ACCTG 211 FINANCIAL ACCOUNTING ASSIGNMENT 4 Semester 1 2023

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ACCTG 211 FINANCIAL ACCOUNTING

Reference: Assignment 4

Note:

(a) You must use the Assignment 4 Answer Booklet word document provided on Canvas to submit your answers online. Do not change the format of the answer booklet when submitting it online. At times, more space has been provided than is necessary to answer a question.

(b) It is your responsibility to ensure this assignment is successfuIIy submitted befbre 6 pm on Friday, 26 May 2023.

What does 'successfully submitted' mean?

It means your completed Assignment 4 Answer Booklet word document(Youmust submit the correct document for each assignment) was accepted by Speedgrader(Ultimately, there must be an acceptance cut-off policy. Late submissions, as determined by SpeedGrader, cannot be accepted for grading. It may take SpeedGrader a few minutes to process your submission. So? Submit your assignment well before 6 pm.), and the said document is downloadable and readable by the ACCTG 211 markers.

(c) This assignment counts for 4% of the final grade for the course.

![]() (d) If you have questions about the topics covered in this assignment, use Piazza to discuss with other students and teaching staff.

(d) If you have questions about the topics covered in this assignment, use Piazza to discuss with other students and teaching staff.

A NEW requirement for Assignment 4 and Assignment 5:

You must submit your Assignment 4 Answer Booklet as a pdf file.

You must submit your Assignment 4 Answer Booklet as a pdf file.

Canvas has been set up to ONLY accept pdf file uploads.

Points 4

Submitting a file upload

File types pdf

WHY?

We want you to practice for the ACCTG 211 exam, i.e., you must upload your exam Answer Booklet onto Inspera as a pdf file.

QUESTION 1

What is the primary criterion for determining whether or not to consolidate an entity?

QUESTION 2

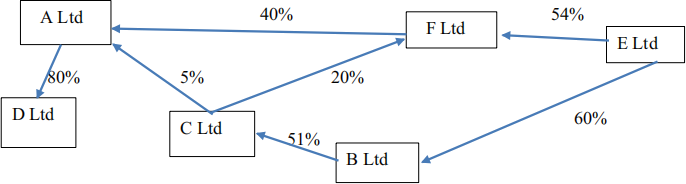

Determine which entity is the parent and which entities are the subsidiaries of the said parent in the following diagram. The percentages provided below are the direct ownership interests. You are required to complete the table in the answer booklet to support your answer.

QUESTION 3

Parent Ltd has asked for your help in the preparation of consolidated financial statements for the financial year ended 31 March 2022; they value your understanding of NZ IFRS 10 Consolidated Financial Statements and NZ IFRS 3 Business Combinations. Parent Ltd sent you the following information:

回 The equity in Subsidiary Ltd was acquired on 1 April 2013. At that date the equity of Subsidiary Ltd comprised: Share capital balance of$100 000 and Retained earnings of$30 000.

回 The identifiable net assets of Subsidiary Ltd were not fairly valued on 1 April 2013 because: Subsidiary Ltd had an internally generated intangible asset with an estimated fair value of$15 000. Subsidiary Ltd uses the cost model for its property, plant and equipment (PPE); the cost of the PPE was $70 000 and the fair value was estimated to be $95 000.

回 Prior years,impairment of total goodwill amounted to $3 000. For the current year ended 31 March 2022 the directors of Parent Ltd believe that the total goodwill has been further impaired by $4 000.

Question 3 continued:

回 During the month ended 31 March 2021 Subsidiary Ltd made sales to Parent Ltd of $30 000 and recognised a profit of $5 000. Parent Ltd sold this purchase of inventory to Pink Ltd on 15 May 2021.

回 During the month ended 31 March 2022 Subsidiary Ltd made sales to Parent Ltd of $7 000 and recognised a profit of $3 200. This purchase remained in the inventory of Parent Ltd asat31 March 2022.

回 During the month ended 31 March 2022 Parent Ltd made sales to Subsidiary Ltd of $3 000 and recognised a profit of $900. Subsidiary Ltd sold this purchase of inventory to Ford Ltd on 5 April 2022.

回 Subsidiary Ltd billed Parent Ltd $4 200 for consulting advice provided on 28 February 2022. This transaction had been recognised by both entities; it remained unpaid asat31 March 2022.

Required:

(a) Assume Parent Ltd acquired 100% of the equity in Subsidiary Ltd for $200,000 on 1 April 2013. Complete the consolidation worksheet in the answer book for Parent Ltd for the financial year ended 31 March 2022 in accordance with NZ IFRS 3 and NZ IFRS 10. You must present your notionaljournal entries as workings.

(b) Assume Parent Ltd only acquired 70% of the equity in Subsidiary Ltd for $140 000 on 1 April 2013. Prepare the notionaljournal entry asat31 March 2022 to identify the non controlling interest, in Subsidiary Ltd, to be reported in the group accounts in accordance with NZ IFRS 10. The directors ofParent Ltd require the non-controlling interest in Subsidiary Ltd to be measured at the non-controlling interest's proportionate share of the Subsidiary Ltd's identifiable net assets i.e. not at fair value.

(c) Assume Parent Ltd only acquired 70% of the equity in Subsidiary Ltd for $140 000 on 1 April 2013 Prepare the notionaljournal entry asat31 March 2022 to identify the non controlling interest, in Subsidiary Ltd, to be reported in the group accounts in accordance with NZ IFRS 10. The directors of Parent Ltd now require the non-controlling interest to be measured at fair value.

(d) Reconcile your NCI (b) balance answer above to your NCI (c) answer above.

(e) Explain your consolidation treatment of the sale of inventory from Subsidiary Ltd to Parent Ltd during March 2022.

QUESTION 4

Big Parent Ltd acquired 60% of the equity in Sub Ltd for $5 400 000 on 1 April 2014.

At the date of acquisition, the equity of Sub Ltd consisted of Share capital of $4 100 000 and Retained profits of$1 520 000.

Because Sub Ltd uses the cost model for its recognised property, plant and equipment, it had several items whose book values were lower than fair values at the date of acquisition. The following table lists the identified assets and liabilities at their book values and fair values as at the date of acquisition:

|

As at the date of acquisition: |

At book value: |

At fair vaIue: |

|

Land and building |

$2 080 000 |

$3 000 000 |

|

Land |

2 500 000 |

4 200 000 |

|

Equipment |

1 998 000 |

2 200 000 |

|

Accounts receivable |

220 000 |

180 000 |

|

Inventory |

780 000 |

678 000 |

|

Intangible assets |

- |

880 000 |

|

Liabilities |

1 958 000 |

1 958 000 |

|

Contingent liabilities |

- |

340 000 |

Required:

(a) Prepare a 100% acquisition analysis to determine the total amount of goodwill in Sub Ltd.

(b) Prepare the notionaljournal entry, asat31 March 2021, to eliminate the Big Parent Ltd asset 'Investment in Sub Ltd,and to eliminate the parent's portion of equity in the Sub Ltd, in accordance with NZ IFRS 10 Consolidated Financial Statements and NZ IFRS 3 Business Combinations.

(c) Explain, by referring to relevant accounting standards, why the Group recognised

the Sub related contingent liability in the Group Statement ofFinancial Position but Sub Ltd did not recognise it in its Statement ofFinancial Position.

QUESTION 5

The 2022 Financial Results/Report for Air NZ and Auckland Airport are provided on Canvas/Modules/Assignments 1 to 5. Answer the questions in the answer booklet for both Air NZ and Auckland Airport. All questions only relate to 2022.

2023-05-31