ECON 211 2023 SPRING ASSIGNMENT #2 KEY

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ECON 211 2023 SPRING ASSIGNMENT #2 KEY

Q1: (10 points) Suppose you are given the following information for a particular individual consuming two goods, a and b: Pa = $5, Pb = $6, MUa = 100, MUb = 200, and income (m) = $200.

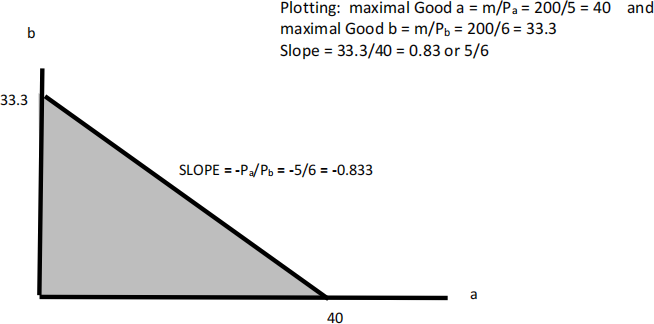

a) (2 points) Sketch the budget set. What is the slope of the Budget Line? What are maximal possible consumptions of a and b?

b) (2 points) What is the MRSab for the two goods?

The MRS is defined to be the ratio of marginal utilities: It is the slope of the indifference curve at a point.

MRSab = MUa/MUb = -100/200 = - 1/2

Interpretation: An additional unit of Good a yields 100 utils and an additional unit of Good b yields 200. Hence the consumer is willing to give up only ½ a unit of good b to get one unit of good a.

c) (2 points) Is this person maximizing her utility? How can you tell?

No, she is not. The market rate of exchange is equal to the ratio of prices: Pa/Pb = 5/6. That is, the market allows the consumer to exchange (buy) one unit of Good a by giving up 5/6 of a unit of Good b. But her preferences are such that she is only willing to give up ½ of a unit of b for a unit of

![]() .

.

At the optimum, we must have the willingness to substitute equal to the ability to substitute:

MRS = Pa/Pb

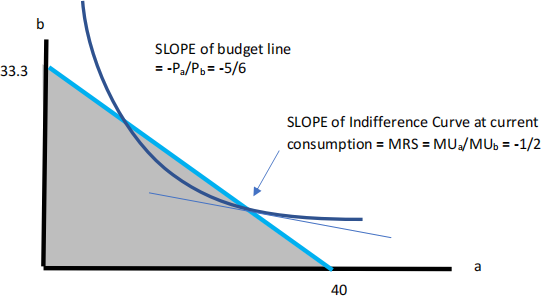

Diagrammatically: the indifference curve penetrates the budget line and is not tangent.

d) (2 points) Should she consume more of good a or of b? Explain.

She should shift consumption toward good b and away from good a.

We have at the optimum: MRS = Pa/Pb . but we can rewrite this.

Consider the ratio MUa/ Pa = 100/5 = 20 and MUb/ Pb = 200/6 = 33.3

Interpretation: The consumer receives 20 utils on the last dollar spent on Good a but 33.3 utils on the last dollar spent on Good b.

Hence the benefit of the last dollar is higher on b than it is on a. If the consumer were to switch their last dollar from a to b, they would have an increase of (+33.3 -20) = +13.3 utils.

e) (2 points) Why can’t you tell what her optimal bundle is? Explain.

You cannot tell what the optimal bundle is since you need to know how the MRS changes as we move along the budget line. All you know is that the MRS is less than the slope of the budget line and so the current bundle is too far to the right. See figure.

Q2: (10 points) Consider the following consumer’s problem: U(x,y) = X1/3 Y2/3 . Prices are Px = $10, Py = $10 and Income is m = $1000.

a) (2 points) Sketch the budget set. What is the slope of the Budget Line? What are the maximal possible consumptions of X and Y?

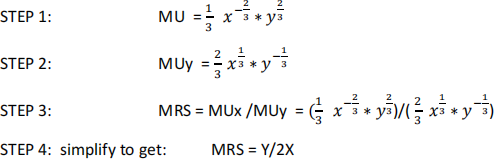

b) (2 points) Show that the MRSXY = Y/(2X).

