ACCT346-20S1 (C) Auditing Mid-year Examinations, 2020

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Department of Accounting and Information Systems

EXAMINATION

Mid-year Examinations, 2020

ACCT346-20S1 (C) Auditing

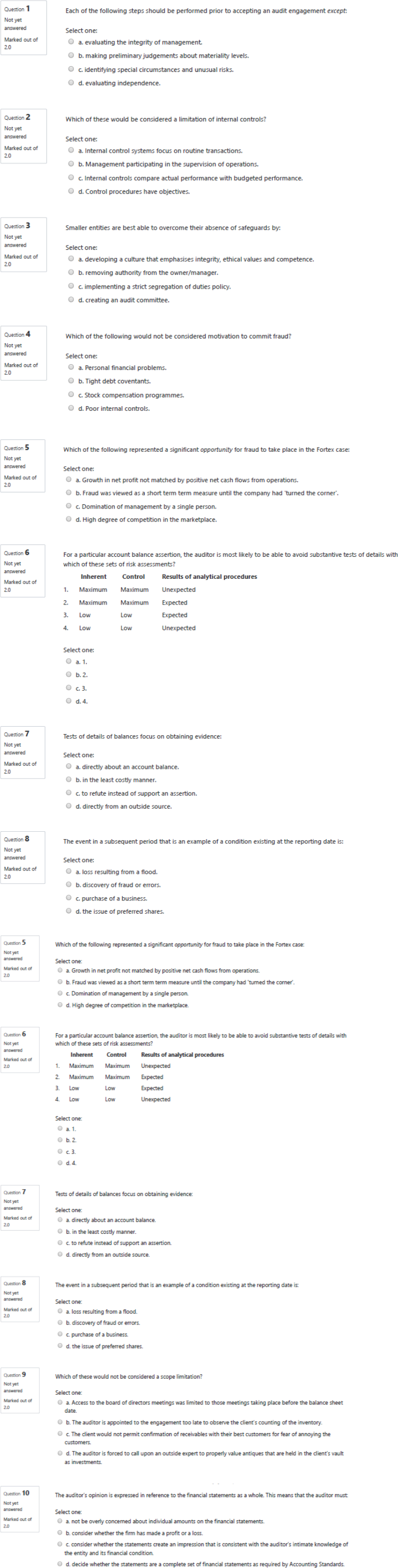

Part A – Multiple Choice

List numbers 1 to 10 in your answer book. Write your answer to each question next to the corresponding question number in your answer book. All questions are of equal value.

TOTAL: 20 MARKS

Part B

QUESTION 1

You are engaged on the audit of Justlikehome Hotels Ltd (JHL)

For the year ending 31 March 2019

JHL operates three boutique hotels, one each in Rotorua, Queenstown, and the Bay of Islands. Each hotel caters for a maximum of twelve guests in six rooms, and offers five-star accommodation and service, with a Michelin-starred restaurant at each site, and personal butler service. The hotels have been very popular with the Asian and German markets, which together supply 80 per cent of all guests. The other 20 per cent are from elsewhere, including New Zealand.

JHL is owned by three wealthy New Zealand investors, who are also directors of the Company. The Board of Directors meets once a year to sign the accounts, followed by a dinner at one of JHL’s restaurants.

Basil Forty, JHL’s Managing Director, is the company’s fourth director. Basil is left by his fellow-directors to run the company how he wishes, as long as JHL continues to show an increase in profits each year. Basil is much-loved by guests, but is extremely unpopular with the JHL staff. He has a reputation for being rude and severe to his staff, who avoid meeting with him. In particular, if the monthly financial results are down, he quickly loses his temper. Partly because of Basil’s reputation, and also because of a severe skills shortage in tourist towns, JHL has been unable to appoint a permanent accountant. Instead, JHL has obtained temporary staff from a local job agency. During the year, JHL has employed three different temporary accountants to fill this vacancy.

The company uses Xero as its accounting platform. Since most of its customers are from overseas, JHL charges guests for their rooms and services in US dollars, which are deposited in JHL’s US Dollar account at the Bank of New Zealand, and translated into New Zealand dollars as and when required.

Invoices are emailed to guests after they have departed to speed up their check-out procedure. If a customer subsequently calls to dispute an invoice, the receptionists at each hotel are authorised to issue a credit note or to refund the client if they consider this to be appropriate.

Due to demand, JHL decided to build a new, five-star hotel at Lake Tekapo. Construction commenced in August 2018 and is scheduled for completion in May 2020 in time for the 2020 winter tourist season. To fund this new hotel, JHL arranged a three-year bank loan, which it intends to repay with the expected revenue from the new hotel. The directors have also given personal guarantees to the bank.

REQUIRED:

(a) Provide a brief outline of the objective of, and approach prescribed by, ISA (NZ) 315. (4 Marks)

(b) Based on the information provided above, identify four distinct factors that might affect an

auditor’s assessment of the control environment of JHL for the year ending 31 March 2019. Explain why each factor is a possible audit risk, and what action(s) an auditor might undertake to reduce this risk to an acceptable level. (12 Marks)

(c) Assume it is now a year later and you are planning the 2020 audit. Despite raising a number of concerns in your 2019 Management Letter, little has changed to the control environment at JHL. As part of your planning, would you change your assessment of audit risk for the year ending 31 March 2020? If so, why? (4 Marks) TOTAL: 20 MARKS

QUESTION 2

Kim Stevens, a qualified Chartered Accountant, is the engagement partner on the financial statement audit of Christchurch-based company, Meat Processors Limited (MPL), for the year ended 30 June 2020. On 5 July 2020, Jan, the senior auditor assigned to the engagement, had the following conversation with Kim concerning the planning phase of the audit:

Kim: Have you updated all the audit work programmes yet for the MPL engagement? Jan: Mostly. I still have work to do on the fraud risk assessment.

