BUS1 170 Fundamentals of Finance Midterm exam #2

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

BUS1 170 Fundamentals of Finance

Midterm exam #2

List of topics and problems that may appear on the Midterm Exam #2

Disclaimer: This study guide contains problems that you may use to practice for the midterm exam #2. This is not an exhaustive list by any means. Additional problems will also be included in the exam, as well as modifications to the problems’ structure/content/question may be introduced. In addition, the midterm exam #2 will include many conceptual questions, that are not listed in this guide. To prepare for them, students need to read respective textbook chapters and review lecture slides and notes. In addition, I highly recommend students to review problems covered in class and in homework assignments. Cengage Adaptive Test Preparation is available for each Chapter in MindTap and is highly recommended for practice.

1. Chapter #5

a. Simple and compound interest

b. Time Value of Money for a single cash flow (Present value, Future value, Number of time periods, Interest rate)

c. Annuities: ordinary, due, perpetuity (Present value, Future value, Number of time periods, Interest rate, Periodic Payments)

d. Uneven cash flows calculations: annuity plus final payment, irregular cashflows.

e. Amortized loans and related calculations

f. Nominal and Effective annual rate

Practice problems

Chapter #5

Problem #1

If you deposit today $500 in a savings account that pays 5%, how much will your account total in 10years?

Solution:

PV=-500

PMT=0

N=10

I=5

Solve for FV=814.45

Answer: $814.45

Problem #2

You are considering buying a Treasury bond that will pay $1,000 5 years from now. Banks are currently offering a guaranteed 4.5% interest on 5-year certificates of deposit (CDs), and if you don’t buy the bond, you will buy a CD. What’s the most you should pay for the T-bond?

Solution:

FV=1,000

PMT=0

N=5

I=4.5

Solve for PV=-802.45

Answer: For that bond you should pay no more than $802.45

Problem #3

Currently, you have $15,000 and you want to buy a car for $20,000 in 4 years. You can invest $15,000 today. What rate of return (interest rate per year) should your investment earn, so you could fulfill your wish.

Solution:

PV=- 15,000

FV=20,000

PMT=0

N=4

Solve for I=7.457% per year

Answer: 7.457%

Problem #4

Your small business generates $50,000 in revenue. How long will it take your business to double the revenue at a annual growth rate of 10%?

Solution:

PV=-50,000

FV=100,000

PMT=0

I=10

Solve for N=7.27

Answer: 7.27 years.

Problem #5

You want to buy a house for $1,000,000. For that you need to have a 20% down payments which amounts to $200,000. With your current income you can save $12,000 per year and deposit them at the end of each year in a savings account that generates 6% return per year. How long (in years) it will take you to accumulated the amount needed for down payment?

Solution:

PV=0

FV=200,000

PMT=- 12,000

I=6

Solve for N=11.9

Answer: 11.9 years

Problem #6

Take previous problem and calculate how many years it will take you to accumulate $200,000 if you can save and deposit $20,000 per year each year in the very same savings account.

Solution:

PV=0

FV=200,000

PMT=-20,000

I=6

Solve for N=8.06

Answer: 8.06 years

Problem #7

Suppose your friend borrowed $100,000 at a rate of 9% and must repay it in 7 equal installments at the end of each of the next 7 years. How much would your friend still owe at the end of the first year, after he has made the first payment?

Solution:

To find how much your friends owes after the first payment, we need to find present value of all future payments. For that you need to know the size of payments.

So, first, we find the size of the payments:

PV=100,000

FV=0

N=7

I=9

Solve for PMT=- 19,869.05168 (try not to round)

Now we find PV of 6 future payments, that will tell us the amount of principal after the first payment:

![]()

![]() PMT=- 19,869.05168

PMT=- 19,869.05168

FV=0

N=6

I=9

Solve for PV=89,130.95

Answer: $89,130.95

Problem #8

You aunt has $840K invested at 5.5% and she wants to retire. She wants to withdraw $45K at the beginning of each year, beginning immediately. She also wants to have $50K left to give you when she ceases to withdraw funds from the account. For how many years can she make the $45K withdrawals and still have $50K left in the end?

Solution:

Switch your calculator to the BGN mode

PV=-840,000

FV=50,000

I=5.5

PMT=45,000

Solve for N=66.4463

After solving the problem, switch your calculator back to the END mode

Answer: 66.44 years

Problem #9

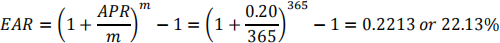

Suppose your credit card issuer states that it charges a 20.00% nominal annual rate, but they use daily compounding. What is the effective annual rate?

Solution:

Answer: 22. 13%

Problem #10

Assume that you own an annuity that will pay you $10,000 per year for 10 years, with the first payment being made today. You need money today to start a new business, and can sell your annuity for $88,000. If you sell it, what rate of return would the buyer of your annuity earn on such investment?

Solution:

Switch your calculator to the BGN mode

From the buyer point of view.

PV=-88,000

FV=0

N=10

PMT=10,000

Solve for I=2.96

After solving the problem, switch your calculator back to the END mode

Answer: 2.96%

Problem #11

You have a chance to buy an annuity that pays $22,500 at the end of each year for 6 years. You could earn 4% on your money in other investments with equal risk. What is the most you should pay for the annuity?

Solution:

FV=0

N=6

I=4

PMT=22,500

Solve for PV=-117,948.08

Answer: $117,948.08

Problem #12

10 years ago, GoGreen Inc. earned $1.50 per share. Its EPS this year were $6.80. What was the growth rate in earnings per share (EPS) over the 10 -year period?

Solution:

PV=- 1.50

FV=6.80

N=10

PMT=0

Solve for I=16.32

Answer: annual growth rate of EPS is 16.32%

Problem #13

Suppose a U.S. treasury bond will pay $1,085 seven years from now. If the going interest rate on 7 -year treasury bonds is 3.50%, how much is the bond worth today? (Assume annual compounding and zero coupons)

Solution:

FV=1,085

N=7

I=3.5

PMT=0

Solve for PV=852.80

Answer: $852.80

Problem #14

Suppose you borrowed $200,000 at an annual rate of 7% and must repay it in 36 equal monthly installments, at the end of each of the next 36 months. What will be the proportion of the 20th payment that will go towards the interest.

Solution:

Since payments are made monthly, we deal with monthly compounding, so interest must be monthly = 7%/12=0.583333%.

1) We start with finding the size of loan payments.

PV=200,000

FV=0

N=36

I=7/12 = 0.58333333 (we need monthly interest rate)

Solve for PMT=-6175.41937

2) To find the proportion of the 20th payment that goes toward the interest, we need to find how do you owe (principal of the loan) before making the 20th payment.

For that we need to find present value of 17 future payments (there are 17 payments left including the 20th payment).

FV=0

N=17

I=7/12 = 0.58333333 (we need monthly interest rate)

PMT=-6175.41937

Solve for PV=99,668.3926 – this is how much you still owe before making the 20th payment (beginning balance of the loan).

3) The proportion of the 20th payment that goes toward the interest, is calculated as an interest on the principal before the 20th payment.

Interest = 99,668.3926 * 0.58333333% = 581.399

If you want to find the proportion of the 20th payment that goes to repay the principal, simply subtract the amount of interestfrom the payment:

Principal repayment in the 20th payment = 6,175.41937 – 581.399=5,594.02

Answer: $581.40

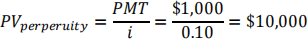

Problem #14

How should you pay for a perpetuity that pays $1,000 per year, if you want to earn at least 10% on your investment?

Solution:

Answer: $10,000

2023-07-01