MACC7019 Module 4 of 2022/23

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

MACC7019

Module 4 of 2022/23

Group Project

Instructions:

1. This group project contains 17 questions (plus one question on group members feedback) around financial and managerial aspects of Accounting.

2. The assignment has to be solved collectively as a group. You will work with the group members and provide one submission per group.

3. Clearly mention group member names and their IDs at the top of the submission document.

4. Submit a PDF document with your answers.

5. You can make use of R or Excel or Tableau in solving the questions.

6. If you are using R then please provide the code you have developed as part of submission. For Excel or Tableau, please provide the Excel worksheets or Tableau workbooks that clearly show the analysis and visualizations you have developed.

7. Paste the screenshot of output where appropriate for the answers.

8. Due date for the group project is 16th March, 2023 (11:59 PM HKT)

9. This project carries 25 marks that are allocated as follows:

• Project analysis and R/Excel/Tableau worksheets/code files (5 Marks)

• Accuracy of answers (15 Marks)

• Group members’ feedback (5 Marks)

Project Description:

The purpose of this project is to help solve a number of problems to analyze and communicate answers to accounting questions that accountants face in their day-to-day lives. As a manager, auditor, or financial accountant, your role is to understand how different business processes operate and ensure controls exist over those processes. Companies use data analytics to summarize data, evaluate performance, and identify risk in these cycles.

There are two main sets of questions related to the Procedure To Pay (P2P) process that you’ll try and answer in the following project:

Understand the procedure-to-pay (P2P) process, or purchasing cycle within a company to evaluate purchasing activity and potential savings when paying or interacting with vendors:

The Procedure-To-Pay (P2P) process, or purchasing cycle, for a retailer involves four main processes:

1. Create and submit a purchase order

2. Receive inventory

3. Receive an invoice

4. Pay the invoice

The P2P process has some challenges in that there are numerous opportunities to divert company funds. Therefore, you should focus on the risk of unauthorized and fictitious payments (e.g. to shell vendors) and ensure that the process is appropriately controlled.

Managers would want to ensure that inventory matches what the company ordered, that invoices aren’t paid more than once, and that the payments are sent to approved parties.

Auditors are interested in testing the internal controls that govern who can create orders, receive items, and approve payments. In addition to the segregation of duties, they may be interested in matching each of the documents (i.e., purchase order, receiving the report, and vendor invoice) in a three-way match.

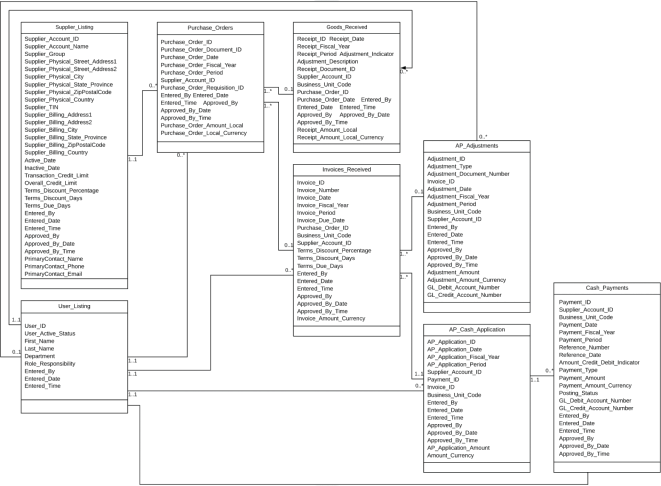

The following diagram shows the connection between different data tables provided in the file Group_Project_Set2_ProcedureToPay:

QS1 Part 1 Financial: Is the Company Missing Out on Discounts by Paying Late

Compute account balances to prepare financial statements. The P2P process provides data to evaluate cash paid to suppliers and accounts payable balances, which the company calculates based on the difference between the invoice received and cash payments and adjustments. These are essential for inclusion in the Statement of Cash Flows and Balance Sheet respectively.

Q1. What are the total purchases for Q3?

Q2. Which quarter had the highest total purchases?

Q3. What is the total amount of cash paid to suppliers for 2020?

Q4. What is the balance for accounts payable that would appear on the balance sheet?

Q5. How much discount (in dollars) has the company forfeited from the top three suppliers?

Q6. Why do you think there are still balances from the beginning of the year?

Q7. What would you expect to happen with outstanding balances in Q1 and Q2?

Q8. Is it reasonable to have outstanding balances in Q3? Why or why not?

Q9. When might a large company prefer to forfeit discounts on its invoices?

Q10. Should the company adjust its policy to pay suppliers more quickly, in your opinion?

QS1 Part 2 Audit: Are There Any Erroneous Payments

Auditors would be interested in evaluating the origin of invoices and payables to make sure that they are paid correctly and aren’t out of normal behaviour. Using the data provided, use an average Z-score value to determine which suppliers are receiving an abnormally high amount of purchases.

Q11. Which supplier(s) had an abnormally high dollar amount of purchases?

Q12. Which of the invoices received warrants further investigation by the auditors?

Q13. What do you consider “abnormally high”? Are these suspicious?

Q14. What statistical tools can the company use to diagnose behavior that is outside of normal behavior?

Q15. How might an outlier be used to focus the auditors on high-risk transactions?

Q16. Why aren’t the other purchases suspicious?

Q17. While you still have your auditor hat on, what are some additional analyses you could perform to understand whether the purchase process is being followed or controls are functioning properly?

Q18. This question has to be done individually and submitted by each member separately from the group project. On a scale of 0 to 2 (0 being no effort, 1 below average effort, and 2 good effort), please provide a score to each of the team members in your group (excluding yourself). If you wish to justify the scores, you can write a brief description as well.

2023-03-14