Assignment 2: ERMC_Credit Risk Management ARORA

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Assignment 2: ERMC_Credit Risk Management ARORA

Details

This is an individual assignment. If you need assistance, my associate and I are available through normal channels.

Assessment

The entire assignment is worth ten points and the points for each question are listed. Correct answers, while important, are not as important as correct analysis. Show your work. More credit will be given for correct analysis than for correct final numbers. Conversely, missing analysis or incorrect analysis will be more heavily deducted than incorrect final numbers.

Submission

To complete your submission,

1. Click the blue Submit Assignment button at the top of this page.

2. Click the Choose File button and locate your submission.

3. Feel free to include a comment with your submission.

Finally, click the blue Submit Assignment button.

Directions

For each question, please provide both the analysis (equations and/or verbal thought processes) and final equations.

1. ( 1 pts) Going into a bad credit cycle, with elevated PDs, do you expect the LGDs to be:

a. Relatively better than average

b. Relatively worse than average

c. About average

d. Not enough information has been provided.

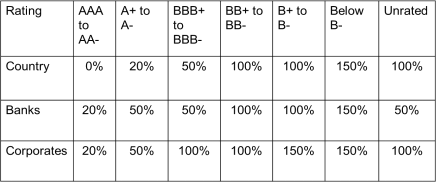

2. (2 pts) Suppose as a Risk Manager, you have been asked to assess the capital impact of 2 portfolios. Portfolio A has assets that consist of $500M of US Treasury Bonds (assume the best country rating), $200M of B+ Corporate Loans, $800M of residential mortgages. Portfolio B has assets that have $200M of Fannie Mae Bonds (has the implicit guarantee of the US Government), $800M of A rated Corporate Loans, and $100M of residential mortgages. Provide the Capital requirement for both portfolios (assume Basel 2, and use the table given below).

Basel II (Risk Weights)

Residential Mortgages Risk Weight: 35%

3. (2 points) Assume that Bank ABC has a portfolio of Construction Loans that has PD of 2.75%, EAD of $600M, Recovery rate of 60%, weighted average term life of 12 months. In addition, the WCDR at 99.95% is 15%. Calculate the minimum capital required.

4. (1 point) For most major banks, who does the CRO report into, and why?

a. CEO, to maintain independence.

b. CEO, and Board Risk Committee, to maintain independence.

c. Chief Compliance Officer, and CEO, to help the Bank grow profitably.

d. CEO, and Chief Operating Officer, to help the Bank grow profitably.

5. (4 points) Bank Prestige provides residential mortgages to the state of NY. Richard applies to Bank Prestige for a $800,000 loan for a house that costs $1,000,000 (assume the appraisal value is equal to the sale price). Richard has a monthly gross income of $10,000 with credit card monthly payment of $1500, personal loan payment of $1000, auto loan payment of $500, and rent of $2000.

a. What’s the LTV for the loan? (1 point)

b. What’s the Debt-to- Income ratio? (1 point)

c. If the loan defaults, what’s the loss given default (LGD). Assume that no payment has occurred, and the value of the house remains the same as purchase price. (2 points)

2023-06-26