ACCT7101 Tutorial questions Semester 2, 2022 Tutorial 4

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ACCT7101

Tutorial questions

Semester 2, 2022

Tutorial 4: Accounting for merchandising firms

![]() Readings: Chapter 4&5

Readings: Chapter 4&5

![]() Pre-tutorial activities: PSB4.3, E5.7

Pre-tutorial activities: PSB4.3, E5.7

![]() Tutorial questions: E4.1, PSB4.7, PSB5.6

Tutorial questions: E4.1, PSB4.7, PSB5.6

![]() Self-review questions: Q4.1

Self-review questions: Q4.1

Pre-tutorial questions

PSB4.3

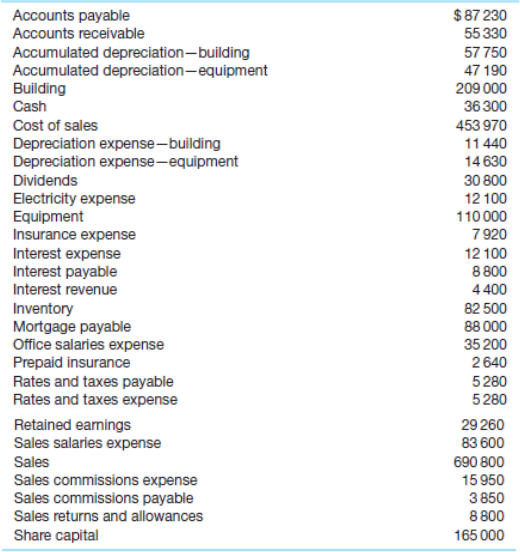

Enoteca Department Store is located near the Village Shopping Mall. At the end of Enoteca’s financial year on 30 June 2022, the following accounts appeared in its adjusted trial balance.

Additional data: $22 000 of the mortgage payable is due for payment next year.

Required

(a) Prepare a fully classified statement of profit or loss, a calculation of retained earnings (refer figure 1.7*), and a classified statement of financial position. (Ignore income tax expense.)

(b) Calculate the return on assets ratio, profit margin ratio, gross profit ratio, and operating expenses to sales ratio. Assume total assets at the beginning of the year were $352 000.

(c) Why is it helpful to fully classify items in the statement of profit or loss?

E5.7

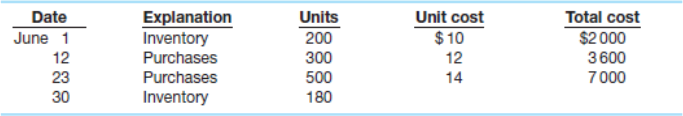

Fenning Pty Ltd reports the following for the month of June:

Required

(a) Calculate cost of the ending inventory and the cost of sales under (1) FIFO, (2) LIFO and (3)

average cost.

(b) Which costing method gives the highest ending inventory and the highest cost of sales? Why?

(c) How do the average cost values for ending inventory and cost of sales compare with ending inventory and cost of sales for FIFO and LIFO?

(d) Explain why the average cost is not $12.

Tutorial questions

E4.1

The following transactions are for Unique Artworks Ltd.

1. On 7 December Unique Artworks Ltd sold $792 000 of inventory to Cambridge Collectables Ltd, terms 2/7, n/30. The cost of the inventory sold was $528 000.

2. On 8 December Cambridge Collectables Ltd was granted an allowance of $33 000 for inventory purchased on 7 December.

3. On 13 December Unique Artworks Ltd received the balance due from Cambridge Collectables Ltd.

Required

(a) Prepare the journal entries to record these transactions in the records of Unique Artworks Ltd.

(b) Assume that Unique Artworks Ltd received the balance due from Cambridge Collectables Ltd on 2 January of the following year instead of 13 December. Prepare the journal entry to record the receipt of payment on 2 January.

(c) What are the advantages and disadvantages associated with granting a discount for early payment?

PSB4.7

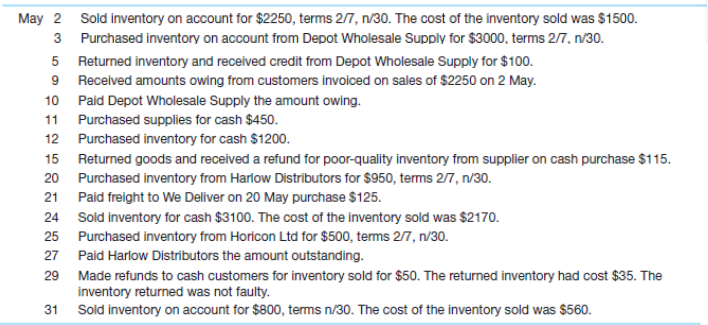

Fixit Hardware Pty Ltd completed the following inventory transactions in the month of May. At the

beginning of May, Fixit Hardware Pty Ltd’s ledger showed cash $2500 and share capital $2500.

Fixit Hardware Pty Ltd’s chart of accounts includes 100 Cash, 110 Accounts receivable, 120 Inventory, 130 Supplies, 200 Accounts payable, 300 Share capital, 400 Sales, 405 Sales returns and allowances,

410 Discount received, 500 Discount allowed, 505 Cost of sales, and 510 Freight inwards.

Required

(a) Journalise the transactions using a perpetual inventory system.

(b) Post the transactions to T accounts. Be sure to enter the beginning cash and share capital balances.

(c) Prepare a statement of profit or loss up to gross profit for the month of May.

(d) Calculate the profit margin and the gross profit ratio. (Assume operating expenses were $700 and ignore the effects of income tax for this question.)

PSB5.6

Watson Pty Ltd began operations on 1 July. It uses a perpetual inventory system. During July the business had the following purchases and sales:![]()

Required

(a) Determine the ending inventory under a perpetual inventory system using (1) FIFO, (2) average cost and (3) LIFO.

(b) Which costing method produces the highest cost allocation to ending inventory?

Self-review questions

Q4.1

(a) ‘The steps in the accounting cycle for a merchandising business are different from the steps in the accounting cycle for a service business. ’ Do you agree or disagree?

(b) Is the measurement of profit in a merchandising business conceptually the same as in a service business? Explain.

2023-03-27

Accounting for merchandising firms