Financial Accounting 101 Portion of Spring 23’ Project

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Financial Accounting 101 Portion of Spring 23’ Project

• Identify a merchandising business you would like to start. Explain the product you picked and why. If you prefer a service business that is okay but you will need to use the below data from a merchandising company.

• How will you fund this business? Debt, equity, outside investors? Explain why.

• Location - will you buy or lease the property/building? Why and Where will it be?

• What sort of entity will you create? Sole prop, partnership, corporation? Why did you choose this entity type?

• Create an estimated Income statement for this business using the facts below for the period ending December 2022.

• Create a beginning balance sheet for the November 30 based on the December 31, 2022 ending, below.

• Provide a general journal showing the journal entries for transactions of this business during December, 2022. You should also include hypothetical entries for revenue and expenses. If be sure to include inventory, COGS, etc. There should be at least 10 journal entries. Journal entries should match for the period (i.e. sales, COGS, etc.) State what type of system you are using and the journal entries should be consistent (Perpetual or Periodic).

• Assist your fellow 102 students in calculating item f below and show calculations here.

Spelling, grammar, and formatting errors reduce the grade by one point each. Projects can initially be completed in Google Docs, Microsoft Excel, Word, or other word or spreadsheet software. Regardless of how your project was initially created, each of the above items shall then be posted as one PDF page in Canvas within your group in the exact order as above. This group project is worth 130 points of your overall grade. Participation using Pronto by all members is required. Your grade on these projects will be composed of a group grade (determined by your instructor) and an individual grade (determined by your group members). How the assignment is divided up is up to your group, however each 101 student must present a portion on the recorded presentation. All Financial Accounting Students must record their portion together using Pronto only in only the Group that was created by your professor. There will be five points extra credit if you record your portion in the same meeting with the Managerial Accounting Students within your group.

ACCT C102 Managerial Accounting Portion Blue Group B

Group Project I: Master Budget – 102 Students except for Item f.

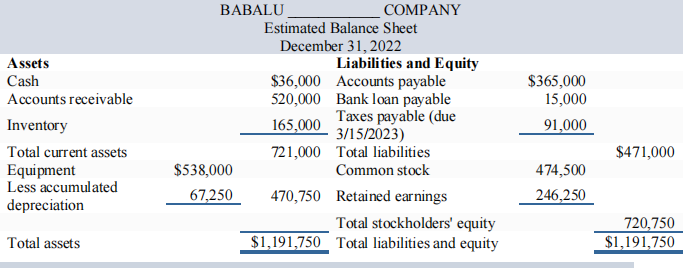

Near the end of 2022, the management of Babalu ___________ Co., a new merchandising company, prepared the following estimated balance sheet for December 31, 2022.

To prepare a master budget for January, February, and March of 2023, management gathers the following information.

a. Babalu ________’s single product is purchased for $30 per unit and resold for $55 per unit. The expected inventory level of 5,500 units on December 31, 2012, is more than management’s desired level for 2023, which is 20% of the next month’s expected sales (in units). Expected sales are: January, 7,250 units; February, 8,750 units; March, 11,500 units; and April, 10,000 units.

b. Cash sales and credit sales represent 25% and 75%, respectively, of total sales. Of the credit sales, 70% is collected in the first month after the month of sale and 30% in the second month after the month of sale. For the December 31, 2022, accounts receivable balance, $125,000 is collected in January and the remaining $395,000 is collected in February.

c. Merchandise purchases are paid for as follows: 20% in the first month after the month of purchase and 80% in the second month after the month of purchase. For the December 31, 2022, accounts payable balance, $85,000 is paid in January and the remaining $280,000 is paid in February.

d. Sales commissions equal to 20% of sales are paid each month. Sales salaries (excluding commissions) are $60,000 per year.

e. General and administrative salaries are $144,000 per year. Maintenance expense equals $2,200 per month and is paid in cash.

f. Equipment reported in the December 31, 2022, balance sheet was purchased in January 2022. It is being depreciated over eight years under the straight-line method with no salvage value. The following amounts for new equipment purchases are planned in the coming quarter: January, $34,000; February, $98,000; and March, $29,500. This equipment will be depreciated under the straight-line method over eight years with no salvage value. A full month’s depreciation is taken for the month in which equipment is purchased.

g. The company plans to acquire land at the end of March at a cost of $145,000, which will be paid with cash on the last day of the month.

h. Babalu Musical has a working arrangement with its bank to obtain additional loans as needed. The interest rate is 12% per year, and interest is paid at each month-end based on the beginning balance. Partial or full payments on these loans can be made on the last day of the month. The company has agreed to maintain a minimum ending cash balance of $27,588 in each month.

i. The income tax rate for the company is 30%. Income taxes on the first quarter’s income will not be paid until April 15.

Requirements: ACCT C102 Managerial Accounting Portion Blue Group B

Prepare a master budget for each of the first three months of2023; include the following component budgets (show supporting calculations as needed directly behind that budget, and round amounts to the nearest dollar):

1.) Monthly sales budgets (showing both budgeted unit sales and dollar sales).

2.) Monthly merchandise purchases budgets.

3.) Monthly selling expense budgets.

4.) Monthly general and administrative expense budgets.

5.) Monthly capital expenditures budgets. This will not be in your text so find other sources.

6.) Monthly cash budgets.

7.) Budgeted income statement for the entire first quarter (not for each month).

8.) Budgeted balance sheet as of March 31, 2023

9.) Prepare a written analysis summarizing your findings. Please include:

i.) Financial ratios in your discussion of the company’s financial position.

ii.) What accounting recommendations do you have for the new company?

iii.) What business recommendations do you have to help the new company?

iv.) What did you learn from preparing a Master Budget? Do you find this to be an easy or challenging project? Why? Gather each member’s thoughts and report separately, not as a group consensus.

v.) Do you feel you could prepare a master budget for a company on your own? Gather each member’s thoughts and report separately, not as a group consensus.

Reports should be neatly compiled in the above order and include a cover page with all team member names. All items in number 9 will be presented in a group recording along with 101 students.

Grading Criteria

Spelling, grammar, and formatting errors reduce the grade by one point each. Projects can initially be completed in Google Docs, Microsoft Excel, Word, or other word or spreadsheet software. Regardless of how your project was initially created, each of the above items shall then be posted as a page in Canvas within your group in the exact order as above. This group project is worth 130 points of your overall grade. Participation by all members is absolutely required. Your grade on these projects will be composed of a group grade (determined by your instructor) and an individual grade (determined by your group members). How the assignment is divided up is up to each group, however each student must present a portion on the recorded presentation. Each 102 group member should also present at least one item from requirement number 9 above. The entire recorded presentation must be completed using Pronto only. You will be assessed on your collaboration so it must be done using Pronto in only the Group your professor created. On the due date, you will submit a confidential peer evaluation form for which you will grade each of your team members. You will also be posting your progress, etc… in the Discussion by your respective Group in Canvas. You may not change groups.

2023-05-21