Statement of Cash Flows and AASB 107

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Study Pack Questions

Statement of Cash Flows and AASB 107

QUESTION 1: The reconstruction of accounts approach

The statements of financial position of Allthrough Ltd as at 30 June 2027 and 30 June 2026 are presented below.

ALLTHROUGH LTD

Statements of Financial Position

as at 30 June 2027

Additional Information

Examination of the company’s general ledger accounts revealed the following:

(a) Depreciation expense was recorded during the year as follows: buildings $13 800; and equipment $22 900.

(b) An extension was added to the building at a cost of $300 000 cash.

(c) Long-term investments with a cost of $90 000 were sold for $125 000.

(d) Vacant land next to the company’s plant was purchased for $129 000 with payment consisting of $39 000 cash and a loan payable for $90 000 due on 31 July 2028.

(e) Debentures of $100 000 were issued for cash at nominal value.

(f) Thirty thousand shares were issued at $3.80 per share.

(g) Equipment was purchased for cash.

(h) Sales for the period were $875 600; cost of sales amounted to $525 300; other expenses (excluding depreciation, carrying amount of investments sold, interest, and bad debts) amounted to $149 400.

(i) Bad debts of $3500 were written off.

(j) Income tax paid during the year amounted to $73 700.

(k) Interest expense and interest paid amounted to $40 000.

(l) The bank overdraft is integral part of the company’s cash management function.

Required

A. Prepare the statement of cash flows of Allthrough Ltd for the year ended 30 June 2027 using the direct method of presentation.

B. Prepare a note disclosure to reconcile net cash flows from operating activities with the profit for the year and also prepare any other notes required by AASB 107.

QUESTION 2: Statement of Cash Flow

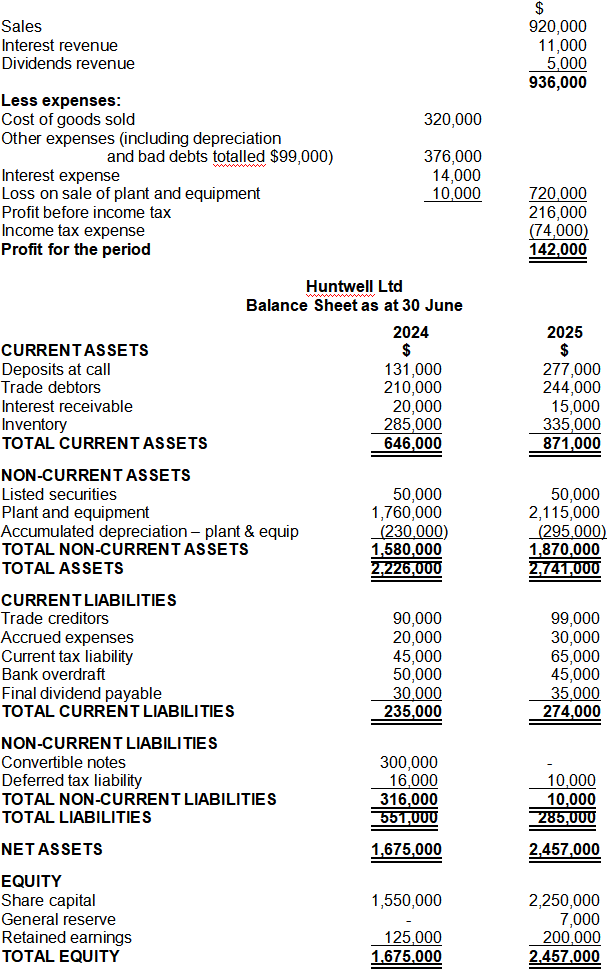

The following financial statement information was obtained for Huntwell Ltd:

Huntwell Ltd

Income Statement

for the year ended 30 June 2025

Other information:

i) During the reporting period Huntwell Ltd made two issues of ordinary shares as follows:

- the convertible notes outstanding at 30 June 2024 were converted to 150,000 ordinary shares issued at a conversion price of $2.00 per share.

- an issue of 200,000 shares to the public at an issue price of $2.00 per share.

ii) During the year ended 30 June 2025 plant and equipment costing $60,000 and with a carrying amount of $30,000 was sold.

iii) An interim dividend was declared and paid during the year.

iv) The opening and closing balances of the accrued expenses were attributable to wages and salaries, and interest payable as follows:

Wages and salaries Interest

Opening 5,000 15,000

Closing 10,000 20,000

v) The bank overdraft is used as part of the company’s short-term cash management activities.

Required

1. Prepare a cash flow statement of Huntwell Ltd for the year ended 30 June 2025 in compliance with AASB 107, using the direct method. Show all workings.

