MFIN 290 APPLICATION OF MACHINE LEARNING IN FINANCE

MFIN 290

APPLICATION OF MACHINE LEARNING IN FINANCE

SUMMER 2021

Classroom Etiquette, Guidelines, & Policies

Academic Honesty

By enrolling in this course, you agree to be bound by the University of California, Irvine’s policy on academic honesty https://aisc.uci.edu/students/academic-integrity/index.php). This policy may also be found in your Graduate Student Handbook.

Attendance

Your attendance for each class session is expected, as is your active participation. If you miss a class for personal or business reasons, please inform the instructor in advance if at all possible. Absences without pressing reasons indicate disinterest in the course and will reflect on your grade. Initiate arrangements for submitting any make-up assignments.

Diversity & Inclusiveness Policy

The University of California, in accordance with applicable Federal and State law and University policy, does not discriminate on the basis of race, color, national origin, religion, sex, gender identity, pregnancy, physical or mental disability, medical condition (cancer related or genetic characteristics), ancestry, marital status, age, sexual orientation, citizenship, or service in the uniformed services. The University also prohibits sexual harassment. This nondiscrimination policy covers admission, access, and treatment in University programs and activities.

Remote Learning Tech Requirements and Policies

Overarching Tech Requirements

Learning at a distance requires specific technical skills and device configurations. To learn more, please read these Technology Requirement Policies.

Tech Support

If you have technical problems:

1. Clear your browser’s cache

2. Try a different browser (Chrome, Firefox, Safari)

3. Shutdown and restart your computer

4. If your problems persist, click the HELP button in Canvas for technical support.

Camera Usage

We strongly recommend that cameras remain active and live during a synchronous course session, as this will allow your instructor and fellow students a better opportunity to make a personal connection with you. This practice also promotes more meaningful engagement with your instructor and your peers.

Overarching Policies

Read Overarching Policies and Academic Integrity Expectations as they apply to each student when taking a course or series of courses from a distance. The overarching policies outline the terms of engagement each student should abide by. Carefully review and reference regularly the policies as you are responsible for knowing them in relation to each of the courses you take in a remote delivery format.

Course Policies

Honor Code

All assignments and projects are to be done by individual/group members only. You cannot use material from concurrent or prior version of this course. If you are in possession of such material, please discard them.

Keep the course materials (except for the recommended books) for your own use. Do not disseminate the cases and notes. It will diminish the learning experience and fun for students who will take the class in the future.

Make-up Exams

No make-up exams are allowed.

Contesting a Grade/Re-grading Policy

Within 1 week from the day the exam is returned, a written request detailing why you feel the exam should be re-graded must be submitted to the instructor. Keep in mind that if a re-grade is granted, the entire exam will be re-graded and the grade can either increase or decrease.

Course Objectives

This course will introduce one of the hottest topics in industry, machine learning, and its application in finance, investment, and fintech. It will cover fundamental statistical and machine learning methods as well as real world financial applications of these methods using Python programming. Topics covered include regression and classification methods, tree-based models, SVM, Neural Network, Advanced time-series models, Natural Language Processing, etc. Some of the applications include business and financial market forecast, credit default detection, sentiment analysis, etc.

The overall goal of this course is to provide fundamental understandings of machine learning models, a good foundation for students in their quantitative-related interviews and jobs. This course will be quantitative oriented. However, students are not expected to memorize all the equations, code entire models in details, or even develop new algorithms. Students are expected to become sufficient machine learning “users”, other than machine learning “scientists and technicians” (think about car drivers vs. car technicians). We emphasize more on the fundamental thinking behind the models and how to apply models in the real word. In another word, we teach you how to “drive” machine learning “car”.

Pre-Requisites

Pre-requisites of this course are FIN 290 Financial Econometrics and Forecasting and FIN 290 Programing and Data Analysis. Students with knowledge of basic statistics, linear algebra, and Python programming will be able to enhance their quantitative skillsets to the next level after this course.

Exceptions may be granted to students who have not taken the prerequisites but have sufficient foundations in statistics and programming. The interested students should discuss their individual cases with the instructors to get the permission.

Course Materials

Required

● A laptop computer that can run Jupyter Notebook and Python program; recommend installing Anaconda Python distribution (Python 3.7).

● James, G., Witten, D., Hastie, T., & Tibshirani, R. (2013). An Introduction to Statistical Learning. New York: Springer.

● Bishop, C. M. (2006). Pattern Recognition and Machine Learning. New York: Springer.

● Python Scikit-learn tutorial: http://scikit-learn.org/stable/.

Optional

● Hastie, T., Tibshirani R., & Friedman J. (2009). The Element of Statistical Learning (2nd ed.). New York: Springer.

● Tsay, R. S. (2010). Analysis of Financial Time Series (3 nd ed.). Hoboken, NJ: Wiley.

● Kim, C. J., & Nelson, C. R. (1999). State-Space Models with Regime Switching. Cambridge, MA: The MIT Press.

● Jurafsky, D., & Martin, J. H. (2018). Speech and Language Processing (2nd ed.). New Jersey: Pearson.

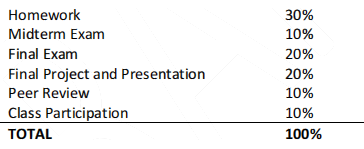

Grading

Homework (30%)

There will be three homework sets. Homework is individual assignment. Homework write-up and code are required to be submitted at designated deadline. Plagiarism is completely prohibited and will be subject to discipline action from the university.

