term interest rate for the term currency country over the sample in a chart. Repeat this for the base currency country. What does each graph show regarding the relation between these two rates? Is it consistent with the Fisher Effect? (2 marks)

Section 3 - Regression Modelling

3.1 - Consider the following econometric structural model of the change in the exchange rate:

Δeh/f,t = β0 + β1ΔGDp h,t+ β2ΔGDpf,t + β3InfRDt+ β4IntRDt+ Et

where

Δeh/f,t is the percentage change in the exchange rate over period t.

ΔGDp t is the annual percentage growth rate in real GDP over period t.

InfRDt is the inflation rate differential for period t.

IntRDt is the interest rate differential for period t.

Et is the error term for period t.

Using linear regression, obtain the coefficient estimates for each of the 3-time horizons. You need to report for each time-horizon, ALL coefficient estimates, p-values, Adjusted R-squares, F-statistics (and p-value) in one table, so the grader is able to see your results in your written submission (rather than the Excel file). (3 marks)

3.2 - Consider both the p-value from the F-test (at the 5% level of significance) and the adjusted R-squared as the forecast horizon increases from 1 quarter to 3 years. Provide some commentary and discuss whether such results (across the 3 models) are consistent with PPP theory. Word limit: 150 words. (4 marks)

3.3 - Analyse the statistical significance of the coefficient estimates at the 5% level. You are to provide a summary/high-level analysis of the key results. Word limit: 150 words. (3 marks)

3.4 - Which macroeconomic variables from the model you have estimated are considered economically important for modelling changes in the exchange rate? Are you surprised by these results? Are they consistent with PPP theory? Word limit: 150 words. (5 marks)

Section 4 - Forecasting

4.1 – Using the latest values of the key macroeconomic variables forecast the estimated change in the exchange rate:

|

a) |

1-quarter ahead, |

|

b) |

1-year ahead |

|

c) |

3-years’ ahead |

Report the magnitude of the forecasts for each regression model in no more than two

sentences. Provide brief commentary (no more than one sentence) as to whether the

currency you have been assigned is forecast to depreciate or appreciate against the USD over each forecast horizon. (3 marks)

4.2 – Do you think that the structural model in 3.1 is a useful model for modelling changes in the exchange rate? What are some of its limitations? Irrespective of your answer,

suggest 1 other independent variable that you would include in the equation? Provide at

least one economic reason for that variable’s inclusion. You should also provide

commentary indicating what relationship this variable has with the change in the exchange rate (that is, the dependent variable). Word limit: 150 words. (3 marks)

Additional Information

Note 1: Grammar, Spelling, Punctuation and Style.

1. Please ensure that your overall responses are written professionally and that all data and calculations in the Excel file are expressed to 3 decimal places. You need to ensure that your work is polished and contains NO errors. Remember you are presenting your work. When you are working professionally, the market expects high quality output.

2. If you use sources in your answers, ensure that you formally cite them. The style of referencing is for you to decide.

3. Plagiarism is not tolerated. Your answers must be written by you and only you. Turnitin has a similarity indicator that reports a percentage similarity score. Submissions with similarity scores should not be greater than 15% if they are written in your own words.

Turnitin includes the cover sheet and your references list in its calculation of its similarity score. However, the grader will be able to filter this out and see the percentage similarity score based only on the student’s written responses.

Note 2: iLab Assignment Submissions and Responses.

1. Students will only be permitted to submit their iLab assignment ONCE in Turnitin. There are NO multiple submission options permitted. What is submitted first will be graded.

2. Lengthy responses to questions will result in only the first 150 words of each part (or whatever the word limit is for that section) being graded.

3. You must type your answers and submit as a PDF document via Turnitin. Ensure that the cover sheet is attached with your submission. See Moodle for cover sheet. A

submission without the cover sheet will result in 1 mark being deducted. If your submission is not submitted in PDF format, 1 mark will be deducted.

4. Submit your Excel file with the calculations. Failure to submit the Excel file will result in a deduction of 5 marks.

5. The School of Banking and Finance’s policy stipulates late submissions will attract a 5% penalty per day following the assignment due date (weekend days included). A submission made one week (that is, 7 days) after the specified due date will result in a grade of 0.

2023-07-22