Kim: Why? Our “errors and irregularities” programme from last year should be fine to roll over to this year. Besides, we don’t have specific duties regarding fraud. If we find it, we’ll deal with it as it arises.

Jan: I’m not sure we should do that. That new CEO, Thompson, is receiving only a small salary, but most of his remuneration is from bonuses and stock options. Doesn’t that concern you?

Kim: No. The board of directors approved Thompson’s employment contract just three months ago. It was passed unanimously.

Jan: I guess so, but Thompson told those financial analysts that MPL’s earnings would increase 30% next year. Can Thompson deliver numbers like that?

Kim: Who knows? We’re auditing the 2020 financial statements, not 2021. Thompson will probably amend that forecast every month between now and next June.

Jan: Sure, but all this may change our other audit work programmes.

Kim: No, it won’t. The programmes are fine as is. If you find fraud in any of your tests, just let me know. Maybe we’ll have to extend the tests? Or maybe we’ll just report it to the audit committee.

Jan: What would they do? Anderson is the audit committee’s chair, and remember, Anderson hired Thompson. They’ve been best friends for years. Besides, Thompson is calling all the shots now. Also, Jane Austen, the old CEO, is still on the board, but she’s never around. Austen’s even been skipping the board meetings. Nobody in management or the board would stand up to Thompson.

Kim: That’s nothing new. Austen was like that years ago. Austen caused frequent disputes with the predecessor auditors, Rice & Porthouse. Three years ago, Rice & Porthouse told Austen how ineffective the internal audit department was then. Next thing you know, Rice & Porthouse is out and we’re in as auditors. Why bother? I’m just as happy that those understaffed internal auditors won’t get in our way. Just remember, the bottom line is: are the financial statements fairly presented? And they always have been. We don’t provide any assurances about fraud. That’s management’s job.

REQUIRED:

(a) Identify and briefly discuss four (4) fraud risk factors that are indicated in the dialogue. (8 marks)

(b) Identify Kim’s misconceptions regarding the consideration of fraud in the forthcoming audit

of MPL’s financial statements that are mentioned in the dialogue. Explain why each is a misconception. (6 marks)

(c) Identify how and where MPL’s financial statements are most likely to be susceptible to material misstatement due to fraud, including how such fraud might occur. (6 marks) TOTAL: 20 MARKS

QUESTION 3

You are auditing the financial statements of USeeTech Limited (UL) for the year ended 30 June 2020. UL owns and operates a number of computer stores and has several product lines: software, computers and peripherals. Tests of controls have confirmed your original control assessment. Your audit programme now requires you to undertake substantive analytical review procedures on selected income statement items. Anything above $10,000 is regarded as material. Below is an extract from the income statement for the 2 years ended 30 June 2019 and 2020:

Sales

Cost of sales

Grost Profit

Expenses

Wages

Rent

Depreciation

Interest

Other expenses

Profit/(loss) before tax

![]() 2019

2019

($000)

2,292

1,452

840

![]() 648

648

230

46

33

167

![]() 110

110

![]()

Your enquiries establish the following further information:

i. Sales summary and analysis of sales across the three product classes:

|

|

Standard gross profit |

2020 ($000) |

2019 ($000) |

|

Software |

30% |

660 |

492 |

|

Computers |

30% |

1,340 |

1,120 |

|

Peripherals |

40% |

1,098 |

680 |

3,098 2,292

ii. During 2019 the company employed 5 staff. This fell to 4 on 1 January 2020 after one staff member resigned. On 1 July 2019, all staff members were given a 10% pay rise.

iii. As at 1 July 2019, the company had a $300,000 long term loan with Westpac with a fixed interest rate of 10%. A $40,000 lump sum repayment was made on 31 December 2019. On

1 October the company obtained second loan from Westpac for $50,000. This is a variable rate loan and the average interest rate over the remainder of the financial year was 13%. No repayments were made on the second loan during the year ended 30 June 2020.

REQUIRED:

Perform substantive analytical review procedures on the gross profit, wages, and interest items in the income statement for the year ending 30 June 2020 by comparing your expectation for each of these items with corresponding recorded amounts. Clearly state your conclusion about each of the three items. Where relevant, indicate what further procedures and information would be required in order to conclude that each of the items is fairly stated. Show all workings and state any assumptions you have made. TOTAL: 20 MARKS

QUESTION 4

The financial statements and performance information of Tauranga City Aquatics Limited for the year ended 30 June 2012 contained an auditor’s report from Audit New Zealand which contained a modified opinion. An extract from that report is shown below. Audit New Zealand did not indicate any other issues with the financial statements apart from the concern alluded to below.

|

Reason for our […] opinion Prior to being recorded, control over cash receipts of $3,119,941 (2011 $3,281,000) from swimming pool, gym, café and merchandise takings, which are included within the total operational revenue of $4,769,000 (2011 $5,235,000), is limited and there are no satisfactory audit procedures that we could adopt to confirm independently that all cash receipts revenue was properly recorded. |

REQUIRED:

(a) Based on the information above, identify the specific type of modified opinion that would have been appropriate. (3 marks)

(b) Draft the appropriate modified opinion paragraph. (5 marks)

(c) Identify four internal controls that would address Audit New Zealand’s concerns and could be recommended to Tauranga City Aquatics Limited. (6 marks)

(d) Discuss why you believe that Audit New Zealand concluded that there were no satisfactory audit procedures that they could have adopted. In your answer, be sure to refer to the specific account(s) and assertion(s) involved. (6 marks) TOTAL: 20 MARKS

2023-06-15