Midterm Exam (10%)

The one-hour, in-class midterm Exam will be held in Lecture 5. It will cover materials from Lecture 1 to Lecture 4.

Final Exam (20%)

The two-hour, out-of-class final exam will be held after Lecture 10 in a separate time. It will cover all the materials in all lectures.

Final Project and Presentation (20%)

The final project is designed to apply machine learning methods in the real-world setting. You will work as a group and choose one of two available projects. Projects will be announced at the end of Lecture 5. You will have one week to select your team member/project and submit your selection to the instructor. The final presentation is scheduled in Lecture 10. Write-up and code are also required to be submitted before Lecture 10.

Please note that the instructors may intentionally give you the minimum amount of information necessary to complete your project. You need to be proactive and make reasonable assumptions in order to continue the analysis. The real-life projects you will face as an analyst will rarely be perfectly specified as textbook problems.

Peer Review (10%)

The group approach of final project and presentation is valuable because it simulates real-world team approaches to analysis and decision-making. It facilitates learning among peers, and by spreading the workload, a more thorough analysis is possible.

However, the main problem with the group approach is that it is difficult for the instructor to identify the individual contribution of each member: the free-rider problem. The peer-review portion is designed to mitigate this problem. Each student must evaluate every other member of the group. Failing to do so will result in a reduction in your grade. You should find the best way of working in a group environment. After all, you will very likely face the similar problem on your job. The instructor will also evaluate the overall collaboration of the group.

Class Participation (10%)

Attend each lecture, engage in discussions, and complete course evaluation. You are encouraged to present your thought to your classmates. You are also encouraged to challenge your classmates’ assumptions and analyses. The ability to engage and explain concepts to others is a key component of a successful career. The quality of participation is more concerned than the quantity. Honest mistakes will not be viewed negatively. Instead, they will be used as learning opportunities and discussion springboards.

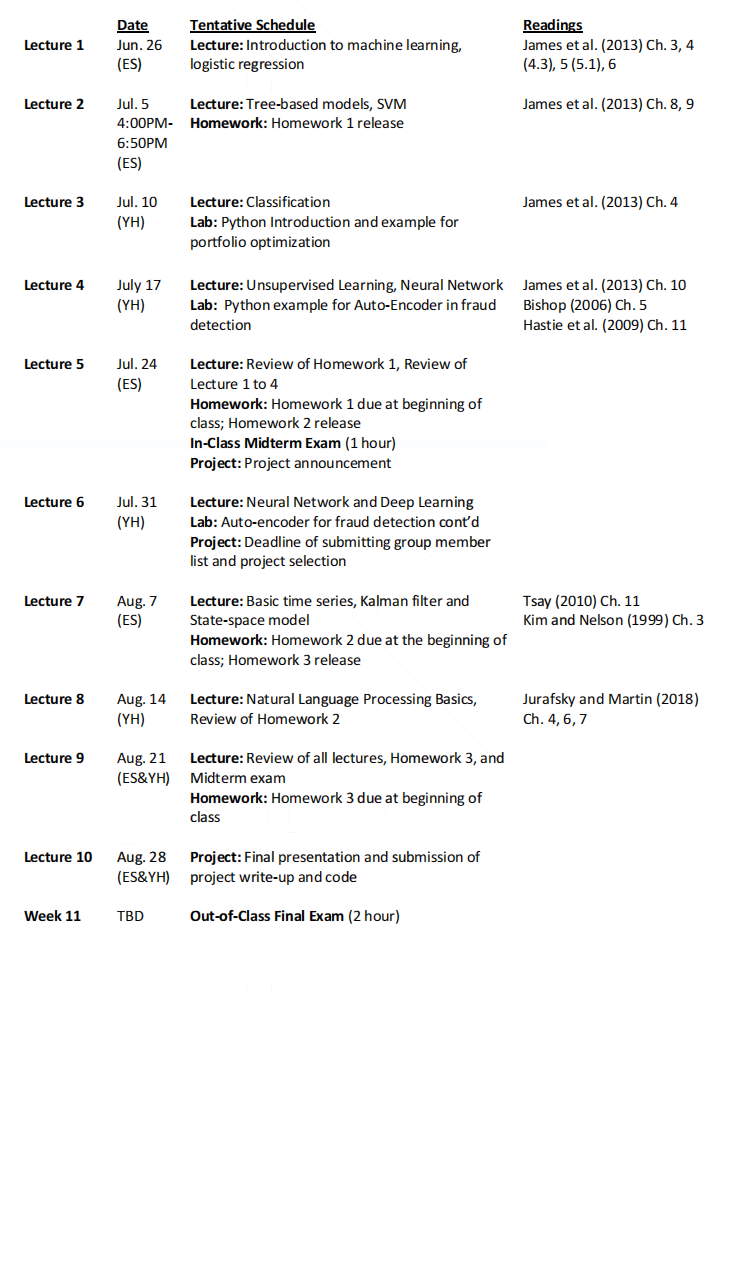

Course Schedule

All classes except the week of July 4th are scheduled on Saturdays from 9:00AM to 11:50AM.

2021-08-03