EC2020 Microeconomics 2 Summer Examinations 2021/22

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

EC2020

Summer Examinations 2021/22

Microeconomics 2

Section A: Answer ALL FOUR questions

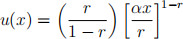

1. Consider Rajesh whose preferences can be represented by the following function:

(a) Derive Rajesh’s coefficient of relative risk aversion. (3 marks)

(b) Rajesh is contemplating betting on Arsenal beating Tottenham. The probability that Arsenal wins is ρ and the probability Arsenal does not win is (1 − ρ). If he bets X he will receive X if Arsenal wins and zero if they do not. Rajesh’s initial wealth is W and therefore his wealth in the good state (in which Arsenal win) will be W + X and in the bad state it will be W − X. Derive an expression representing Rajesh’s bet, X. (5 marks)

(c) Suppose Rajesh is risk averse. For which values of ρ will Rajesh place a bet, X? (5 marks)

(d) Maintining the assumption that Rajesh is risk averse, how does his bet depend on his level of initial wealth? (5 marks)

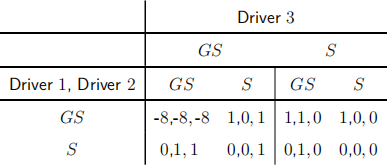

2. Three drivers are racing towards a narrow tunnel which is only wide enough for two cars at a time. Each driver faces a choice to go straight (Gs) or to swerve (s). If they all play Gs , they will suffer serious injury and get payoffs equal to -8. If at least one driver swerves, the payoff to the driver(s) that swerved is 0 whereas the payoff to those that went straight is 1. The game is illustrated in the following table:

(a) Identify all pure-strategy Nash equilibria. (3 marks)

(b) Identify all Pareto efficient outcomes of the game. (3 marks)

(c) Is there a mixed strategy Nash equilibrium of the game and what is the payoff to each player in this equilibrium? (6 marks)

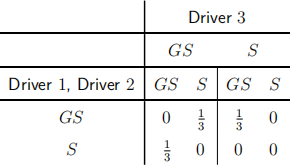

(d) Consider the following mechanism. An ‘umpire’ uses a randomisation device to select one cell in the game matrix with the probabilities shown in the following table:

Show that this mechanism can be supported in a correlated equilibrium, and compute each driver’s payoff . (6 marks)

3. Consider a 2 x 2 pure exchange economy with two consumers, Andy and Beth, or {A, B|, and two goods {1, 2|. Andy has endowment eA = (4, 2) and Beth has endowment

e会 = (2, 2). Andy’s preferences can be represented by the utility function uA = zA1 + zA2 and Beth’s preferences can be represented by the utility function u会 = z会1z会2 . Let prices be (p1 , p2 ) = (1, 2).

(a) Sketch an Edgeworth box showing the dimensions, initial endowment, both players’ indifference curves through the initial endowment and budget sets. (5 marks)

(b) Find consumers’ optimal demands at prices (p1 , p2 ) = (1, 2) and show that Walras’ Law holds at these prices. (5 marks)

(c) Find the Pareto Set (you may either describe it mathematically or illustrate it on an Edgeworth box). (4 marks)

(d) Without calculating the Walrasian Equilibrium, say how equilibrium prices compare to (p1 , p2 ) = (1, 2). Then using the First Welfare Theorem or otherwise find the Walrasian Equilibrium allocation and prices. (4 marks)

4. (a) The First Welfare Theorem for pure exchange economies can be stated as “If there are no externalities and everyone has locally non-satiated preferences, then every Walrasian Equilibrium is Pareto efficient.” Take the contrapositive of this statement. What can we say about an economy where everyone has locally non-satiated preferences and which has a Walrasian Equilibrium which is not Pareto efficient? (3 marks)

(b) Consider a 2 x 2 pure exchange economy with two consumers, Andy and Beth, or {A, B|, and two goods {1, 2|. Andy has endowment eA = (1, 1) and Beth has endowment e会 = (1, 1). Andy’s preferences can be represented by the utility function uA = zA1zA2 and Beth’s preferences can be represented by the utility function

u会 = z会1z会2 + zA1 . Notice that Andy’s consumption of good 1 creates a positive

externality for Beth . Show that there is a Walrasian Equilibrium at the initial

endowment with prices (p1 , p2 ) = (1, 2). Show that this Walrasian Equilibrium is not Pareto efficient. (7 marks)

(c) Discuss the extent to which you agree with the following satement: “The problem of externalities can be solved by the people electing a government which then intervenes in markets to restore efficiency.” (8 marks)

Section B: Answer ONE question.

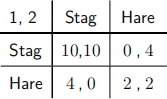

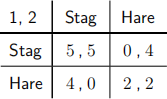

5. Two hunters must decide separately and simultaneously whether to hunt a stag or a hare. One hunter can catch a hare alone with less effort, but the only way to successfully hunt a stag is with the other’s help. The value to each hunter of a stag is much higher. The game with payoffs from catching a stag and a hare is illustrated in the following table:

(a) Identify all Nash equilibria of the game, and illustrate them in a diagram. (6 marks) (b) What are the payoffs in each Nash equilibrium? (6 marks)

(c) Players can now be of two types – starving (s) or full (F). For a starving hunter, the payoffs are as in the previous sub-questions. For a full hunter, however, the payoff when both play stag is 5. The bimatrix game for two hunters that are both of type F is thus:

Suppose the two types are equally likely. Construct the normal form representation of this game. (8 marks)

(d) What are the pure-strategy Bayes-Nash equilibria of the game? (8 marks)

6. Suppose there are two players: a Worker (w) and a Firm (F). w has private information about their own level of ability. F knows that with probability p = ![]() , w is high ability type (H), and with probability (1 - p) =

, w is high ability type (H), and with probability (1 - p) = ![]() , w is low ability type (L). After w observes their own type (a draw by nature), they decide whether to get a degree (play E) or not (play N). F observes w ’s education, but not their type. F then decides whether to employ w in a managerial job, or a clerical job (C). The payoffs are as follows: if F employs a worker of type H in a managerial job, it obtains a payoff equal to 10; if F employs a worker of type L in a managerial job, it obtains payoff equal to 0; if F employs a worker in a clerical job, it obtains a payoff equal to 4 regardless of the type of w . A worker of either type obtains a payoff of 10 in a managerial job, and 4 in a clerical job. The cost of education differs, however. For an H-type worker the cost of doing a degree is 4, whereas for an L-type worker it is 5.