Note: see key to Assignment #1 and tutorial video: by defn MRSab = MUa/MUb

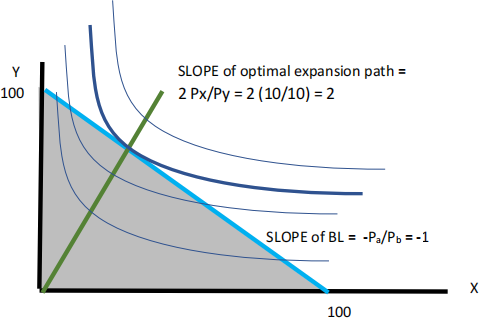

c) (2 points) Show that the optimality condition implies that Y = 2PXX/PY . Graph this relationship onto your budget set in (a).

STEP 1: Optimality implies that MRS = Px/Py

STEP 2: by substitution: Y/2X = Px/Py

STEP 3: isolate Y Y = 2Px X/Py or Y = (2Px /Py) X

INTERPRETATION: recall that the equation for a line is: y = b+mX. So the above is a line with intercept b = 0 and slope m = 2 Px/Py = 2 10/10 = +2

Plotting: Y = 2 Px/Py X has zero as the vertical intercept and a slope of +2

d) (2 points) Find the consumer’s optimal consumption bundle (X*, Y*) given these prices and income.

1 optimality condition (tangency) MRS =- Px/Py implies Y = 2Px/Py X

2 budget constraint Px X + Y Py = m

STEP 1: substitute eq 1 into eq2 Px X + (2Px/Py X) Py = m

STEP 2: simplify Px X + 2Px X = m

STEP 3: simplify more 3 Px X = m

STEP 4: hence X = ![]() m / Px This is the demand curve for X.

m / Px This is the demand curve for X.

can substitute back into Y = 2Px/Py X to get Y = ![]() M/Py

M/Py

STEP 5: put in values X = 1/3 (1000) / 10 = 33.3

STEP 6: and Y = 2/3 M/Py = ![]() (1000) / 10 = 66.67

(1000) / 10 = 66.67

Interpretation: with Cobb-Douglas preferences, the consumer spends ![]() of her income on good X and the remainder

of her income on good X and the remainder ![]() of her income on good Y. So she spends $333 on X which, given its price is $10, yields X=33.3 Similarly, she spends 66.7% of her income, $667, on Y which yields Y = 66.7

of her income on good Y. So she spends $333 on X which, given its price is $10, yields X=33.3 Similarly, she spends 66.7% of her income, $667, on Y which yields Y = 66.7

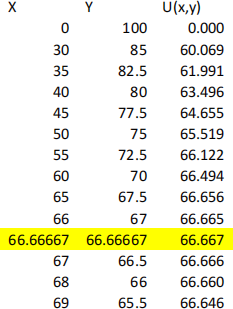

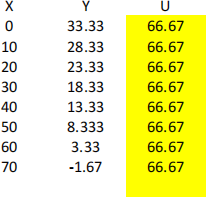

ALTERNATIVE approach: Use EXCEL

STEP 1: Choose combinations of X and Y that are on the budget line:

we have PxX + PyY = M or Y=(M-Px X)/Py

STEP 2: Calculate the utility for each combination.

STEP 3: Choose the one combination with the highest utility. Note, you may want to use ‘solver’ or refine your grid.

e) (2 points) Suppose the price of good X falls to $5.

![]() Find the new optimum.

Find the new optimum.

![]() Are goods X and Y substitutes or complements? Explain.

Are goods X and Y substitutes or complements? Explain.

STEP 1: we have from the above that X = (1/3) m / Px so X = (1/3) (1000) / 5 = 66.67

STEP 2: and Y = (2/3) (1000) / 10 = 66.67

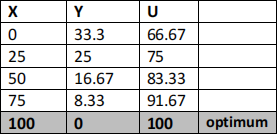

Or we can use Excel again: note the grid is slightly different

Def’n: Substitutes goods imply that a rise in the price of one good induces a rise in the demand for the other good. Conversely, a fall in the price of one good induces a fall in the demand for the other good.

