ECON0016: MACROECONOMIC THEORY AND POLICY SUMMER TERM 2023

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

SUMMER TERM 2023

ECON0016: MACROECONOMIC THEORY AND POLICY

TAKE HOME EXAM

TIME ALLOWANCE: SEE MOODLE PAGE ASSESSMENT SECTION

Answer ALL questionsfrom Part A and ALL questionsfrom Part B

The Summer Take Home Exam comprises 75% of yourfinal mark.

Part A comprises 6 questions and carries 25 points; Part B carries 50 points, split equally between Question B1 and Question B2.

Answers must be typed, although you can paste in hand-written equations and hand-drawn figures labelled with your 4-digit candidate number. You may use written, diagrammatic, and mathematical arguments as appropriate. All diagrams and data charts must be constructed by you; pasted in figures from slides, textbooks, published or unpublished material produced by someone else will not be awarded marks. Similarly, equations cannot be pasted in from another source. You may paste simulator output into your answer document.

PART A

Answer ALL questions from this section. For each question identify the statement as True, False, or Uncertain. Explain your reasoning in a total of not more than 120 words. The maximum marks for each question will be given for a full and correct explanation.

A1. According to the 3-equation model studied in the module, foreign exchange market and bond traders take account of the nominal but not the real UIP condition in making their trading decisions.

A2. In the 3-equation model, in the absence of a lagged effect of monetary policy on aggregate demand, both supply and demand shocks can be offset without any consequences for employment.

A3. Compare a closed with an open economy, each of which is initially in medium-run equilibrium and has an inflation-targeting central bank. Assume that both are modelled by the 3-equation model and wage-setters use the producer rather than the consumer price index. Statement: The response of output and inflation to a decision by the central bank to raise the inflation target is identical in the closed and open economies.

A4. If a climate change-related shock wipes out a domestic tradeables industry (e.g. through drought) and is modelled as a permanent negative trade shock for the home economy, the long-run real exchange rate is depreciated.

A5. Economic theory and experience during the pandemic suggest that countries whose governments borrow in a currency they do not issue are susceptible to a sovereign debt crisis in a time of fiscal stress.

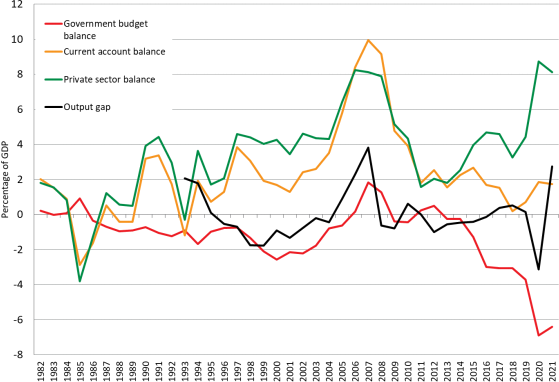

A6. Assume that the cause of a recession is a fall in autonomous consumption or investment. The government financial balance (also referred to as the government budget balance) and the external financial balance move inversely with the private sector financial balance. Refer to Figure A6 in your answer.

Figure A6. China Sector Financial Balances, 1982-2021 (Source: OECD Economic Outlook, Various years).

PART B

Answer ALL questions from this section in a total of not more than 1800 words (not including equations and figures). We do not expect you to use the full 1800 words. Use a standard referencing system if you wish to refer to other sources. It is not necessary to reference lecture notes or the textbook unless you make a direct quotation.

Question B1 [25 points]

[context] In the 2023 budget speech, the Chancellor Jeremy Hunt stressed that this was a ‘budget for growth’ and implemented a loosening of fiscal policy. According to the Office for Budget Responsibility, “it is now harder for this Chancellor to deliver a falling path for the debt-to-GDP ratio in the medium term than it has been for any of his predecessors since the OBR was established in 2010” .

(a) Using the models you have studied in this module, explain the relationship between

• ‘a budget for growth’

• a loosening of fiscal policy and

• a falling path for the debt-to-GDP ratio.

Summarize the economic basis for the OBR’s judgement. Note that using numerical calculations to illustrate your argument (including showing your working) will be rewarded with up to 5 points. [15 points]

(b) Does your answer depend on households’ inflation forecasts and on monetary policy? [10 points]

Question B2 [25 points]

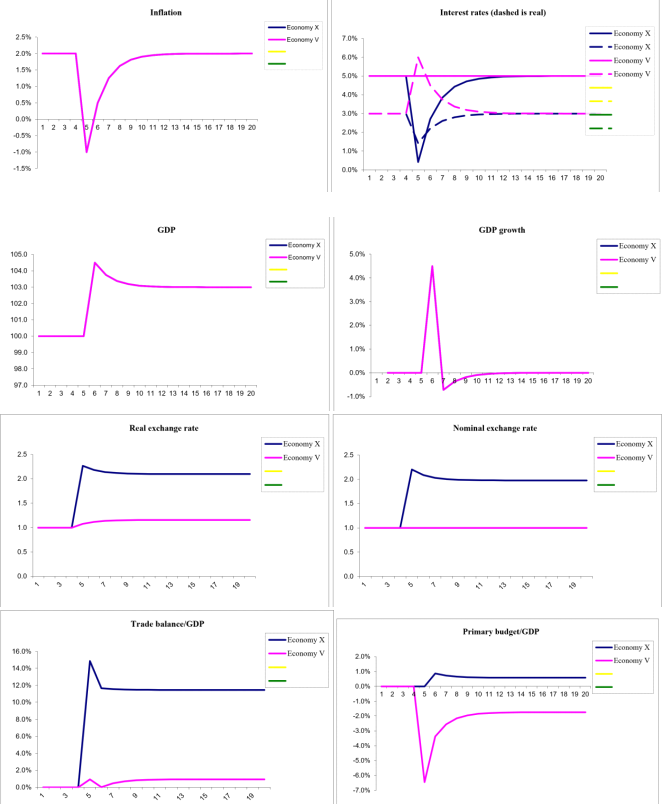

Consider two small open economies called V and X that are identical except for their exchange rate regime and the choice of policy instruments available to them. A single identical shock hits each economy, and you are provided with output from simulations of the shock and its aftermath. The simulation output in the form of impulse-response functions is shown below in Figure B2 (where a single line is shown, the two paths coincide). You are tasked with writing a report describing the shock, diagnosing the nature and effects of the shock and identifying the policy interventions that have been implemented in each economy (consistent with the simulations shown).

Figure B2. Output from the Macroeconomic Simulator (Carlin and Soskice).

In your report, complete all the tasks listed here.

a) Explain how you interpret ‘economies identical except for their exchange rate regime and the choice of policy instruments available to them’ . [5 points]

b) Describe the economic performance of each economy and concisely compare them. [5 points]

c) Copy the table into your answer and fill in the cells. For each column, briefly describe your reasoning. Describe the policy you think was implemented in each economy in response to the shock, explaining your reasoning. [5 points]

|

|

Inflation, aggregate demand, external trade, or supply shock |

Temporary or permanent shock |

Flexible or fixed exchange rate regime |

|

Economy V |

|

|

|

|

Economy X |

|

|

|

d) Use the AD-BT-ERU diagram to model the initial and new medium-run equilibrium in each economy (use the same diagram to show both). Show in the diagram and briefly describe the correspondence between your results and those in the simulation output. [5 points]

e) Write a conclusion to your report highlighting the similarities and differences in the impact on performance and policy of such a shock. You can also highlight limitations of the analysis. [5 points]

2023-04-29