, w is low ability type (L). After w observes their own type (a draw by nature), they decide whether to get a degree (play E) or not (play N). F observes w ’s education, but not their type. F then decides whether to employ w in a managerial job, or a clerical job (C). The payoffs are as follows: if F employs a worker of type H in a managerial job, it obtains a payoff equal to 10; if F employs a worker of type L in a managerial job, it obtains payoff equal to 0; if F employs a worker in a clerical job, it obtains a payoff equal to 4 regardless of the type of w . A worker of either type obtains a payoff of 10 in a managerial job, and 4 in a clerical job. The cost of education differs, however. For an H-type worker the cost of doing a degree is 4, whereas for an L-type worker it is 5.

(a) Draw this game in extensive form. (4 marks)

(b) Is there a separating equilibrium in which the H-type chooses to do a degree, and the

L-type doesn’t? Carefully explain your answer. (8 marks)

(c) Is there a pooling equilibrium in which both workers play N? Carefully explain your answer. (8 marks)

(d) Now suppose that the cost of doing a degree for the L-type is 7, whereas the cost of doing a degree for the H-type is 4 as it was in previous subquestions. All other payoffs stay the same. Does this change your answer in subquestion (b)? Carefully explain your answer. (8 marks)

.

7. Consider a 2 x 2 pure exchange economy with two consumers, Andy and Beth, or {A, B|,

and two goods {1, 2| . Andy has endowment eA = (1 , 4) and Beth has endowment

e会 = (4, 1). Andy’s preferences can be represented by the utility function wA = ^zA1zA2 and Beth’s preferences can be represented by the utility function w会 = min {z会1, z会2|.

(a) Find all Walrasian Equilibria. (5 marks)

(b) Now we introduce a firm owned equally by the two agents with production set

y = {y e R2 | y1 s 0, y2 s -2y1 |. Find the profit maximising output y (p) as a function of prices and argue that there are no Walrasian Equilibria when ![]() < 2 or when

< 2 or when ![]() > 2. (5 marks)

> 2. (5 marks)

(c) Find the Walrasian Equilibrium. (Hint: start by finding equilibrium prices and then both agents’ demand). (6 marks)

(d) Return to the economy without production in part (a). Find the Pareto Set and use this to put this scenario into the form of a bargaining problem: define a pair (s, d) where s is the set of feasible utility pairs and d is the disagreement point (no trade). Illustrate (s, d) on a diagram. (6 marks)

(e) Find: (i) the Nash Bargaining Solution and (ii) the Subgame Perfect Equilibrium of the Ultimatum game with Andy as proposer . For each, find both the utilities and allocation . (6 marks)

8. This question has 7 parts. For each part you should say whether the statement in quotation marks is true and false and justify your answer. For each part, 1 mark is given to identifying whether it is true or false and the remaining marks are given to the justification. (The first part, as only 1 mark, requires no justification.)

(a) If somebody’s preferences violate local non-satiation then the Walrasian Equilibrium will violate Pareto efficiency. (1 marks)

(b) In a pure exchange economy with complete markets, if there is a Pareto efficient allocation that cannot be supported as a Walrasian Equilibrium, then at least one agent must have preferences violating either local non-satiation, convexity or continuity. (2 marks)

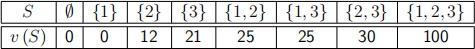

(c) The following co-operative game violates super-additivity. (3 marks)

(d) When there are 3 alternatives and 3 voters each with a strict preference relation, the

following SWF satisifies the Independence of Irrelevant Alternatives (IIA) axiom. SWF: Each voter votes for their most preferred alternative and we rank alternatives by how many votes they receive: if two candidates get the same number of votes then our

SWF ranks them indifferent to each other; if one candidate gets more than another then the candidate with more votes is ranked above the one with fewer by our SWF. (4 marks)

(e) Consider a pure exchange economy where there are 10 units of each good and

preferences of our two agents are uA = zA1 + ln (1 + zA2) , u会 = z会1 +^z会2 . Then

every Pareto efficient allocation can be supported as a Walrasian Equilibrium . (5 marks)

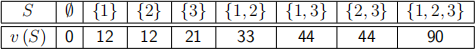

(f) In the following co-operative game, the Shapley Value is an element of the core. (6 marks)

(g) Consider the following public goods game, where Alice and Beth plant flowers in their shared garden. The demands of Alice and Beth respectively are given by QA = max {6 - P, 0| and Q会 = max {5 - ![]() , 0} . Let the market price be P = 4. Assume that without any intervention Alice completely free-rides on Beth. Now, an omniscient social planner implements the Lindahl Equilibrium. Our statement is: the Lindahl Equilibrium makes both consumers better off compared to what would be achieved without the social planner’s intervention. (7 marks)

, 0} . Let the market price be P = 4. Assume that without any intervention Alice completely free-rides on Beth. Now, an omniscient social planner implements the Lindahl Equilibrium. Our statement is: the Lindahl Equilibrium makes both consumers better off compared to what would be achieved without the social planner’s intervention. (7 marks)

2023-06-30