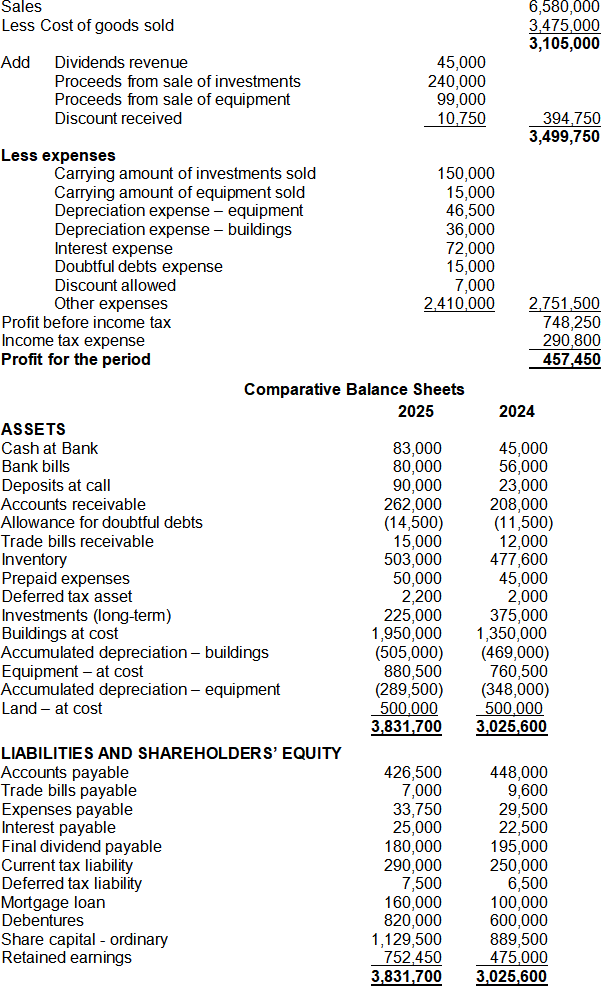

QUESTION 3:

Douglas Berry Ltd provided the following information in regard to its operations for the year ended 30 June 2025:

Douglas Berry Ltd

Income Statement

for the year ended 30 June 2025

Additional information:

i) New equipment was purchased at a cost of $240,000; $150,000 was paid in cash and the balance covered by arranging a long-term mortgage loan with Northshore Credit Ltd.

ii) Equipment with a cost of $120,000 and accumulated depreciation of $105,000 was sold.

iii) Additional ordinary shares and debentures were issued for cash.

Required

1. Prepare a cash flow statement for the year ended 30 June 2025 in accordance with AASB 107 using the direct method. Show all workings.

QUESTION 4:

The accounting records of Winston Ltd recorded the following information.

Required:

Calculate the total amount of cash paid to suppliers and employees during the year ended 30 June 2023. (8 marks. Both direct method and the use of T-ledgers are accepted.)

Tax-effect Accounting AASB 112

QUESTION 5: Change in tax rates

At 30 June 2023, Blue Heeler Ltd recognised a deferred tax asset of $12 000 and a deferred tax liability of $15 000. This has resulted by applying a tax rate of 30%. The Australian government has determined to raise more revenue from companies by way of taxation. It announced that it will increase the tax rate as of 1 July 2023 to 35%. In its deferred tax worksheet for the year ending 30 June 2024, Blue Heeler Ltd calculated that its taxable temporary differences were $6000 and its deductible temporary differences were $12 000.

Required

Prepare a report for the chief accountant on how the increase in the tax rate will affect the application of tax-effect accounting for the year ended 30 June 2024. (LO6)

QUESTION 6:

The following are all independent situations. Prepare the journal entries for deferred tax on the creation or reversal of any temporary differences. Explain in each case the nature of the temporary difference. Assume a tax rate of 30%.

1. The entity has an allowance for doubtful debts of $10 000 at the end of the reporting period relating to accounts receivable of $125 000. The prior period balances for these accounts were $8500 and $97 500 respectively. During the current period, debts worth $9250 were written off as uncollectable.

2. The entity sold a vehicle at the end of the reporting period for $15 000. The vehicle cost $100 000 when purchased 4 years ago, and had a carrying amount of $20 000 when sold. The tax depreciation rate for vehicle of this type is 25% p.a.

3. The entity has recognised an interest receivable asset with an opening balance of $17 000 and an ending balance of $19 500 for the current year. During the year, interest of $127 000 was received in cash.

4. At the end of the reporting period, the entity has recognised a liability of $4 000 in respect of outstanding fines for non-compliance with safety legislation. Such fines are not tax-deductible.