Since Y is unchanged, they are not substitutes

Def’n: Complement goods imply that a rise in the price of one good induces a fall in the demand for the other good. Conversely, a fall in the price of one good induces a rise in the demand for the other good. Note that demand for both goods moves in the same direction.

Since Y is unchanged, they are not complements

These are neither (gross) complements or substitutes. We say that they are price independent.

Q3: (10 points) Consider the following consumer’s problem: U(X,Y) = X + 2Y. Prices are Px = $5, Py = $15 and Income is m = $500.

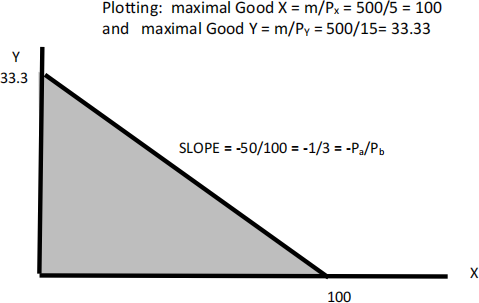

a) (2 points) Sketch the budget set. What is the slope of the Budget Line? What are maximal possible consumptions of X and Y?

![]() (2 points) Show that the MRSXY = -1/2.

(2 points) Show that the MRSXY = -1/2.

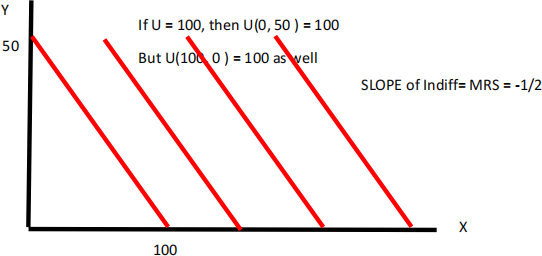

Here we are going to plot the Indifference curves.

Step 1: pick a level of utility: let’s say U = 100

Step 2: so X + 2Y = 100

Step 3: 2Y = 100 – X

Step 4: Y = 100/2 – X/2 This is a line with intercept at 50 and slope -1/2. Hence the MRS is -1/2

ALTERNATIVE:

MRS = MUx/MUy with MUx = du/dx = 1 and MUy = du/dy = 2

Therefore MRS = - 1/2

c) (2 points) Sketch the indifference curves onto the budget set and show that, given these prices, optimal consumption implies Y = 0.

The idea is that the MRS = -1/2. Hence the consumer is willing to give up more units of Y to get less units of X and maintain the same utility as before. By inspection, optimal is to buy only good X. hence Y = 0. Alternately: MUx/Px = 1/5 versus MUy/Py = 2/15. Therefore the benefit of spending on X is higher than on Y. so spend more on X. but as Mus do not change, this pushes you to the corner solution with X = 500/5 = 100 and Y = 0

d) (2 points) Find the consumer’s optimal consumption bundle (X*, Y*) given these prices and income.

By inspection. The highest indifference curve is to the right. So the point where X = 100 and Y = 0 has the highest Utility and is the optimum. We can also use a spreadsheet to find the optimum directly.

e) (2 points) How high would the price of X have to rise for the consumer to choose Y > 0? Explain. ![]() Are goods X and Y substitutes or complements? Explain.

Are goods X and Y substitutes or complements? Explain.

The price of X has to be higher than $7.5

Think about the slope of the indifference curve (MRS = - 1/2) and the slope of the budget line (Px/Py). As long as the budget line has a lower slope than the indifference curve (as in the figure above), the consumer chooses only good X. But once the slope of the budget line is greater than - 1/2, the agent will shift to good Y.

The goods are substitutes as long as the price of X shifts from less than 1/2 Py to more than. In this case, if Px rises above $7.5

Note that at Px = $7.5 we have a constant utility and a 1 to 1 ratio of substituting between goods x and y. so we can buy any bundle and we would have achieved the maximum utility.

TOTAL: 30 points

2023-06-25