Study Pack Solutions

Statement of Cash Flows and AASB 107

QUESTION 1: The reconstruction of accounts approach

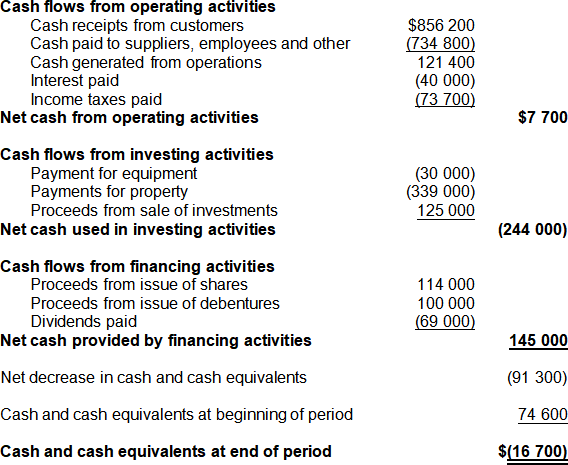

A.

ALLTHROUGH LTD

Statement of Cash Flows

for the year ended 30 June 2027

B.

Note 1: Cash and cash equivalents

Cash and cash equivalents included in the statement of cash flows are comprised of the following amounts included in the statement of financial position:

2027 2026

Cash at bank $ – $ 74 600

Bank Overdraft (16 700) –

Cash and cash equivalents $(16 700) $ 74 600

The bank overdraft is integral to the company’s cash management function.

Note 2: Non-cash Financing and Investing Activities

During the period, property was acquired for $129 000, part of the purchase consideration amounting to $90 000 is deferred until July 2028

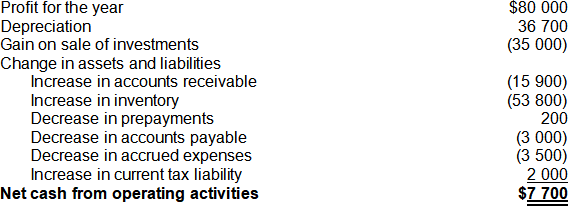

Note 3: Reconciliation of Net Cash from Operating Activities with Profit

Workings

Receipts from customers

Accounts Receivable

|

Balance b/d |

111 300 |

Bad debts expense |

3 500 |

|

Sales |

875 600 |

Cash (from customers) |

856 200 |

|

|

|

Balance c/d |

127 200 |

|

|

986 900 |

|

986 900 |

Payments to suppliers, employees and other

Inventory

|

Balance b/d |

221 200 |

Cost of sales |

525 300 |

|

A/c Payable (purchases)* |

579 100 |

Balance c/d |

275 000 |

|

|

800 300 |

|

800 300 |

*balancing item for reconstruction

Accounts Payable

|

Cash (paid to suppliers) |

582 100 |

Balance b/d |

218 000 |

|

Balance c/d |

215 000 |

Inventory (purchases) |

579 100 |

|

|

797 100 |

|

797 100 |

Prepayments and Accrued Expenses Liability (Net)

|

Balance b/d |

9 000 |

Other operating expenses |

149 400 |

|

Cash (paid employees/other) |

152 700 |

Balance c/d |

12 300 |

|

|

161 700 |

|

161 700 |

Cash payments to suppliers and employees = $582 100 + $152 700 = $734 800

Income tax paid

Current Tax Liability

|

Cash (income tax paid) |

73 700 |

Balance b/d |

24 000 |

|

Balance c/d |

26 000 |

Income tax expense* |

75 700 |

|

|

99 700 |

|

99 700 |

*balancing item for reconstruction

Dividends paid

Profit or Loss Summary

|

Cost of sales |

525 300 |

Sales revenue |

875 600 |

|

Other operating expenses |

149 400 |

Proceeds from sale of invest |

125 000 |

|

Depn expense - buildings |

13 800 |

|

|

|

Depn expense - equipment |

22 900 |

|

|

|

Cost of investments sold |

90 000 |

|

|

|

Bad debts expense |

3 500 |

|

|

|

Interest expense |

40 000 |

|

|

|

Income tax expense |

75 700 |

|

|

|

Profit for the year* |

80 000 |

|

|

|

|

1 000 600 |

|

1 000 600 |

*balancing item for reconstruction

Retained Earnings

|

Dividends paid |

69 000 |

Balance b/d |

140 600 |

|

Balance c/d |

151 600 |

Profit |

80 000 |

|

|

220 600 |

|

220 600 |

QUESTION 2:

Huntwell Ltd

Cash Flow Statement

for the year ended 30 June 2025

Cash flows from operating activities

Cash receipts from customers 882,000

Cash paid to suppliers and employees (633,000)

Cash generated from operations 249,000

Interest paid (9,000)

Income taxes paid (60,000)

Net cash used in operating activities 180,000

Cash flows from investing activities

Proceeds from sale of plant 20,000

Payment for plant and equipment (415,000)

Interest received 16,000

Dividends received 5,000

Net cash used in investing activities (374,000)

Cash flows from financing activities

Proceeds of share issue 400,000

Dividends paid (55,000)

Net cash used in financing activities 345,000

Net increase in cash and cash equivalents 151,000

Cash and cash equivalents at the beginning of period 81,000

Cash and cash equivalents at the end of period 232,000

2023-06-26